ElwoodBlues · M

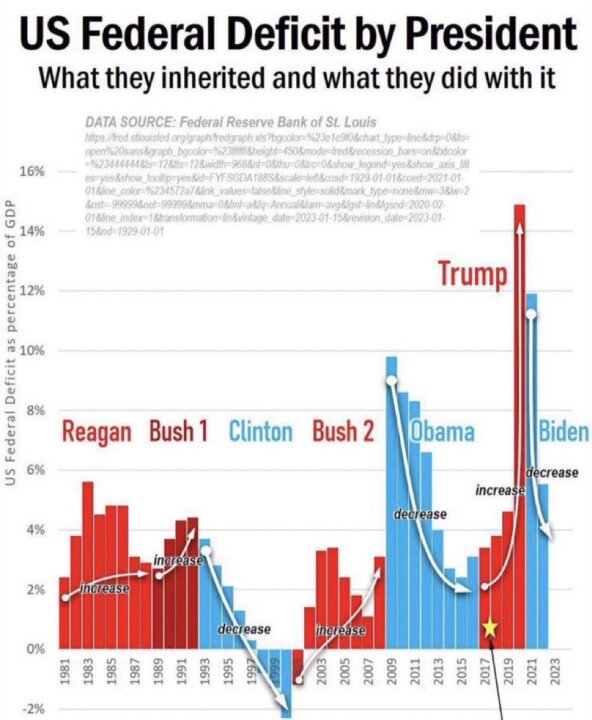

A very relevant figure of merit here is the deficit as a percent of GDP and here's a graph. Notice how many of the big rises in the ratio occur during republican admins? Wouldn't it be great if those deficit hawks could acknowledge that pattern and apportion responsibility accordingly?

from https://www.economicshelp.org/blog/3018/economics/history-of-us-national-debt-gdp/

from https://www.economicshelp.org/blog/3018/economics/history-of-us-national-debt-gdp/

Wouldn't it be great if those deficit hawks didn't hibernate during republican admins? Wouldn't it be great if those deficit hawks fought back against the ongoing lies of "supply side economics"?

Wouldn't it be great if those deficit hawks didn't hibernate during republican admins? Wouldn't it be great if those deficit hawks fought back against the ongoing lies of "supply side economics"?

View 60 more replies »

HoraceGreenley · 61-69, M

@Kypro @ElwoodBlues

Today, these organizations buy mortgages to free up capital for lenders. But they don't lend money to the borrowers or originate loans.

Beginning in the late 90's they started offering guarantees on mortgages. If the loan defaulted, they would pay off the balance.

So mortgages were easy to get. And these organizations would issue guarantees for any loan.

They never did that before. It was because Congress made them do it.

Now underwriters could approve any loan without fear of default. Over $1 Trillion of mortgages were guaranteed over approximately 10 years. At that point Congress stopped the guarantees.

So with the tax payer picking up the tab for the guarantees, mortgage originators got as many loans as they could find and collect their origination fee. Underwriters could approve any laon and start collecting interest payments.

Wall Street made fees packaging the loans and sell portfolios.

No one was concerned about defaults since the guarantee would cover any losses. Everyone kept originating, underwriting, and selling portfolios because they made money.

Ordinarily this would be impossible to do because the defaults would wipe put all the gains in the portfolio and the portfolio owner woukd lose big. That's why it never happened before...or since.

Thank Congress for using taxpayer funds for creating this mess.

Today, these organizations buy mortgages to free up capital for lenders. But they don't lend money to the borrowers or originate loans.

Beginning in the late 90's they started offering guarantees on mortgages. If the loan defaulted, they would pay off the balance.

So mortgages were easy to get. And these organizations would issue guarantees for any loan.

They never did that before. It was because Congress made them do it.

Now underwriters could approve any loan without fear of default. Over $1 Trillion of mortgages were guaranteed over approximately 10 years. At that point Congress stopped the guarantees.

So with the tax payer picking up the tab for the guarantees, mortgage originators got as many loans as they could find and collect their origination fee. Underwriters could approve any laon and start collecting interest payments.

Wall Street made fees packaging the loans and sell portfolios.

