sunsporter1649 · 70-79, M

In 1962, speaking at the Economic Club of New York, Kennedy said he was committed to "an across-the-board, top-to-bottom cut in personal and corporate income taxes." The tax system, mostly designed during World War II, "exerts too heavy a drag on growth in peace time; that it siphons out of the private economy too large a share of personal and business purchasing power; that it reduces the financial incentives for personal effort, investment, and risk-taking," he said.

View 8 more replies »

ElwoodBlues · M

@sunsporter1649 Actually, that's only part of the story, sunstroke. Those LEGAL undocumented immigrants - who are awaiting asylum decisions - also paid $96 billion in taxes in 2022. But wait, there's more! They also purchased about $260 billion in food, housing, and other goods and services that year. And those purchased generated income and profits to the sellers, who paid more in taxes. Let's assume a 25% tax rate on the sellers, and there's another $65 billion in taxes generated by the purchases made by those LEGAL asylum waiting undocumented immigrants. And it doesn't stop there! Due to an Econ 101 effect called the 'velocity of money,' the recipients of that $260 billion go out and spend more, generating further economic activity and further taxes.

Just to make my position clear, I'm waiting for a full cost-benefit analysis of economic activity of these LEGAL asylum waiting undocumented immigrants. Without that info it's silly to make a decision about what to do with them. Perhaps those geniuses in the Dept of Efficiency and provide us with this key info.

!! UPDATE !!

Oh, look! In response to economic facts, sunstroke has a CARTOON!!!

Just to make my position clear, I'm waiting for a full cost-benefit analysis of economic activity of these LEGAL asylum waiting undocumented immigrants. Without that info it's silly to make a decision about what to do with them. Perhaps those geniuses in the Dept of Efficiency and provide us with this key info.

!! UPDATE !!

Oh, look! In response to economic facts, sunstroke has a CARTOON!!!

sunsporter1649 · 70-79, M

This comment is hidden.

Show Comment

JSul3 · 70-79

Reagan cut the tax rates and the nation has never recovered.

This comment is hidden.

Show Comment

NatureGuy77 · 56-60, M

NatureGuy77 · 56-60, M

@Northwest Federal tax revenue did not fall gross or as a percent of GDP after marginal tax rates were lowered. The Laffer Curve was proven accurate. I might add Clinton governed to the center after the ‘94 mid terms flip Congress to Republicans for 3/4ths if his Presidency

Northwest · M

@NatureGuy77

Not true.

The Latter curve cannot be taken as an island. What's the context?

Only as far as social/unemployment programs were concerned. The Silicon Valley driven economic boom has nothing to do with Gingrich's Congress.

Federal tax revenue did not fall gross or as a percent of GDP after marginal tax rates were lowered.

Not true.

The Laffer Curve was proven accurate.

The Latter curve cannot be taken as an island. What's the context?

I might add Clinton governed to the center after the ‘94 mid terms flip Congress to Republicans for 3/4ths if his Presidency

Only as far as social/unemployment programs were concerned. The Silicon Valley driven economic boom has nothing to do with Gingrich's Congress.

This comment is hidden.

Show Comment

thisguy20 · 41-45, M

A higher tax rate for the rich would definitely make the US better.

Need to go back to the 90% rate on capital gains

Need to go back to the 90% rate on capital gains

This comment is hidden.

Show Comment

Northwest · M

The top tax rate was higher than that during Americas golden age, the post WWII era when we completely dominated the world.

At the time though, the middle class dominated and people could afford all the "goodies" that made us the envy of the world.

At the time though, the middle class dominated and people could afford all the "goodies" that made us the envy of the world.

Northwest · M

@trollslayer Let's see what he comes up with. I look forward to ending the wars in Europe and Middle East. To bringing manufacturing back to the USA. To the expansion of the Middle class as the largest segment of US demographics.

NatureGuy77 · 56-60, M

@Northwest The post WWII era was dominated not due to US tax rates but because European economies were in shambles due to their manufacturing base was destroyed by the war in Europe. US was able to fill that void until Europe recovered their economy and manufacturing capabilities

Northwest · M

@NatureGuy77

Huh? As if anyone suggested this is the case, or this assertion is anyhow shape or form somewhat connect to the topic at hand.

No shit 🤣 but you think this is somehow germane to the discussion?

I know, you forget to throw Japan in the mix.

The post WWII era was dominated not due to US tax rates

Huh? As if anyone suggested this is the case, or this assertion is anyhow shape or form somewhat connect to the topic at hand.

but because European economies were in shambles due to their manufacturing base was destroyed by the war in Europe. US was able to fill that void until Europe recovered their economy and manufacturing capabilities

No shit 🤣 but you think this is somehow germane to the discussion?

I know, you forget to throw Japan in the mix.

Burnley123 · 41-45, M

How the right take advantage of a yearning for social democracy and impose turbo-charged neoliberalism.

Burnley123 · 41-45, M

Project 2025 includ s proposals to either reduce taxes on the wealthy and increase the tax burden on consumers.

