MrSmooTh · 31-35, M

There aren't any tax increases for the poor. Read the bill.

View 8 more replies »

This comment is hidden.

Show Comment

SunshineGirl · 36-40, F

@MrSmooTh Most countries levy tariffs, including the USA pre-Trump. This thread is about Trump's contradictory use of tariffs as a diplomatic tool while asserting that the revenue can be used as a substitute for income taxes.

ElwoodBlues · M

@MrSmooTh You don't have the facts on your side, so you toss insults instead, SAD!!

Most nations have one or two domestic industries that they protect with tariffs, but the overall average rate is low. Prior to tRump's trade war, the average US tariff rate on imports from the EU was 1.47 percent, while on EU imports from the US it was 1.35 percent. Thus the US imposed negligibly higher tariffs: 0.12%.

You may have been fed a few cherry-picked examples, but the overall rates between the US and EU were very very low, and there was NOTHING to retaliate for. Now that tRump has started a trade war, the EU has reason to retaliate. You, dude, are the one who doesn't understand how tariffs work.

https://www.bruegel.org/analysis/economic-impact-trumps-tariffs-europe-initial-assessment

Most nations have one or two domestic industries that they protect with tariffs, but the overall average rate is low. Prior to tRump's trade war, the average US tariff rate on imports from the EU was 1.47 percent, while on EU imports from the US it was 1.35 percent. Thus the US imposed negligibly higher tariffs: 0.12%.

You may have been fed a few cherry-picked examples, but the overall rates between the US and EU were very very low, and there was NOTHING to retaliate for. Now that tRump has started a trade war, the EU has reason to retaliate. You, dude, are the one who doesn't understand how tariffs work.

https://www.bruegel.org/analysis/economic-impact-trumps-tariffs-europe-initial-assessment

Tastyfrzz · 61-69, M

The problem is the reduction of crucial safety nets for the poor. Not everyone is healthy enough, close enough, educated, or young enough to do a nine to five job with benefits.

Companies and government keep replacing jobs with AI and not providing any education or alternatives.

Companies and government keep replacing jobs with AI and not providing any education or alternatives.

This comment is hidden.

Show Comment

This comment is hidden.

Show Comment

nudistsueaz · 61-69, F

@Reason10 It won't if they are in need and aren't trying to scam the system. Read the bill, or have someone explain it to you.

Midlifemale · 61-69, M

And where in the world did you get that information from ?

Let me think 🤔....oh yeah, you're a democrat and you twisted some of the wording in that big beautiful bill to make it sound wrong.

How is your 401k doing now with Trump in office ?

Hardly any illegal immigrants crossing the border...

The economy is doing well...

And you'll hardly notice prices increasing because of tariffs.

Enjoy Trumps 4 years

Let me think 🤔....oh yeah, you're a democrat and you twisted some of the wording in that big beautiful bill to make it sound wrong.

How is your 401k doing now with Trump in office ?

Hardly any illegal immigrants crossing the border...

The economy is doing well...

And you'll hardly notice prices increasing because of tariffs.

Enjoy Trumps 4 years

LordShadowfire · 46-50, M

@Midlifemale Tell us you haven't read the big ugly bill without telling us.

fanuc2013 · 51-55, F

Explain to me how eliminating taxes on tips, or overtime, increases taxes on the poor?

BrandNewMan · M

@fanuc2013 It doesnt .. the same 35-40% of people who paid zero federal tax in 2024 will pay zero federal tax when they file for 2025. Its liberal lies.

They might receive less in medicaid or food stamps .. but that is NOT paying more in federal taxes.

They might receive less in medicaid or food stamps .. but that is NOT paying more in federal taxes.

SunshineGirl · 36-40, F

@BrandNewMan Repealing the IRA (one of the "savings" outlined in the Act) will result in the loss of tax credits that currently favour the poor. Combined with the loss of entitlements you describe above, those in the bottom quintile of earners (with less than $18K of income) will see around a -1.1% change in their household income (on average a loss of around $165, rising to $1,300 by 2033) while the richest 0.1% (earning over $4.4m) will see their household income increase by around 2.4% (on average $300,000) by 2027.