No one was concerned about defaults since the guarantee would cover any losses. Everyone kept originating, underwriting, and selling portfolios because they made money.

Ordinarily this would be impossible to do because the defaults would wipe put all the gains in the portfolio and the portfolio owner woukd lose big. That's why it never happened before...or since.

Thank Congress for using taxpayer funds for creating this mess.

ElwoodBlues · M

@HoraceGreenley Wow, it took $700 billion to handle the whole subprime mortgage problem. Sounds like a big number, doesn't it?

Start with Lehman. Lehman Bros owed $600 billion in debt, of which $400 billion was “covered” by credit default swaps sold by AIG, Pacific Investment,, and hedge fund Citadel. They couldn't cover the swaps they had sold. And if any of them collapsed, there were hundreds of billions more CDSs that would come due, sold by other institutions.

And nobody knew who had CDSs on what. There was no clearinghouse. They weren't declared as risks on anybody's books.

"The value of credit default swaps stood at $45 trillion" and they were set up worse than dominoes; if any one institution fell it would take down all the others.

$45 trillion. THAT was what was too big to fail. $45 trillion in undeclared unregulated securities. THAT was why Bush was forced to bail out Wall St. Because if he didn't, the bloodbath would be worse than 1929. The subprime mortgages were peanuts compared to the CDS mess.

You think you can blame it all on Fannie Mae & Freddie Mac, but private lenders held far more subprime mortgages, and the ones they held were riskier. So what? If a financial institution makes bad choices they fail and their stockholders take a bath. Nope. $45 trillion in CDSs made the whole system as weak as its weakest link. $45 trillion in CDSs made Bush bail out the whole system at taxpayer expense.

The 2008 Financial Crisis

The value of credit default swaps stood at $45 trillion compared to $22 trillion invested in the stock market, $7.1 trillion in mortgages and $4.4 trillion in U.S. Treasuries.

The value of credit default swaps stood at $45 trillion compared to $22 trillion invested in the stock market, $7.1 trillion in mortgages and $4.4 trillion in U.S. Treasuries.

Start with Lehman. Lehman Bros owed $600 billion in debt, of which $400 billion was “covered” by credit default swaps sold by AIG, Pacific Investment,, and hedge fund Citadel. They couldn't cover the swaps they had sold. And if any of them collapsed, there were hundreds of billions more CDSs that would come due, sold by other institutions.

And nobody knew who had CDSs on what. There was no clearinghouse. They weren't declared as risks on anybody's books.

"The value of credit default swaps stood at $45 trillion" and they were set up worse than dominoes; if any one institution fell it would take down all the others.

$45 trillion. THAT was what was too big to fail. $45 trillion in undeclared unregulated securities. THAT was why Bush was forced to bail out Wall St. Because if he didn't, the bloodbath would be worse than 1929. The subprime mortgages were peanuts compared to the CDS mess.

You think you can blame it all on Fannie Mae & Freddie Mac, but private lenders held far more subprime mortgages, and the ones they held were riskier. So what? If a financial institution makes bad choices they fail and their stockholders take a bath. Nope. $45 trillion in CDSs made the whole system as weak as its weakest link. $45 trillion in CDSs made Bush bail out the whole system at taxpayer expense.

HoraceGreenley · 61-69, M

@ElwoodBlues No one would underwrite the subprime mortgages without the loan guarantees. That's the point.

Congress made that happen, because the authority to do so didn't exist.

You're talking about the exposure of the derivatives. That's not the same as the underlying portfolio values.

The point is, none of this happened before the loan guarantees were made. And they haven't happened since then. This is what caused the problem.

I mean why hadn't this happened before? Something had to change.

Congress made that happen, because the authority to do so didn't exist.

You're talking about the exposure of the derivatives. That's not the same as the underlying portfolio values.

The point is, none of this happened before the loan guarantees were made. And they haven't happened since then. This is what caused the problem.

I mean why hadn't this happened before? Something had to change.

Longpatrol · 31-35, M

Conservatives love to hate Clinton but the man did something about the debt. Bush blew it with an unnecessary war.

