@

Burnley123 This point is really laboured given that its a secondary issue but you are sticking with it because you think you have a huge gotcha. You don't. The Soviet Union was the second biggest economy is the post-war period.

I stayed with the Soviet point because it was the first thing you mentioned in your previous comment. And now you claim the USSR had the second largest economy in the world. In this, you are naively accepting the “official” figures (about 50% of the US economy), which have since been shown to have been great exaggerations. The truth of the matter is that the Soviet GDP was probably no more than about 15% that of the USA, and this is well borne out by the fact that today, the Russian GDP is about 8% that of the US, less than that of Canada or South Korea, and only slightly larger than that of Australia or Spain. Russia has been aptly named a “1-dimensional superpower” that was

never an economic rival to the US, only a military one, as I said at the outset.

https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal)The US top marginal tax rate was never below 70% until the Reagan period.

Really? There was no regular income tax

at all in the US at all until 1913.

The point beying made is that high marginal taxes are not actually a disincentive to growth.

That’s because almost no one actually

paid the 70 or 90% top marginal rate. As I have already pointed out, there were/are plenty of loopholes for the very wealthy to avoid them. Heck, even at today’s relatively low rates, Warren Buffett famously said a few years ago that his secretary pays income taxes at a higher rate than he does.

Now, US taxes are abour 40% and growth is much lower.

So therefore, the lower tax rate is the

cause of the lower growth rate, and therefore a 70% rate (which would presumably give the government more money to spend) would increase economic growth? But the government is

already spending much more money as a percentage of GDP than it did when the taxes were high, as the graph I posted earlier shows.

The graph you posted about % of govt spending and GDP is evidence that America has its priorities wrong.

Your comment completely missed (or dodged) the point of my question. Whatever you may think about priorities, how did the US government get so much extra money to spend in the first place, so that it is now spending about 35% of GDP (when the top marginal tax rate is about 40%), as compared with only about 20% of GDP when the top rate was 90%?

The answer really is quite easy.

And regarding the graph you posted of top marginal tax rates in the US and some European countries, I notice that the US tax rate was/is generally lower than the UK’s (more so if you take into account the European VAT, which far exceeds any US sales tax), yet in your very next graph of GDP history, I notice that the US rate of GDP increase is higher than the UK’s. Hmmm.

BTW, your poetry is as bad as your economic analysis. Well done for trying though.

Thanks for the compliment. Since my economic analysis is excellent, I guess my poetry is too. 🤭

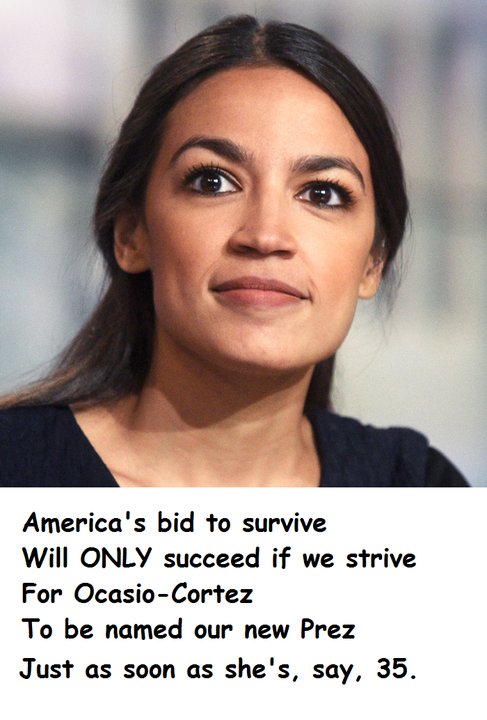

But it is true that with a few exceptions, not many lefties like my poetry, but I suspect it is because of content rather than form. So for their benefit, I sometimes post this limerick, which meets more with their approval. 😂

There once was an orange-faced fascist,

Whose words were the crudest and brashest.

Not JUST were they racist,

But all-around basest,

And actions? His ALWAYS were rashest.