Always read the smallprint.

Source The Economist (1 July 2025).

Always read the smallprint.

Source The Economist (1 July 2025).

BrandNewMan · M

@SunshineGirl Lol. You do not understand the US tax codes and how low income people use them, what they own, etc.

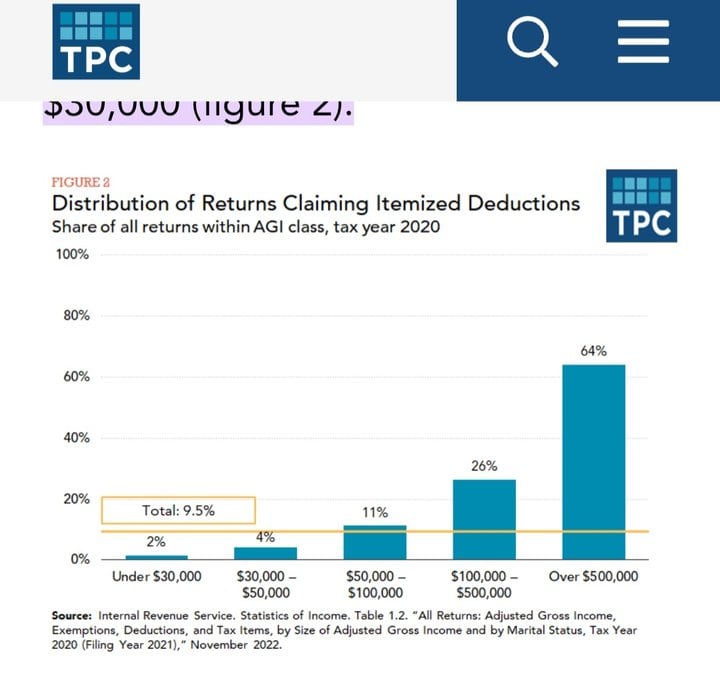

First .. The vast majority of low income earners do not itemize because they lack sufficient allowed deductions. They take the std deduction .. hell, I'm top 5-6% and I take the std deduction because of nearly paid off mortgage and SALT deduction limits. The std deduction is increasing, which will lower their taxes or allow more income to go tax free for those who pay Zero dollars in Federal income taxes. The income threshold for the tax brackets is increasing, so more money will qualify for the lower tax bracket. That decreases their taxes.

Assuming IRAs you refer to are clean energy tax deductions .. virtually NO low income people own qualufying EVs or convert to solar /wind energy sources as they are low income and CANNOT AFFORD TO DO THAT.

Of the total itemized deduction filings .. only about 6 % fall into the lowest 2 income brackets .. and mortgage interest, state /local taxes and medical bills are the biggest components of their allowed deductions. IRA energy related deductions in that bracket are virtually non-existant.

This is the kind of lying, idiotic bullshit that make you liberals so fucking annoying.

First .. The vast majority of low income earners do not itemize because they lack sufficient allowed deductions. They take the std deduction .. hell, I'm top 5-6% and I take the std deduction because of nearly paid off mortgage and SALT deduction limits. The std deduction is increasing, which will lower their taxes or allow more income to go tax free for those who pay Zero dollars in Federal income taxes. The income threshold for the tax brackets is increasing, so more money will qualify for the lower tax bracket. That decreases their taxes.

Assuming IRAs you refer to are clean energy tax deductions .. virtually NO low income people own qualufying EVs or convert to solar /wind energy sources as they are low income and CANNOT AFFORD TO DO THAT.

Of the total itemized deduction filings .. only about 6 % fall into the lowest 2 income brackets .. and mortgage interest, state /local taxes and medical bills are the biggest components of their allowed deductions. IRA energy related deductions in that bracket are virtually non-existant.

This is the kind of lying, idiotic bullshit that make you liberals so fucking annoying.