HoraceGreenley · 61-69, M

@ElwoodBlues I'm not changing anything

Kypro · 46-50, M

@HoraceGreenley you don’t let facts get in your way I guess

HoraceGreenley · 61-69, M

@Kypro Elwood is the historical revisionist

DeWayfarer · 61-69, M

Yes let's have some facts, yet with links!

50 year U.S. Debt by President Short % table

Joe R. Biden..*projected 46.36%

Donald J. Trump......40.43%

Barack Obama..........69.98%

George W. Bush... 105.08%

William J. Clinton.....31.64%

George H. W. Bush..54.39%

Ronald Reagan........ 186.36%

Jimmy Carter............ 42.79%

Gerald Ford..................47.11%

https://www.self.inc/info/us-debt-by-president/

*projected figures from:

https://www.statista.com/statistics/262893/national-debt-in-the-united-states

Party increases over the last 50 years!

Democratic increases: 47.69%

Republican increases: 86.67%

50 year U.S. Debt by President Short % table

Joe R. Biden..*projected 46.36%

Donald J. Trump......40.43%

Barack Obama..........69.98%

George W. Bush... 105.08%

William J. Clinton.....31.64%

George H. W. Bush..54.39%

Ronald Reagan........ 186.36%

Jimmy Carter............ 42.79%

Gerald Ford..................47.11%

https://www.self.inc/info/us-debt-by-president/

*projected figures from:

https://www.statista.com/statistics/262893/national-debt-in-the-united-states

Party increases over the last 50 years!

Democratic increases: 47.69%

Republican increases: 86.67%

Kypro · 46-50, M

I used the wrong attachment. This was the deficit one. Here is debt. My mistake. https://youtu.be/nmeF_hIkX18

Kypro · 46-50, M

@HoraceGreenley correlation. Maybe reread this convo

HoraceGreenley · 61-69, M

@Kypro OK...I'll take your word for it.

Kypro · 46-50, M

@HoraceGreenley good, rereading it would be a chore lol

ElwoodBlues · M

@HoraceGreenley

Banks competed to make loans and afterwards hoped to sell them on the secondary market, in which the biggest players were Fannie & Freddie. There was no prior check with Fannie or Freddie. There was no guarantee they could sell a subprime loan on to Fannie or Freddie. Fanny & Freddie bought very few subprime loans.

Athough they did buy Alt-A loans, there was again no guarantee that a primary lender could sell any particular loan to Fanny or Freddy. The problems came, not from subprime loans but from loans in overheated markets - see the table below.

Some more facts:

Banks in overheated housing markets suddenly had lots of underwater mortgages. So why not just let them fail and let their stockholders take a bath? Why the bailout? It's because falsely rated securitized mortgages were all over the place, owned by big institutions with credit default swaps waiting in the wings.

This DID happen before. It happened in 1929. And to prevent it from happening again, the government imposed strict regulations on banks. But by the early 2000s there were non-bank entities offering mortgages and there was the secondary mortgage market taking loans off the banks' books thus allowing banks to lend again.

My wife and I knew General Motors was in big trouble when GM credit & finance re-sold our mortgage. The institution to which we wrote our mortgage check kept changing. And it was never Freddie or Fannie; the secondary mortgage market was and is huge. And that's OK as long as the risks aren't falsified. But the rating agencies took "tranches" of crappy mortgages and rated them AAA, thus falsifying the risks.

No one would underwrite the subprime mortgages without the loan guarantees.

FALSE. Banks competed to make loans and afterwards hoped to sell them on the secondary market, in which the biggest players were Fannie & Freddie. There was no prior check with Fannie or Freddie. There was no guarantee they could sell a subprime loan on to Fannie or Freddie. Fanny & Freddie bought very few subprime loans.

Athough they did buy Alt-A loans, there was again no guarantee that a primary lender could sell any particular loan to Fanny or Freddy. The problems came, not from subprime loans but from loans in overheated markets - see the table below.

