SatanBurger · 36-40, F

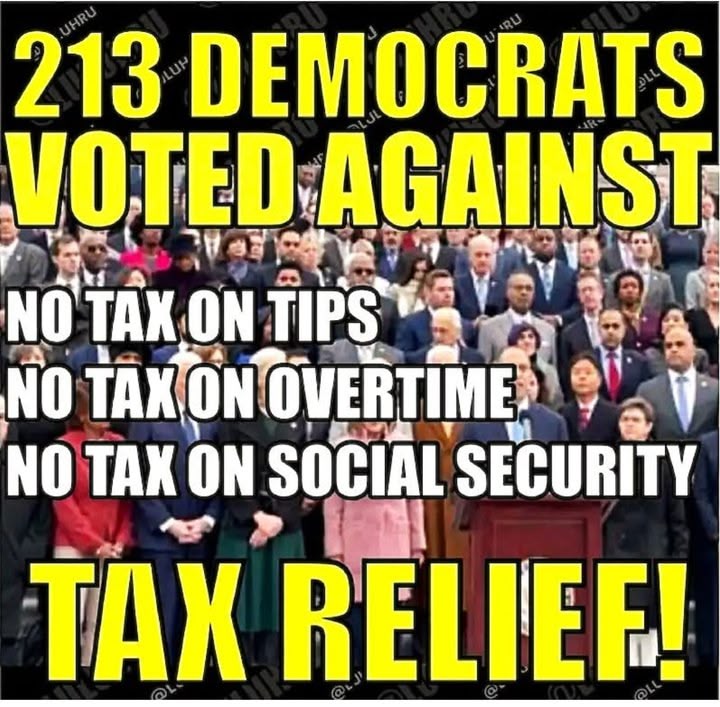

Just for perspective:

Fiscal Responsibility / Budget Concerns

Removing the tax without replacing the lost revenue would drain funds from:

The Social Security Trust Fund (federal level)

The state budget (state level like in Minnesota)

Many Democrats opposed a full repeal because:

1. It would create a multi-billion dollar budget hole

That shortfall might be used to justify future cuts to Social Security or Medicare

They didn’t want a tax break for wealthier seniors to lead to reduced benefits for lower-income retirees

2. Targeting Relief More Fairly

Most proposals to repeal the Social Security tax benefit higher-income retirees more, because:

Lower-income seniors already pay little to no tax on Social Security

Some Democrats supported a means-tested approach:

“Let’s cut taxes only for seniors who need it most—not the wealthy.”

3. Political Strategy

Some Democrats believed that Republicans were using the issue as a wedge—pushing an unfunded repeal to:

Force Democrats to look like they “voted against seniors”

Avoid raising taxes on the wealthy or corporations to offset the cost

4. Support for Alternative Proposals

In several cases, Democrats did offer their own bills to:

Reduce or phase out the tax more gradually

Protect low- and middle-income seniors

Ensure Social Security solvency with offsetting revenue sources

But those bills were often blocked by Republicans or not brought to the floor.

So to sum up:

It wasn’t about taxing Social Security out of spite. It was about how to do it responsibly, without gutting programs or giving giveaways to the top income brackets.

Fiscal Responsibility / Budget Concerns

Removing the tax without replacing the lost revenue would drain funds from:

The Social Security Trust Fund (federal level)

The state budget (state level like in Minnesota)

Many Democrats opposed a full repeal because:

1. It would create a multi-billion dollar budget hole

That shortfall might be used to justify future cuts to Social Security or Medicare

They didn’t want a tax break for wealthier seniors to lead to reduced benefits for lower-income retirees

2. Targeting Relief More Fairly

Most proposals to repeal the Social Security tax benefit higher-income retirees more, because:

Lower-income seniors already pay little to no tax on Social Security

Some Democrats supported a means-tested approach:

“Let’s cut taxes only for seniors who need it most—not the wealthy.”

3. Political Strategy

Some Democrats believed that Republicans were using the issue as a wedge—pushing an unfunded repeal to:

Force Democrats to look like they “voted against seniors”

Avoid raising taxes on the wealthy or corporations to offset the cost

4. Support for Alternative Proposals

In several cases, Democrats did offer their own bills to:

Reduce or phase out the tax more gradually

Protect low- and middle-income seniors

Ensure Social Security solvency with offsetting revenue sources

But those bills were often blocked by Republicans or not brought to the floor.

So to sum up:

It wasn’t about taxing Social Security out of spite. It was about how to do it responsibly, without gutting programs or giving giveaways to the top income brackets.

SW-User

Meanwhile, the Republicans vote against a healthy, happy, employed and educated population.

MasterLee · 56-60, M

@SW-User how so

Gibbon · 70-79, M

They are sticking to their tradition of being the tax tax tax party.

This comment is hidden.

Show Comment

4meAndyou · F

@AbbeyRhode Now THAT is God's honest truth!!!

ron122 · 41-45, M

Democrats hate the American people. All they care about is power and money. Liz Warren even said, taxpayers have no right to know what they do with our money.

This comment is hidden.

Show Comment

Musicman · 61-69, M

The Democrats love power and hate America. Their goal is to destroy the country while stealing all of our money.