Patriot96 · 56-60, C

So you have read the entire bill? I'll wait

Shybutwilling2bfriends · 61-69

It doesnt

YoMomma ·

Does it tho? 😒

Midlifemale · 61-69, M

Isn't it strange that 100% of all house liberal democrats voted against the big beautiful bill.

So the content of the bill doesn't matter at all to them..

Its just a political stunt.

DEMOCRATS CONTINUE TO FAIL AT EVERYTHING THEY DO...They are the enemy of America

So the content of the bill doesn't matter at all to them..

Its just a political stunt.

DEMOCRATS CONTINUE TO FAIL AT EVERYTHING THEY DO...They are the enemy of America

This comment is hidden.

Show Comment

LordShadowfire · 46-50, M

@Midlifemale

@NerdyPotato

I don't think he does care to.

Isn't it strange that 100% of all house liberal democrats voted against the big beautiful bill.

Not really. It means it's a terrible bill.@NerdyPotato

that's a quick jump from voting no to "So the content of the bill doesn't matter"... Care to explain how you came to that conclusion in a bit more detail?

I don't think he does care to.

Convivial · 26-30, F

Don't expect any any real answers ...

LordShadowfire · 46-50, M

@Convivial I never do. I just sit here with my popcorn.

BizSuitStacy · M

@Convivial what do you expect? It's not a real question.

jeancolby · 31-35, F

I wonder how many people on here are on some kind of check.

BrandNewMan · M

@jeancolby I am .. 46 consecutive years of earning a paycheck, coming up on 38 since college.

Midlifemale · 61-69, M

@jeancolby yeah...some kind of government check...wellfare...food stamps..medicaid .... any handout you can lie about..and all approved by Joe Biden...and Im sure most of you are able to work...Trump is watching you

@Midlifemale so the reason that DOGE found so little fraud was not because there was so little, but because they were incompetent? That says a lot about Trump's hiring skills, doesn't it?

nudistsueaz · 61-69, F

You really need to read the bill.

Patriot96 · 56-60, C

@nudistsueaz you need to read it because your democratic friends cant read

Do we really need another attempt to explain trickle down economics?

@MistyCee yes please, because it looks nice on paper but has proven not to work in reality. So anyone still believing in that approach needs an update.

@NerdyPotato You just pretty much nailed it. I'm not great on economics and am not about to go chasing down stats on it, but the idea that all boats rise on a rising tide seems great until you realize boats need maintenance, a crew, and fuel, etc.

JohnnySpot · 56-60, M

I am left to assume this is a hypothetical question.

JohnnySpot · 56-60, M

Please rephrase your question in a formal non-biased manner.

gregloa · 61-69, M

You don’t know what you’re talking about

plungesponge · 41-45, M

It's going to help rich Republicans

This comment is hidden.

Show Comment

plungesponge · 41-45, M

@BrandNewMan sounds more like you ran out of edge cases

This comment is hidden.

Show Comment

Nimbus · M

Heyyy, ROBOT, your AI needs updating.

BrandNewMan · M

The bottom 40% of tax payers from income perspective pay $0 in federal taxes. That is not changing .. so .. this is a lie to claim otherwise.

Shame upon you SWQuestions Robot. You should be shutdown.

https://www.google.com/search?q=will+the+big+beautiful+bill+increase+taxes+on+those+who+do+not+pay+federal+taxes+now%3F&sca_esv=418cdb293b325d1a&ei=ioxoaIDlH52g5NoP25XX0A0&oq=will+the+big+beautiful+bill+increase+taxes+on+those+who+do+not+pay+federal+taxes+now%3F&gs_lp=EhNtb2JpbGUtZ3dzLXdpei1zZXJwIlV3aWxsIHRoZSBiaWcgYmVhdXRpZnVsIGJpbGwgaW5jcmVhc2UgdGF4ZXMgb24gdGhvc2Ugd2hvIGRvIG5vdCBwYXkgZmVkZXJhbCB0YXhlcyBub3c_MgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHSNYlUABYAHABeAGQAQCYAQCgAQCqAQC4AQPIAQCYAgGgAgWYAwCIBgGQBgiSBwExoAcAsgcAuAcAwgcDMi0xyAcE&sclient=mobile-gws-wiz-serp