Some more facts:

Fannie and Freddie never purchased subprime loans in any significant quantities. They did build large portfolios of AAA-rated, privately-issued subprime mortgage-backed securities, but these securities differed from whole loans because they generally enjoyed a very substantial credit enhancement — meaning they were structured in a way that made them significantly safer investments. But although they generally stayed away from buying subprime loans directly, the two GSEs did begin acquiring Alt-A and interest-only loans on a large scale at the end of 2005 in an effort to win back market share. While both types of loans had features that made them riskier than traditional, prime mortgages, they were not subprime. Moreover, both types of loans tended to be made to borrowers with relatively high credit scores, and they tended not to involve very low down payments.

About 80% of Fannie and Freddie's combined $213 billion in credit losses between 2008 and 2011 involved mortgages that were either Alt-A, interest-only, or both. As a result, it is common for GSE losses to be attributed to "subprime or other 'high risk' mortgages." Given this performance record, it may seem reasonable to lump these loans with subprime mortgages. Grouping all these non-traditional mortgages into a "high risk" bucket because of high realized-default rates, however, introduces an element of hindsight that thoroughly confuses the issue. It ascribes huge significance to factors like mortgage structure that in reality had very little effect on the volume of mortgage defaults. The simple fact is that any mortgage on a house that declines in price by 70% is likely to appear "high risk" in hindsight.

Alt-A and interest-only loans were called "affordability products" because they were originated in areas — Miami, Tampa, Arizona, Las Vegas, and parts of California — where house prices had grown faster than borrowers' incomes. As a result, these mortgages were concentrated in the precise locations where house prices fell most dramatically when the bubble burst.

https://www.nationalaffairs.com/publications/detail/fannie-freddie-and-the-crisis About 80% of Fannie and Freddie's combined $213 billion in credit losses between 2008 and 2011 involved mortgages that were either Alt-A, interest-only, or both. As a result, it is common for GSE losses to be attributed to "subprime or other 'high risk' mortgages." Given this performance record, it may seem reasonable to lump these loans with subprime mortgages. Grouping all these non-traditional mortgages into a "high risk" bucket because of high realized-default rates, however, introduces an element of hindsight that thoroughly confuses the issue. It ascribes huge significance to factors like mortgage structure that in reality had very little effect on the volume of mortgage defaults. The simple fact is that any mortgage on a house that declines in price by 70% is likely to appear "high risk" in hindsight.

Alt-A and interest-only loans were called "affordability products" because they were originated in areas — Miami, Tampa, Arizona, Las Vegas, and parts of California — where house prices had grown faster than borrowers' incomes. As a result, these mortgages were concentrated in the precise locations where house prices fell most dramatically when the bubble burst.

Banks in overheated housing markets suddenly had lots of underwater mortgages. So why not just let them fail and let their stockholders take a bath? Why the bailout? It's because falsely rated securitized mortgages were all over the place, owned by big institutions with credit default swaps waiting in the wings.

The value of credit default swaps stood at $45 trillion compared to $22 trillion invested in the stock market, $7.1 trillion in mortgages and $4.4 trillion in U.S. Treasuries.

There was no clearinghouse for CDSs. Companies didn't have to declare them as risks on their books. $45 trillion in unregulated unsecured CDSs dwarfed everything else in the market. 45 trillion in unregulated unsecured CDSs made the whole system brittle, as was discovered when Lehman was allowed to fail and brought due $400 billion in CDSs. I mean why hadn't this happened before? Something had to change.

This DID happen before. It happened in 1929. And to prevent it from happening again, the government imposed strict regulations on banks. But by the early 2000s there were non-bank entities offering mortgages and there was the secondary mortgage market taking loans off the banks' books thus allowing banks to lend again.

My wife and I knew General Motors was in big trouble when GM credit & finance re-sold our mortgage. The institution to which we wrote our mortgage check kept changing. And it was never Freddie or Fannie; the secondary mortgage market was and is huge. And that's OK as long as the risks aren't falsified. But the rating agencies took "tranches" of crappy mortgages and rated them AAA, thus falsifying the risks.

Ynotisay · M

It's been the same song and dance for a long time. The GOP blows up the economy, the Democrats come in and clean it up, the GOP screams about how bad the Democrats are with the economy, and the cycle repeats.

We live in a stupid country.

We live in a stupid country.

Ynotisay · M

@tindrummer I don't know. 40 percent don't even vote in Presidential elections. And it's far less for midterms and local. I'd say that, collectively, that's pretty stupid. And that's not even touching the 'patriots' who've been systematically trained to vote against their personal best interests. "We" just don't get it.

