Peaceful · F

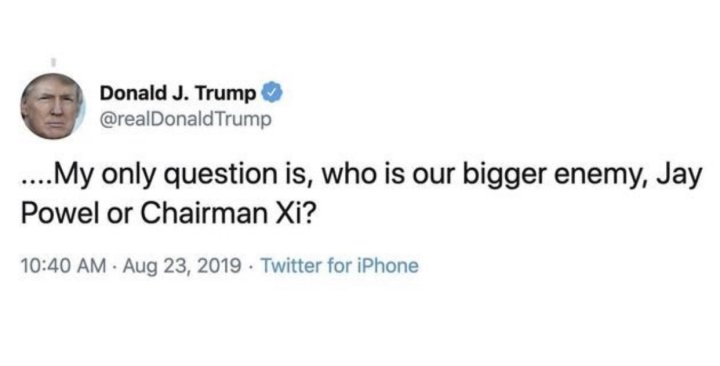

Your misstep is thinking Trump is public enemy #1.

You need to go much deeper. The Rothchild's would be a better start.

Abolishing the Federal Reserve would be great, but go back to point 1 I made.

You need to go much deeper. The Rothchild's would be a better start.

Abolishing the Federal Reserve would be great, but go back to point 1 I made.

View 37 more replies »

SimplyTracie · 26-30, F

@xRedx I don’t think the Federal Reserve does the printing of currency. I truly don’t. But what do I know. 🤷♀️

sarabee1995 · 26-30, F

@SimplyTracie

"Federal Reserve Notes, also United States banknotes, are the banknotes currently used in the United States of America.

Denominated in United States dollars, Federal Reserve Notes are printed by the United States Bureau of Engraving and Printing on paper made by Crane & Co. of Dalton, Massachusetts.

Federal Reserve Notes are the only type of U.S. banknote currently produced. Federal Reserve Notes are authorized by Section 16 of the Federal Reserve Act of 1913 and are issued to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System.

The notes are then put into circulation by the Federal Reserve Banks, at which point they become liabilities of the Federal Reserve Banks and obligations of the United States."

~ Wikipedia

Denominated in United States dollars, Federal Reserve Notes are printed by the United States Bureau of Engraving and Printing on paper made by Crane & Co. of Dalton, Massachusetts.

Federal Reserve Notes are the only type of U.S. banknote currently produced. Federal Reserve Notes are authorized by Section 16 of the Federal Reserve Act of 1913 and are issued to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System.

The notes are then put into circulation by the Federal Reserve Banks, at which point they become liabilities of the Federal Reserve Banks and obligations of the United States."

~ Wikipedia

samueltyler2 · 80-89, M

@Peaceful Rothschild? What sort of antisemitic trop is that?

I was just blocked by the author of an antisemitic comment!

I was just blocked by the author of an antisemitic comment!

samueltyler2 · 80-89, M

When the great recession came, in 2008, the interest rate was lowered which helped the economy but added to a national deficit. When congress passed the tax but the country's deficit increased to over a $ trillion, if we lower the rate and then enter another recession, which some people believe is inevitable, then the government will not be able to lower the rate to try to get us out of that recession.

quitwhendone · M

@SimplyTracie He's never heard of a Cat 5 hurricane either even though he said that the last 4 times we had a Cat 5 hurricane.

SimplyTracie · 26-30, F

@quitwhendone He just dumb.

quitwhendone · M

@SimplyTracie Indeed

ozgirl512 · 31-35, F

There's always swings and roundabouts... Low interest is good if you're a borrower... But with low interest, external companies and countries don't give you the money to invest

SimplyTracie · 26-30, F

@ozgirl512 Sometimes I think I’d rather be in London in 1984. 😂

SimplyTracie · 26-30, F

@KiwiBird Dang! It does sound like a Trumpian.

