This page is a permanent link to the reply below and its nested replies. See all post replies »

ElwoodBlues · M

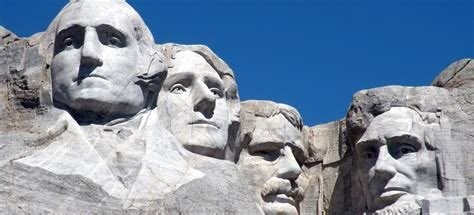

Teddy Roosevelt believed that a graduated income tax, where higher earners paid a higher percentage of their income in taxes, was a more equitable system than relying solely on tariffs. He publicly supported this idea in his 1907 State of the Union address and continued to advocate for it throughout his political career.

Seems tRump is going in the OPPOSITE direction, trying to CUT taxes on high earners and INCREASE tariffs. Parallel, perhaps, but moving in OPPOSITE directions!!

Update from Elon

Seems tRump is going in the OPPOSITE direction, trying to CUT taxes on high earners and INCREASE tariffs. Parallel, perhaps, but moving in OPPOSITE directions!!

Update from Elon

1-25 of 54

jackjjackson · M

Higher income people still pay a higher income tax rate. Woody you can’t help but twist the truth and then confuse things with misleading charts and statements. @ElwoodBlues

ElwoodBlues · M

@jackjjackson Warren Buffett disagrees with you. But maybe you know more than he does about billionaire tax rates???

In 2012, Buffett made headlines when he revealed a startling truth: his secretary, Debbie Bosanek, paid a far higher tax rate than he did. "Debbie works just as hard as I do and she pays twice the rate I pay. I think that's outrageous," he told ABC News after her appearance in President Obama's State of the Union address.

He explained, "I don't pay hardly any payroll taxes. Gov. Romney hardly pays any payroll taxes. Newt Gingrich hardly pays any payroll taxes." Driving the point home, he emphasized the disparity: "Debbie pays lots of payroll taxes."

Buffett's effective tax rate was 17.4% at the time, largely due to his income coming from capital gains, which are taxed much lower than ordinary wages. Bosanek, like many middle-class Americans, was paying nearly 36% when payroll and income taxes were combined.

He explained, "I don't pay hardly any payroll taxes. Gov. Romney hardly pays any payroll taxes. Newt Gingrich hardly pays any payroll taxes." Driving the point home, he emphasized the disparity: "Debbie pays lots of payroll taxes."

Buffett's effective tax rate was 17.4% at the time, largely due to his income coming from capital gains, which are taxed much lower than ordinary wages. Bosanek, like many middle-class Americans, was paying nearly 36% when payroll and income taxes were combined.

jackjjackson · M

Misleading. That may have been the top rate on some of her income (he clearly paid her well) however the effective rate on ALL her income was less than 20% about the same as his. Lower capital gains rates promote investment and sales producing large amounts of tax. It wouldn’t hurt to nudge that up a little over a five year period. @ElwoodBlues

georgelong · 46-50, M

Mr Jackson is running circles around you Woody. AS USUAL. @ElwoodBlues @jackjjackson

ElwoodBlues · M

@jackjjackson So you're saying Warren Buffett lied? He is the source of the numbers I provided; where did you come up with your " effective rate on ALL her income wasless than 20%" number??

Are you still pretending that payroll taxes aren't taxes?? Are you still pretending that capital gains income isn't income???

@georgelong Oh, look, jjj has a cheerleader, isn't that cure🤣😂

Are you still pretending that payroll taxes aren't taxes?? Are you still pretending that capital gains income isn't income???

@georgelong Oh, look, jjj has a cheerleader, isn't that cure🤣😂

georgelong · 46-50, M

As you know income tax has increasing MARGINAL rate as income rises. Buffett did LIE he simply used her highest MARGINAL rate to make his point. He did have a point however the number disparity isn’t as large as he presented it. @ElwoodBlues

ElwoodBlues · M

@georgelong Nope. Buffet included payroll taxes, whereas JJJ only cited income tax rates.

jackjjackson · M

Woody is trying to fool folks. Nice catch! @georgelong

jackjjackson · M

When completing a 1040 payroll taxes are applied to pay the actual income tax bill. Buffett paid half her payroll taxes. Payroll taxes are NOT in addition to income tax. They are a means of COLLECTING income tax. Give it up Woody you never fool anyone with your distortions and pretzel logic. @ElwoodBlues

ElwoodBlues · M

@jackjjackson Look at you, trying to draw a distinction between income tax and payroll tax!! Look at you going on about an income tax bill!! But they're BOTH taxes and they're BOTH deducted from income🤣😂

Payroll taxes are deducted from your paycheck by the government. Are you seriously arguing that mandatory deductions from a paycheck by the government aren't taxes??

