This page is a permanent link to the reply below and its nested replies. See all post replies »

ElwoodBlues · M

@jackjjackson Nope. Because of lower capital gains rates, even income taxes are regressive. Add in payroll taxes and they're even more regressive.

Most Americans pay more in payroll taxes than income taxes

@georgelong Funny thing: you never cite any DATA to support your claims!

Most Americans pay more in payroll taxes than income taxes

@georgelong Funny thing: you never cite any DATA to support your claims!

jackjjackson · M

I just go with the facts. @ElwoodBlues

ElwoodBlues · M

@jackjjackson People with facts can show the sources of their facts. People like you, with pleasing fairytales, give us a song-and-dance instead of sources.

jackjjackson · M

The problem is that you don’t produce anything relevant. @ElwoodBlues

ElwoodBlues · M

@jackjjackson And the song and dance begins🤣😂

georgelong · 46-50, M

Wrong. At a certain income level people stop having to pay in advance but they still pay. @ElwoodBlues

ElwoodBlues · M

@jackjjackson People with facts can show the sources of their facts. People like you, with pleasing fairytales, give us a song-and-dance instead of sources.

@georgelong We're talking about tax RATES here. You do know what a tax rate is, don't you? Just in case, here's a simple definition.

Tax rate = (dollars of tax paid) / (total dollars of income)

Tax rates for the super-rich are lower than for the middle income groups. If you have data to the contrary, please feel free to present it. Since you have no data, you're giving me a song and dance🤣😂

@georgelong We're talking about tax RATES here. You do know what a tax rate is, don't you? Just in case, here's a simple definition.

Tax rate = (dollars of tax paid) / (total dollars of income)

Tax rates for the super-rich are lower than for the middle income groups. If you have data to the contrary, please feel free to present it. Since you have no data, you're giving me a song and dance🤣😂

This comment is hidden.

Show Comment

georgelong · 46-50, M

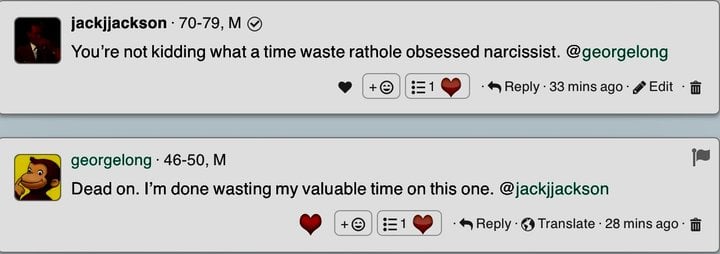

15 and 18 year old data. You’re a hack. Please see my above comment regarding you in general. The end. @ElwoodBlues

ElwoodBlues · M

@georgelong says

Tax rates for the super-rich are lower than for the middle income groups. If you have data to the contrary, please feel free to present it. Since you have no data, you're giving me more song and dance🤣😂

15 and 18 year old data.

And little has changed about regressive taxation in that time, except for tRump reducing the top tax rates even MORE. Tax rates for the super-rich are lower than for the middle income groups. If you have data to the contrary, please feel free to present it. Since you have no data, you're giving me more song and dance🤣😂

jackjjackson · M

iamthe99 · M

@jackjjackson I expect the DMs you and @georgelong are exchanging with each other during this flamewar with @ElwoodBlues are of a somewhat "saucy" nature ;)

georgelong · 46-50, M

ElwoodBlues · M

@georgelong People with facts can show the sources of their facts. People like you, with pleasing fairytales, give us a song-and-dance instead of sources.

georgelong · 46-50, M

jackjjackson · M

ElwoodBlues · M

@georgelong @jackjjackson You guys can't deny that payroll taxes are "called that because they are withheld from paychecks. The government requires employers to collect taxes for them." So instead of logic or evidence, you've shifted to insults. And you keep saying you're going to quit the conversation, but you CAN'T STAND to see the W2 form and pay stubs that PROVE you wrong🤣😂

Notice the three separate deductions from the net wages. Notice federal income tax, SS tax, and Medicare tax are ALL withheld from net wages. Notice the FICA total takes nearly as big a bite as the income tax.

Notice the three separate deductions from the net wages. Notice federal income tax, SS tax, and Medicare tax are ALL withheld from net wages. Notice the FICA total takes nearly as big a bite as the income tax.

jackjjackson · M