Lizabee · F

That’s a lot of questions. To your first question, his companies will save millions on loan payments.

whowasthatmaskedman · 70-79, M

@Lizabee Actually, they wont.. No American bank will lend him money.. And these rate shifts only apply to US loans.. On a side note, it is yet to be discovered if Trump is making ANY repayment on the loans facilitated by Deutsche Bank from the Russian state Commented banks he and Jared have both borrowed heavily from. Maybe the Deutsche papers currently being examined will clarify that.

Th1nkF1rst · 70-79, M

1% is great for a borrower,

But investment income @1% is really really sad for the economy!

But investment income @1% is really really sad for the economy!

whowasthatmaskedman · 70-79, M

@graywanderer Yes. I have never had one. Just lucky I guess. But the easy access to instant money is more tempting to the more vulnerable

Th1nkF1rst · 70-79, M

@graywanderer no

whowasthatmaskedman · 70-79, M

@Th1nkF1rst Yes. My Grandson tells me how much his Pokemon cards and Beyblades are worth. 😉

krf336 · M

The president doesnt control the Fed, he cannot lower the interest rate.

SimplyTracie · 26-30, F

@redredred. My guess is that Chairmen Powell knows better than Trump.

redredred · M

@SimplyTracie I dont know, the Fed has been a relatively poor manager of the economy, generally over-reacting, using a sledgehammer when a flyswatter would do.

SimplyTracie · 26-30, F

@redredred Ohhhh 😬

You would know better than me so I'll trust you on that.

You would know better than me so I'll trust you on that.

EnigmaticGeek · 61-69, M

The US Federal Government and the Federal Reserve Bank have a major conflict of interest: 100% of the profits which the Federal Reserve Bank makes above its operating expenses are by law, paid to the US Treasury. So it is in the Government's interest for the Federal Reserve to set its Federal Funds Interest Rate which it charges to lend to banks as high as the Federal Reserve will set it, from that viewpoint.

I think the provision in the law that directs Federal Reserve profits to be paid to the US Treasury is the single biggest flaw in the Federal Reserve Act. The profits should instead be destroyed, taking those dollars completely out of circulation. That would enable the Federal Reserve to more easily control inflation with smaller increases in the Federal Funds Rate than it currently has to use.

Under the current law, those dollars are simply transferred from the private sector to the government (public) sector of the economy, which doesn't remove them from circulation, so the only way higher interest rates reduce inflation is when the interest rates get high enough to disrupt the business models of enough businesses to cause the private sector of the US economy to contract.

All of the Federal Reserve Board members are intelligent enough to know all of this--but none of them have the balls to say it publicly.

I think the provision in the law that directs Federal Reserve profits to be paid to the US Treasury is the single biggest flaw in the Federal Reserve Act. The profits should instead be destroyed, taking those dollars completely out of circulation. That would enable the Federal Reserve to more easily control inflation with smaller increases in the Federal Funds Rate than it currently has to use.

Under the current law, those dollars are simply transferred from the private sector to the government (public) sector of the economy, which doesn't remove them from circulation, so the only way higher interest rates reduce inflation is when the interest rates get high enough to disrupt the business models of enough businesses to cause the private sector of the US economy to contract.

All of the Federal Reserve Board members are intelligent enough to know all of this--but none of them have the balls to say it publicly.

SimplyTracie · 26-30, F

@EnigmaticGeek But doesn’t the Federal Reserve Banks have to pay dividends to its shareholders? By that I mean, shouldn’t profits be paid to it’s shareholders?

EnigmaticGeek · 61-69, M

@SimplyTracie The federal Reserve Bank is owned by its member banks, which include all US national banks, and the state chartered banks that choose to become members. The dividends are minimal, and not based upon profit, but are only a tiny percentage of the member's investment. The dividends paid are treated as an expense for the Federal Reserve Bank. So higher Federal Reserve Bank profits have no effect on the dividends it pays, resulting in 100% of its profits always going to the US Treasury.

Higher interest rates effectively make the US Federal budget deficit appear to be lower than it actually is.

This is one of many distortions in the US economy that shouldn't exist.

Higher interest rates effectively make the US Federal budget deficit appear to be lower than it actually is.

