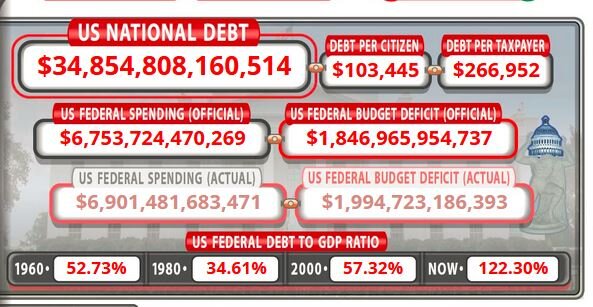

Welcome to the $30 Trillion Club America!

According to the NYT, the US government surpassed $30 trillion in debt for the first time ever February 7th. Pop the champagne!

https://www.nytimes.com/2022/02/01/us/politics/national-debt-30-trillion.html

What a wonderful time to have this much debt! 🙂 Interest rates are clearly heading higher, perhaps significantly. What could possibly go wrong?

How did it get this way? Why did we let it happen? Does it even matter?

https://www.nytimes.com/2022/02/01/us/politics/national-debt-30-trillion.html

What a wonderful time to have this much debt! 🙂 Interest rates are clearly heading higher, perhaps significantly. What could possibly go wrong?

How did it get this way? Why did we let it happen? Does it even matter?