She's lying. Of course the businesses will increase prices at least some to offset tax increases. They already are for inflation costs.

$3.5Tr will be paid by increasing taxes .. that is not $0 .. not "free". Those taxes are beyond high earners (see below). Claiming otherwise is a bald faced lie.

Biden says no higher income tax on middle class (income <$400k) .. yet they are looking at how they could tax:

- Every mile you drive a vehicle

- Unrealized gains, including on an inherited home at time of inheritance, not at time of sale

- Increases to capital gains taxes

- Tax on all financial transactions on top of taxes on any gains (think every 401k, 529 plan, etc other contribution or trade)

- Many other opportunities being sought

- Small business pass throughs

The costs in additional corporate taxes will reduce payments to all employees .. in the form of reduced benefits provided, lower bonuses, lower profit sharing, smaller salary increases, fewer jobs in the U.S. vs other markets. This is based on historical fact of what happened during periods of higher corporate tax rates.

Those will ALL affect every income level under the U.S. tax code. They are coming for every dollar from everyone they can take it from. This from the same government that has mismanaged Social Security (remember, people and companies pay in .. this is not tax funded) for decades and to the point it may not remain solvent beyond 2036.

I do not make $400k per year .. but am already paying every dollar in tuition for two kids in college at the same time and unable to deduct a single cent of those costs on my taxes. I can not deduct over $8000 of state, local and property taxes because of limitations. Yet .. the government wants to take even more of my money to turn around offer free tuition and health care to illegal immigrants and other entitlements to the rest of the country.

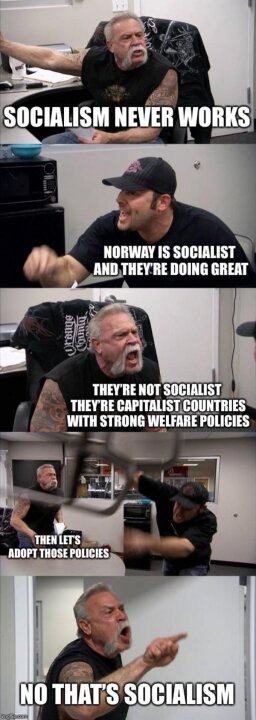

Like they chant in college football games these days .. "FUCK JOE BIDEN !!" .. and Bernie .. AOC and Squad .. Elizabeth Warren .. all the other "Progressives" .. and FUCK socialism in America.