This is one of many distortions in the US economy that shouldn't exist.

SimplyTracie · 26-30, F

@EnigmaticGeek Ohhh 😮

MarkPaul · 26-30, M

Because as the biggest cry-baby the world has ever seen, known, or been subjected to, explained before he became president... "It's not fair. It gave Obama an unfair advantage." PLUS... if the economy is doing fantastic in one half of the sentence, why does it need low to zero interest rates that comparison economies are using for economies that are not doing fantastic?

whowasthatmaskedman · 70-79, M

@MarkPaul They need to be lower, because.......Just, because..🤔

MarkPaul · 26-30, M

@whowasthatmaskedman A convincing argument, at last. You're hired.

whowasthatmaskedman · 70-79, M

Interest rates can in fact go into the negative. But it sounds and looks silly. I am sure Donald doesnt have a clue, since he never pays back loans anyway. But in reality the US economy has been on life support for a decade now. Which makes more sense now you have the brain dead running the show and the ghouls with the money looking to suck the corpse dry. This is such a tragedy.

SimplyTracie · 26-30, F

@SW-User Doesn’t the middle class earn between $60 ~ $100K. They can afford a nice phone.

SW-User

@SimplyTracie I thought middle class in my country was $40-$90. Yes, they can afford a nice phone, too, yet they complain about grocery prices while clothing prices have gone down by their support of putting people out of work.. Funny world.

SimplyTracie · 26-30, F

@SW-User I guess income levels will depend on who generates the report.

Funny world. Yes.

Funny world. Yes.

SW-User

The interest rates were really low for many years. Lowering them now is not going to have a big impact, it might delay the recession just after the election but that's it. The recession will happen regardless, they always do, that's why they're called business cycles. Having a 1% rate might cause people or corporations to take loans, but that won't fix the economy in itself. He's just trying to avoid looking weak before the election. Plus having low-interest rates is bad for savings accounts, and long term low-interest rates weaken the power of lowering interest rates.

SimplyTracie · 26-30, F

@SW-User I’m convinced that Trump should let the Federal Reserve do their thing without interference. 😊

SW-User

Because it provides only a short term boost to the economy and if you lower rates now then you will have less leeway to lower them in the future if the economy slides into serious recession. It’s the fiduciary responsibility of the fed chair to act in the long-term interest of the economy and not simply goose the short term numbers to give a sitting president a better chance of being re-elected.

Also, Trump most definitively does NOT know what is best for the economy, and if he did he would only do it if it benefitted him personally. Stop assuming that money and power are always earned through competence.

Also, Trump most definitively does NOT know what is best for the economy, and if he did he would only do it if it benefitted him personally. Stop assuming that money and power are always earned through competence.

SimplyTracie · 26-30, F

@SW-User Being that he majored in Economics from a fine university, he should have a clue. Yes?

I now have a better understanding about the interest rates and the Federal reserve. 😊

I now have a better understanding about the interest rates and the Federal reserve. 😊

eroslust · 46-50, M

Mayer Amschel Rothschild is: Permit me to issue and control the money of a nation, and I care not who makes its laws!

whowasthatmaskedman · 70-79, M

@eroslust And that worked great until international trade stopped relying on gold backing it. Then nations lost control of their own currency.

quitwhendone · M

Interest rates are part of monetary policy set by a nation's central bank. It's used to control inflation and provide liquidity as needed. At present, the Federal Reserve Bank Chairman and its Board of Governors believe that adequate liquidity is being provided by the current Federal Funds rate (the interest rate banks charge other banks) and inflation can best be kept in check at the current rate. Being that the economy is currently doing well, there is no need for Jerome Powell to lower the Federal Funds rate. The Fed must always strike a balance between providing liquidity and hedging against purchasing power degradation.

SimplyTracie · 26-30, F

@quitwhendone I’m gonna look up the word contracting as it relates to the GDP. 😊

quitwhendone · M

@SimplyTracie Economies either expand or contract. "Expands" means it's growing. "Contracts" means it shrinks (gets smaller.)