@Ynotisay It amazes me that people of a certain age have not figured this out yet. I guess they are too attached to their ideology?

Ynotisay · M

@whippersnapper I think you're right. The manipulation that's coincided with digital and social media has turned it all upside down. As a society we're not discerning. Too many take what they're fed, often by algorithms, and as long as it appease their feelings it's all over. I don't know how we break from from it. Not good.

SW-User

@Kypro @ElwoodBlues

I LOVE that @HoraceGreenley's ONLY comeback to ALL your posts is essentially

And then, when backed into a corner, he runs away 🤣

I LOVE that @HoraceGreenley's ONLY comeback to ALL your posts is essentially

"you're wrong"

. No counterargument, no evidence to support his claims; just "you're wrong"

. And then, when backed into a corner, he runs away 🤣

Kypro · 46-50, M

@SW-User we tried to provide support for what we said….

SW-User

@Kypro Yeah, I know. But he's not interested in facts. Although I also noticed that when the facts are irrefutable, @HoraceGreenley dismisses them as works of fiction by whack-job economists 🤣

whowasthatmaskedman · 70-79, M

It does make it rather easy to blunt an attack when it comes in anger and with no actual research or fact. Just believe what you want to believe ans scream it loud. (It help if you are carrying an American flag and wearing a hat with horns on it.) These people dont seem to get that by attacking in this manner they make their whole case look bad..😷

This message was deleted by its author.

HoraceGreenley · 61-69, M

Kypro · 46-50, M

@HoraceGreenley no by economists not just me

HoraceGreenley · 61-69, M

@Kypro Whack job economists

Kypro · 46-50, M

I don’t claim to know it all but I don’t make up stuff to support a position.

DCarey · 51-55, M

@Kypro Then I'll help you. The four surplus years there was a Republican-controlled Congress, except for the end of 2001 when the defection of Jim Jeffords led to a short-lived Democrat majority in the Senate. The five highest increases occurred in years in which Democrats controlled both houses of Congress (except for 2020, when Dems had the House with a GOP Senate). A simple understanding of federalism would have saved you from embarrassing yourself.

DaliaCQ · 26-30, F

So, Clinton was the last to have the nation in excess of savings,,,, He was a democrat, right? Seems like Democrats are good for the economy, and Republicans are spendthrifts...?

DaliaCQ · 26-30, F

@whowasthatmaskedman I know he liked his cigar smoked, but he was the better president going by those numbers.

whowasthatmaskedman · 70-79, M

@DaliaCQ I dont judge on personal behaviour. Just on the numbers.😷

DaliaCQ · 26-30, F

@whowasthatmaskedman If he did all he did balancing the books while having his cigar smoked, how much more could he have done for America if he got up from his desk!

I feel this meeting could have been an email

whowasthatmaskedman · 70-79, M

Thanks for the facts.. Now watch those on the Right attack the man because they cant add.😷

Kypro · 46-50, M

I think this convo shows how some can’t handle the truth and have to call names to make a point. The can’t accept a fact that slaps them in the head.

@Kypro I have never seen a poster directly reply to his own post as much as you 🤔

Kypro · 46-50, M

@whippersnapper there was a lot of back and forth not just my replies.

@Kypro oh, ok ✌️

HoraceGreenley · 61-69, M

The national debt and deficit are two different things. You have confused them.

Kypro · 46-50, M

@HoraceGreenley how so? This shows debt.

HoraceGreenley · 61-69, M

@Kypro Actually it doesn't show debt.

DCarey · 51-55, M

Congress has the power of the purse. You convienently leave out control of Congress on your so-called chart.

Kypro · 46-50, M

That’s the year it kicked in I think. Decline was due to lower spending.

This message was deleted by its author.

SomeMichGuy · M

Yes. Great post. Thank you.

Kypro · 46-50, M

https://www.cnn.com/2023/02/10/politics/us-federal-debt-past-presidents/index.html

Fukfacewillie · 56-60, M

The rich needed their tax cuts.

This comment is hidden.

Show Comment