I'm surprised that 71 percent (so far) have picked the one about the federal government subsidizing student loans.

Let me walk you through this process:

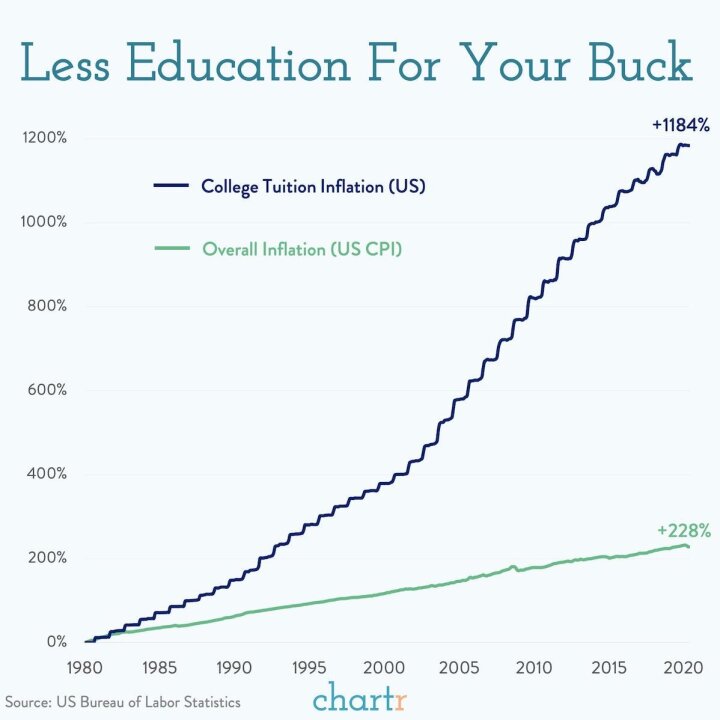

1. There is ONE rate of what colleges can charge, it would be based on only the student (or student's parent) could afford. If that were to happen today, the price of a college education would plummet and there would be an exodus of useless college professors FIRED.

2. When you add private student loan companies, that means a student can borrow for an education. Colleges see that it's not based on what they can afford. So colleges raise their prices, inflate their budgets, PRICE GOUGE. In other words, they are partially protected from market forces. But this only gives them students who have good credit ratings, who have shown they can pay the loan back.

3. When the government is a student loan cosigner, all bets are off. The student might pay it back, or he might not. But the taxpayers are on the hook. So colleges can REALLY price gouge, inflate EVERYTHING (property upgrades, professor salaries, additional professors, aides up the yin yang.) When you take the market forces away, bad things happen.

This is the law of supply and demand. Supply stays the same, demand goes up, price goes up.

Student loans created unnatural demand. The supply remained the same. So price goes up.