SimplyTracie · 26-30, F

@quitwhendone That was easy enough. 😊

KiwiBird · 36-40, F

IDK....dropping it is admitting that the economy is weak and needs more spending and stimulus

SimplyTracie · 26-30, F

@quitwhendone Can we do even better with a lower interest rate? I mean, people will buy new homes and new cars.

quitwhendone · M

@SimplyTracie Well, there is always a downside. As more money is released into the economy, prices go up. Higher prices erode consumer purchasing power. The Fed's job, in part, is to keep growth in check. Growth that is too rapid will send prices up. It's a delicate balance. I don't know all the details and nuances of it. There are people with PhDs in economics that will differ on how to best leverage monetary policy.

I think the bottom line is this: RIght now, the US economy is still doing well. There is no need to adjust rates either lower or higher. Not just yet. Presidents usually want more liquidity because faster, stronger economic growth usually makes a president look good. Presidents will always take credit for economic gains. They'll blame inflation on someone else.

You are too young to have even experienced significant inflation n the US economy. It hasn't been a problem recently but in past decades it was a huge issue. I don't think inflation has been a big problem since the 1980s. Ronald Regan had fights with his Fed Chairman just like Trump.

I think the bottom line is this: RIght now, the US economy is still doing well. There is no need to adjust rates either lower or higher. Not just yet. Presidents usually want more liquidity because faster, stronger economic growth usually makes a president look good. Presidents will always take credit for economic gains. They'll blame inflation on someone else.

You are too young to have even experienced significant inflation n the US economy. It hasn't been a problem recently but in past decades it was a huge issue. I don't think inflation has been a big problem since the 1980s. Ronald Regan had fights with his Fed Chairman just like Trump.

SimplyTracie · 26-30, F

@quitwhendone Okay. Just leave it be.

This message was deleted by its author.

MarmeeMarch · M

@whowasthatmaskedman

well they are the ones that are responsible for the interest rates.

well they are the ones that are responsible for the interest rates.

whowasthatmaskedman · 70-79, M

@MarmeeMarch Yes. However they dont move rates at the wish of the President. They have other performance Criteria. The money supply (those printing presses are running hot) and the exchange rate are other levers. No one has mentioned the US$ exchange rate in a long time. Of course. That would send the price of imports through the roof.

SimplyTracie · 26-30, F

yogibooboo · M

The Fed controls the interest rates. It depends on what you want. In general, when interest rates are low, the economy grows and inflation increases. Conversely, when interest rates are high, the economy slows and inflation decreases.

whowasthatmaskedman · 70-79, M

@yogibooboo Precisely. And it is a measure of how disconnected from real value that money has become that interest rates need to be pushed artificially low for so long to support employment and sales without inflation happening.

it's complicated Tracie.. Trump ain't right and trump ain't wrong..the recession coming is inevitable.. Trump just wants it to be after he is elected for a second term lowering interest can prolong the inevitable. but a crash is coming. nothing could be more certain.

SimplyTracie · 26-30, F

@Peacefulpanda Ohhh. Then we shoulda just let those big banks drown in their greed.

@SimplyTracie yeah.. we just prolonged the inevitable.. kicked the can down the road as they say. it's a lot like the deficit.. all administrations.. dems and reps as well as the whole of confess, all just keep increasing deficit spending. even a elementary school students or anyone with with credit cards knows exactly were that will all lead eventually.

SimplyTracie · 26-30, F

@Peacefulpanda Yeah. Also I think we owe close to half a trillion dollars annually to interest on our debt. Imagine what we could do with that money.

American leaders we elect are so dumb.

American leaders we elect are so dumb.

SimplyTracie · 26-30, F

@sarabee1995 Okay. I wasn’t aware that they print it.

MarkPaul · 26-30, M

@SimplyTracie No... I typed it where I intended.

sarabee1995 · 26-30, F

@SimplyTracie Well, the Bureau of Engraving & Printing prints them and delivers them in bulk to the various Fed banks. Those banks then decide how much to release into the economy, thusly controlling a portion of the money supply.

