I Have a Question

why did EVERYONE HERE

pay Less taxes than

Amazon, a trillion dollar company

they got 129 million BACK

no taxes at all.

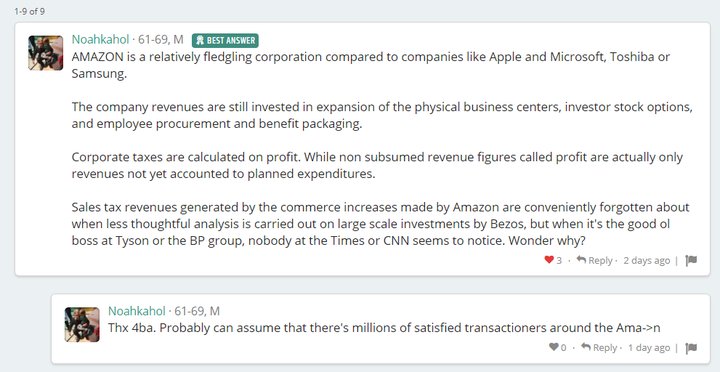

thoughts?

pay Less taxes than

Amazon, a trillion dollar company

they got 129 million BACK

no taxes at all.

thoughts?