Give it up jjj you never fool anyone with your distortions and pretzel logic.

Payroll taxes are deducted from your paycheck by the government. Are you seriously arguing that mandatory deductions from a paycheck by the government aren't taxes??

Give it up jjj you never fool anyone with your distortions and pretzel logic.

This comment is hidden.

Show Comment

ElwoodBlues · M

@jackjjackson I never said payroll taxes are "paying double."

I said payroll taxes are deducted from your paycheck by the government. Are you seriously arguing that mandatory deductions from a paycheck by the government aren't taxes??

Give it up jkss you never fool anyone with your distortions and pretzel logic.

I said payroll taxes are deducted from your paycheck by the government. Are you seriously arguing that mandatory deductions from a paycheck by the government aren't taxes??

Give it up jkss you never fool anyone with your distortions and pretzel logic.

jackjjackson · M

Like I’ve now said for the third time payroll taxes are simply paying early. @ElwoodBlues

ElwoodBlues · M

@jackjjackson Are payroll taxes not mandatory deductions from a paycheck by the government?? Isn't that the very DEFINITION of a tax??

And what does "early" or "late" have to do with the definition of taxes??

P.S. they are called "payroll taxes" because they are a kind of TAX !!!

And what does "early" or "late" have to do with the definition of taxes??

P.S. they are called "payroll taxes" because they are a kind of TAX !!!

jackjjackson · M

Ordinary income tax paid paycheck to paycheck. @ElwoodBlues

ElwoodBlues · M

@jackjjackson Payroll taxes, also known as FICA, mandatory deductions from a paycheck by the government. That makes them taxes. Payment schedule doesn't alter the fact that they are taxes.

P.S. they are called "payroll taxes" because they are a kind of TAX !!!

P.S. they are called "payroll taxes" because they are a kind of TAX !!!

georgelong · 46-50, M

They’re called that because they are withheld from paychecks. The government requires employers to collect taxes for them. @ElwoodBlues

ElwoodBlues · M

@georgelong DUUUDE!!!

That's true of BOTH income taxes AND payroll taxes!!

Thank you for supporting my point🤣😂😝🤣😂

That's true of BOTH income taxes AND payroll taxes!!

Thank you for supporting my point🤣😂😝🤣😂

jackjjackson · M

GL just explained to you as I have that there is ONE income tax and payroll taxes are one way it’s collected. @ElwoodBlues

ElwoodBlues · M

@jackjjackson So this W2 is wrong??

Notice the three separate deductions from the net wages. Notice federal income tax, SS tax, and Medicare tax are ALL withheld from net wages. Notice the FICA total takes nearly as big a bite as the income tax.

You're saying this is wrong? You're saying that's not how withholding really works??

Are these fake paystubs??

Payroll taxes are deducted from your paycheck by the government. Are you seriously arguing that mandatory deductions from a paycheck by the government aren't taxes??

Give it up jkss you never fool anyone with your distortions and pretzel logic.

Notice the three separate deductions from the net wages. Notice federal income tax, SS tax, and Medicare tax are ALL withheld from net wages. Notice the FICA total takes nearly as big a bite as the income tax.

You're saying this is wrong? You're saying that's not how withholding really works??

Are these fake paystubs??

Payroll taxes are deducted from your paycheck by the government. Are you seriously arguing that mandatory deductions from a paycheck by the government aren't taxes??

Give it up jkss you never fool anyone with your distortions and pretzel logic.

jackjjackson · M

For six months work huh? @ElwoodBlues

This comment is hidden.

Show Comment

This comment is hidden.

Show Comment

georgelong · 46-50, M

Dead on. I’m done wasting my valuable time on this one. @jackjjackson

ElwoodBlues · M

@jackjjackson Are these fake paystubs??

Payroll taxes are deducted from your paycheck by the government. Are you seriously arguing that mandatory deductions from a paycheck by the government aren't taxes??

Give it up jkss you never fool anyone with your distortions and pretzel logic.

Payroll taxes are deducted from your paycheck by the government. Are you seriously arguing that mandatory deductions from a paycheck by the government aren't taxes??

Give it up jkss you never fool anyone with your distortions and pretzel logic.

1-25 of 54