QuixoticSoul · 41-45, M

Public enemy #1 would like to retain its major lever for when there is a recession - or there will be nothing at all they can do about it.

SimplyTracie · 26-30, F

@QuixoticSoul Ohh okie. Just checking. 😊

SW-User

First don't ever trust Donald Trump on anything money related. He is an idiot, and before anyone counters with "he's a successful businessman", successful people don't file for bankruptcy 6 times. Second, is our economy weak enough that the stimulus he's proposing is needed? 🤷🏻♂️ To hear him talk our economy is doing well so why do something unnecessary like this?

SimplyTracie · 26-30, F

@quitwhendone Trump is a genius and maybe he knows shit but he’s not telling. 🤐

quitwhendone · M

@SimplyTracie Yep. He's playing a game of 3-dimensional chess that us mere mortals can't even dream of comprehending lol.

SimplyTracie · 26-30, F

@quitwhendone Ugh 😑

SW-User

You are young, collect a little more debt, yes a low interest rate is healthy. The only ones who benefit from a high interest rate is banks, really - but the caveat of that, low interest means the loanee has to be responsible with the affordable credit they've been given.

SimplyTracie · 26-30, F

@SW-User Young and naïve, huh?

If my local bank borrows money from the central bank at 0% they still gonna charge me a higher rate so they’ll still make money.

If my local bank borrows money from the central bank at 0% they still gonna charge me a higher rate so they’ll still make money.

SW-User

@SimplyTracie Everyone knows the set rate by the feds is going to be higher through a bank. And of course the lender wants to make money. It does set limitations to greed; banks are very greedy.

SimplyTracie · 26-30, F

@SW-User Yeah. Greed 😬

redredred · M

Because the Left would prefer a recession and economic upheaval to a Trump re-election and the Fed is clearly in the Left camp.

quitwhendone · M

@SimplyTracie Powell is a banker. Bankers aren't left or right. Bankers follow the laws of economics and finance. Powell is also a Republican.

SimplyTracie · 26-30, F

@quitwhendone Well, I glad Powell isn’t a suck up like his other appointees.

samueltyler2 · 80-89, M

@redredred Powell was appointed by traitor trump!

Th1nkF1rst · 70-79, M

MagesMax · 26-30, M

I'm not good with economics, but I see Trump so it's probably another trump steak.

whowasthatmaskedman · 70-79, M

@MagesMax To be fair to the man, he didnt butcher it. But he let it go off.

KiwiBird · 36-40, F

All is resolved, relax folks. Woke up this morning and it appears that Trump is now the Chosen One

SimplyTracie · 26-30, F

Drewman · 46-50, M

It's a very sensitive balancing game

SimplyTracie · 26-30, F

@Drewman I would think that there is a lot to consider before lowering the prime rate.

vetguy1991 · 51-55, M

I doubt even he knows

SimplyTracie · 26-30, F

@vetguy1991 He probably doesn’t. 🤦♀️

UserNameSW · 46-50, M

The stable genius wants it at 0

samueltyler2 · 80-89, M

@UserNameSW he probably wants it below zero!

This comment is hidden.

Show Comment

SimplyTracie · 26-30, F

@SW-User Me neither. Oh well. 🤷♀️

This comment is hidden.

Show Comment

SW-User

Interest sucks booty

SW-User

@SimplyTracie I already got a job but I am too in love with a strong challenge every semester 😅

I do it to myself every time

I do it to myself every time

SimplyTracie · 26-30, F

@SW-User You da man!

SW-User

@SimplyTracie nah, you da gurl! :3

I'm just a silly young fool as of now 😂

I'm just a silly young fool as of now 😂

SW-User

He is having a mental breakdown he needs taking away in strait jacket and throwing in nuthouse preferably without soap and toothpaste

SW-User

@SimplyTracie 👍️

SimplyTracie · 26-30, F

@SW-User His staff probably feels they’re in one everyday.

SW-User

@SimplyTracie Hahahahahahaha 👍️