SomeMichGuy · M

I think the highest marginal rate got up to 75%, with 38 - 42 different tiers (under RMN).

People often don't get "marginal"...

People often don't get "marginal"...

Zonuss · 46-50, M

Some say America was at its peak between 1950-1980. Then it just slowly but surely started going down the hill. 🤔

AthrillatheHunt · 51-55, M

@Zonuss economically yes. NAFTA accelerated the decline .

jehova · 36-40, M

Thats a good observation in most of the world its 50% across the board.

Bumbles · 56-60, M

Trump raised my taxes once. I suppose he’ll do it again.

Roundandroundwego · 61-69

No, 95 percent. Elvis wasn't all that rich, but he was in the 95 percent bracket.

Americans don't have access to leftist solutions or strategies because they willingly excised their leftist organs and are unable to defend themselves.

Americans don't have access to leftist solutions or strategies because they willingly excised their leftist organs and are unable to defend themselves.

Elessar · 31-35, M

And in 2025 it'll be 0%

Reason10 · 70-79, M

It was JFK, the original supply sider, who dropped the top rate from 91 percent to 70., That ushered in years of prosperity, so good that it took the far left policies of LBJ and NIxon to topple that progress.

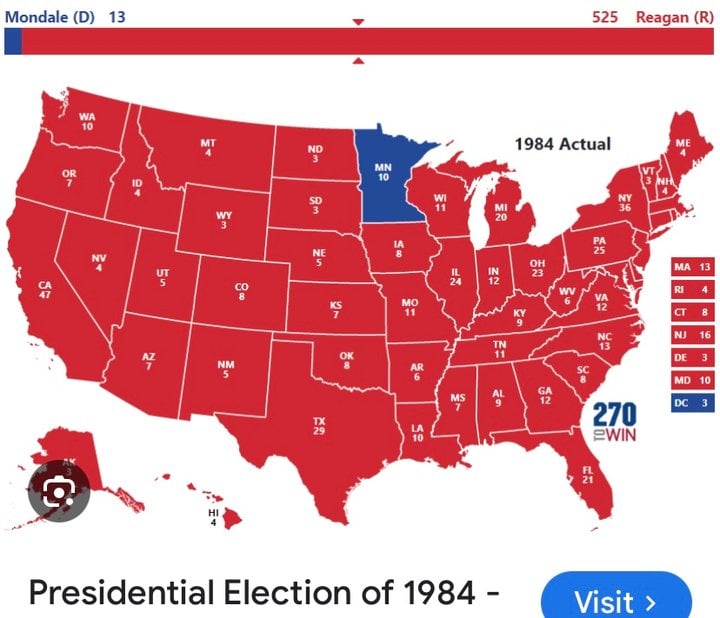

Reagan inherited a failing economy. His tax cuts and deregulation gave America the LONGEST sustained period of economic growth in the history of this country.

When the Trump supporters first adopted MAKE AMERICA GREAT AGAIN, we were in the middle of the Saddam Hussein Obama RECESSION, and the economy was definitely in the shitter. Obama had done so much damage to this country, not just economically but foreign policy wise that he was being compared to Jimmy KKKarter.

When the Trump supporters were ready to support his second term (which he easily earned by giving America the best economy of the 21st Century as well as WORLD PEACE, he asked his supporters if they wanted a new slogan. They all agreed with KEEP AMERICA GREAT AGAIN.

It took massive voter fraud, and Biden's NAZI policies to return the country to the shithole status of KKKarter, KKKlinton, and Saddam Hussein Obama.

It is time to Make America Great Again, because right now, we're in the shitter.

Trump will fix the borders, deport the animals, fix the economy, and dial the world back from World War III.

He'll do it in 4 years, and either Ron DeSantis or JD Vance will maintain that peace and prosperity.

It'll be Keep America Great Again.

Reagan inherited a failing economy. His tax cuts and deregulation gave America the LONGEST sustained period of economic growth in the history of this country.

When the Trump supporters first adopted MAKE AMERICA GREAT AGAIN, we were in the middle of the Saddam Hussein Obama RECESSION, and the economy was definitely in the shitter. Obama had done so much damage to this country, not just economically but foreign policy wise that he was being compared to Jimmy KKKarter.

When the Trump supporters were ready to support his second term (which he easily earned by giving America the best economy of the 21st Century as well as WORLD PEACE, he asked his supporters if they wanted a new slogan. They all agreed with KEEP AMERICA GREAT AGAIN.

It took massive voter fraud, and Biden's NAZI policies to return the country to the shithole status of KKKarter, KKKlinton, and Saddam Hussein Obama.

It is time to Make America Great Again, because right now, we're in the shitter.

Trump will fix the borders, deport the animals, fix the economy, and dial the world back from World War III.

He'll do it in 4 years, and either Ron DeSantis or JD Vance will maintain that peace and prosperity.

It'll be Keep America Great Again.