The American Train Wreck

The United States blew past a Fiscal Nightmare of $35 Trillion in National Debt. That's $105,000 for every Individual and $270,000 for every Household. That Debt surged $2.3 Trillion over 12 months. That’s $6.4 Billion every single day, $266.7 Million an hour, and $4.44 Million a minute. A Quagmire of epic proportions.

Doug Casey and Others sounded the alarm about US Debt. Yet, Wall Street, the Corporate Media, Corrupt Politicians, and US Voters brushed it off. US Consumers are completely in the dark about our Real Crisis. The National Debt is construed as a distant thunderstorm — far off and abstract, rather than the storm right over their heads. You’re the ones who will be forced to Pay the Piper his due when he comes to collect. Did you know your Income Taxes were spent on interest on the National Debt last month?!

According to the latest monthly Statement of the US Treasury net interest expense was $81 Billion. That’s 43% of the $185 Billion the Government collected in Income Tax receipts.

Gross interest paid in June amounted to $140 Billion. That’s 76% of all Income Tax receipts. Simply put, 76 Cents of every Dollar you yourself paid in Income Tax in June went to Debt Interest. If that doesn’t give Taxpayers pause, God help them.

Net interest is the Interest paid on US Treasury Debt held by the Public, including both Domestic and Foreign sources. Gross interest includes Interest paid to US Government "Trust Funds" (Social Security, Medicare, and Medicaid) and other Government accounts holding US Debt.

Every Dollar used to pay interest on the Debt is a Dollar taken from your wallet, your Bank Account, your Insurance Policy, your Reirement Account, and everything else you own/need and sent to Debt holders in Japan, China, and other Foreign Countries.

The US can’t just bank on Foreign Governments buying its Debt as they're De-Dollarizing. They already hold $8.1 Trillion of US Debt, not including Agency Debt.

Think about this from a Foreign Government’s Perspective: Would you be dumb enough to keep trusting a country that’s so irresponsible with its Finances to hold the bulk of your Reserves?!

Last year, Moody’s and Fitch Credit Agencies, downgraded their outlook on US Debt. The main reason they cited for the downgrade was, you guessed it, surging Interest payments.

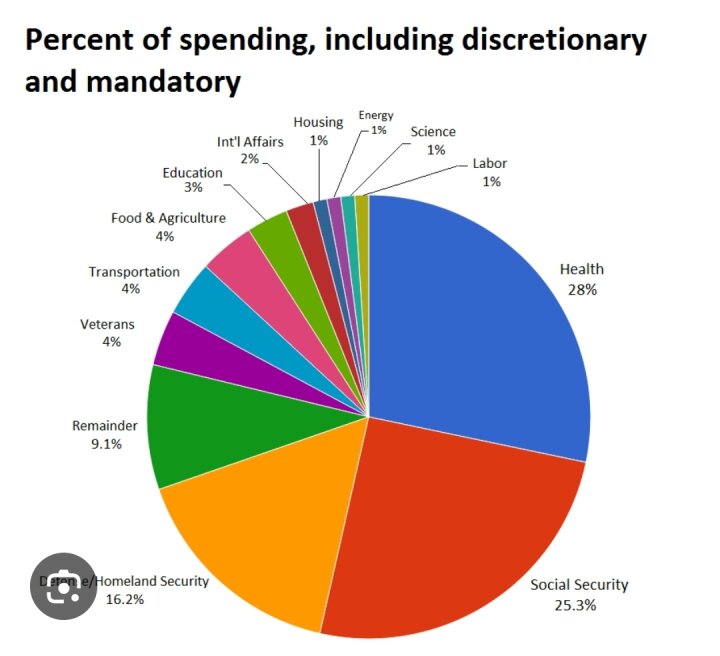

Servicing the Debt is now the second-largest Budgetary Outlay. The United States spends more on interest payments than National Defense, Entitlements, and Welfare combined. How sustainable does anyone really think that is?!

It'd be Political Suicide for the Political Indentured Servants on Capitol Hill and State Capitols with their cannibalistic Corporate paymasters to admit the United States will default. They will; Bail Out the System devaluing the US Dollar. DEVALUE or DIE.

The Corporate Duopoly of Republicans and Democrats is hopelessly Corrupt. Those who look to Political Indentured Servant Legislators to solve their problems are complicit in their own throats being cut. The World Reserve Currency Status of the US Dollar is weaponized against Sovereign Countries and Citizenry to bring them to their knees is and has backfired terribly and horribly. Peace, Commerce, Honest Friendship, and Liberty🗽 is the only thing that'll mitigate the disaster of the US Government's Ponzi Scheme and the bursting of the US Bubble Economy. Time is running out!!!

Doug Casey and Others sounded the alarm about US Debt. Yet, Wall Street, the Corporate Media, Corrupt Politicians, and US Voters brushed it off. US Consumers are completely in the dark about our Real Crisis. The National Debt is construed as a distant thunderstorm — far off and abstract, rather than the storm right over their heads. You’re the ones who will be forced to Pay the Piper his due when he comes to collect. Did you know your Income Taxes were spent on interest on the National Debt last month?!

According to the latest monthly Statement of the US Treasury net interest expense was $81 Billion. That’s 43% of the $185 Billion the Government collected in Income Tax receipts.

Gross interest paid in June amounted to $140 Billion. That’s 76% of all Income Tax receipts. Simply put, 76 Cents of every Dollar you yourself paid in Income Tax in June went to Debt Interest. If that doesn’t give Taxpayers pause, God help them.

Net interest is the Interest paid on US Treasury Debt held by the Public, including both Domestic and Foreign sources. Gross interest includes Interest paid to US Government "Trust Funds" (Social Security, Medicare, and Medicaid) and other Government accounts holding US Debt.

Every Dollar used to pay interest on the Debt is a Dollar taken from your wallet, your Bank Account, your Insurance Policy, your Reirement Account, and everything else you own/need and sent to Debt holders in Japan, China, and other Foreign Countries.

The US can’t just bank on Foreign Governments buying its Debt as they're De-Dollarizing. They already hold $8.1 Trillion of US Debt, not including Agency Debt.

Think about this from a Foreign Government’s Perspective: Would you be dumb enough to keep trusting a country that’s so irresponsible with its Finances to hold the bulk of your Reserves?!

Last year, Moody’s and Fitch Credit Agencies, downgraded their outlook on US Debt. The main reason they cited for the downgrade was, you guessed it, surging Interest payments.

Servicing the Debt is now the second-largest Budgetary Outlay. The United States spends more on interest payments than National Defense, Entitlements, and Welfare combined. How sustainable does anyone really think that is?!

It'd be Political Suicide for the Political Indentured Servants on Capitol Hill and State Capitols with their cannibalistic Corporate paymasters to admit the United States will default. They will; Bail Out the System devaluing the US Dollar. DEVALUE or DIE.

The Corporate Duopoly of Republicans and Democrats is hopelessly Corrupt. Those who look to Political Indentured Servant Legislators to solve their problems are complicit in their own throats being cut. The World Reserve Currency Status of the US Dollar is weaponized against Sovereign Countries and Citizenry to bring them to their knees is and has backfired terribly and horribly. Peace, Commerce, Honest Friendship, and Liberty🗽 is the only thing that'll mitigate the disaster of the US Government's Ponzi Scheme and the bursting of the US Bubble Economy. Time is running out!!!