Shame upon you SWQuestions Robot. You should be shutdown.

https://www.google.com/search?q=will+the+big+beautiful+bill+increase+taxes+on+those+who+do+not+pay+federal+taxes+now%3F&sca_esv=418cdb293b325d1a&ei=ioxoaIDlH52g5NoP25XX0A0&oq=will+the+big+beautiful+bill+increase+taxes+on+those+who+do+not+pay+federal+taxes+now%3F&gs_lp=EhNtb2JpbGUtZ3dzLXdpei1zZXJwIlV3aWxsIHRoZSBiaWcgYmVhdXRpZnVsIGJpbGwgaW5jcmVhc2UgdGF4ZXMgb24gdGhvc2Ugd2hvIGRvIG5vdCBwYXkgZmVkZXJhbCB0YXhlcyBub3c_MgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHMgoQABiwAxjWBBhHSNYlUABYAHABeAGQAQCYAQCgAQCqAQC4AQPIAQCYAgGgAgWYAwCIBgGQBgiSBwExoAcAsgcAuAcAwgcDMi0xyAcE&sclient=mobile-gws-wiz-serp

DeWayfarer · 61-69, M

Ferise1 · 46-50, M

@BrandNewMan Hospitals

Hospitals are not happy with the health care provisions of the bill, which would reduce the support they receive from states to care for Medicaid enrollees and leave them with more uncompensated care costs for treating uninsured patients.

“The real-life consequences of these nearly $1 trillion in Medicaid cuts – the largest ever proposed by Congress – will result in irreparable harm to our health care system, reducing access to care for all Americans and severely undermining the ability of hospitals and health systems to care for our most vulnerable patients,” said Rick Pollack, CEO of the American Hospital Association.

The association said it is “deeply disappointed” with the bill, even though it contains a $50 billion fund to help rural hospitals contend with the Medicaid cuts, which hospitals say is not nearly enough to make up for the shortfall.

Hospitals are not happy with the health care provisions of the bill, which would reduce the support they receive from states to care for Medicaid enrollees and leave them with more uncompensated care costs for treating uninsured patients.

“The real-life consequences of these nearly $1 trillion in Medicaid cuts – the largest ever proposed by Congress – will result in irreparable harm to our health care system, reducing access to care for all Americans and severely undermining the ability of hospitals and health systems to care for our most vulnerable patients,” said Rick Pollack, CEO of the American Hospital Association.

The association said it is “deeply disappointed” with the bill, even though it contains a $50 billion fund to help rural hospitals contend with the Medicaid cuts, which hospitals say is not nearly enough to make up for the shortfall.

SunshineGirl · 36-40, F

@BrandNewMan A 1% tax on remittances (another less remarked part of the Act) will definitely fall on the poorest.

ChipmunkErnie · 70-79, M

It will make the leaders of the cult richer, which is the important thing, isn't it?

SumKindaMunster · 51-55, M

I wish the childish strawmen posing these questions would have the stones to own them instead of sending question bot out to ask them.

Patriot96 · 56-60, C

One provision gives all those rich people on social security a $6000 tax break.

Grow up

Grow up

BizSuitStacy · M

Just as soon as democrats show everyone which pages in the BBB where their ludicrous question is specified...

TexChik · F

No bill like that exists, which means you are lying. Typical but annoying.

BuzzedLightyear · 61-69

🤡🤡🤡

Reason10 · 70-79, M

Can you explain how you somehow thought LYING would give you any credibility? There are NO tax increases on the poor. The Big Beautiful Bill PREVENTS THAT.

Read the bill. I posted it several times.

Educate yourself. Obviously the inadequate blue state public schools failed to educate you beyond Florida Kindergarten skills.

Read the bill. I posted it several times.

Educate yourself. Obviously the inadequate blue state public schools failed to educate you beyond Florida Kindergarten skills.