Your opinion please - should we bail out underinsured homeowners with higher taxes, or higher national debt?

Photo above - Hurricane Milton damage in my hometown. Picture Courtesy of the Plant City Observer.

First Helene. Then Milton. Oh no . . . not Nadine !!!! When will it end?

After several years of below normal hurricane activity, Florida is back to normal. Well, maybe worse than normal. We’ve had two good ones this year, and another is coming. Oh wait, it isn’t? Nadine is just a tropical depression, and will miss Florida entirely? Whew, I can let my homeowners insurance lapse after all. Somebody tell the weather channel. They're still showing the "cone" repeatedly on TV.

Lots of people are about to go without insurance. Companies are cancelling policies. Homeowners aren't replacing them with policies from other companies. They can't afford it. They put their faith in God. After watching the latest devastation. See link below.

Before the climate change cheering section goes bonkers, let's admit that Florida used to have a LOT MOEW hurricanes, and they were a lot deadlier. The worst was “Okeechobee” in 1928. Then the Labor Day Hurricane in 1935. People still talk about Andrew (1992).

So insurance companies have always had PLENTY of reason to raise homeowners' rates down here. They just didn’t do it. They apparently put THEIR faith in a flawed risk model, instead of God. Welcome to reality. And now welcome to the 2024 election.

Watch the candidates now rush to Florida, to chastise “greedy” insurance companies for trying NOT to go bankrupt, and raising insurance rates. Watch those same politicians give you the look of a stunned chicken when you ask them about federal flood insurance – at taxpayer expense – that allows rich beachfront homeowners from the Florida Keys to Martha’s Vinyard to keep rebuilding in the same location, over and over, with hilariously low premiums that no legitimate insurance company would ever consider. I’m not saying this is a vote buying scam . . . but it's a vote buying scam.

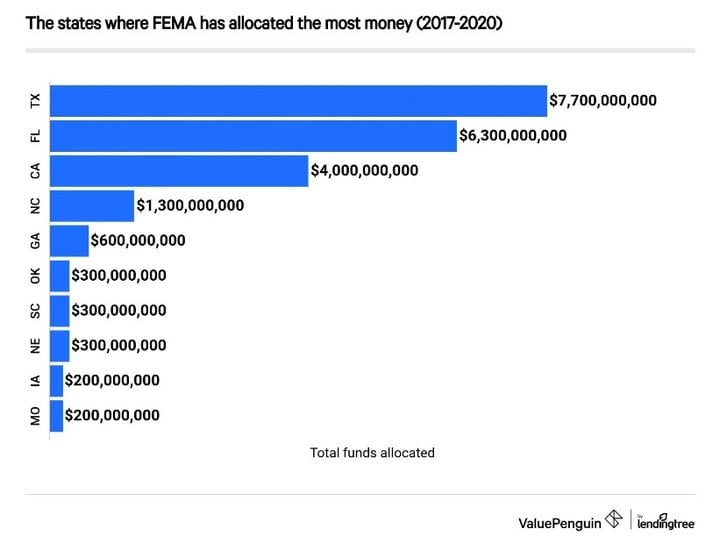

How should we “assist” people who can’t afford homeowners insurance, after actually buying their dream home? Tax hikes? More federal deficits? I’m betting politicians will go for “more deficits”. Nobody wants to announce that taxes are going up, whether it’s an election year or not. Better just to arrive by helicopter or Air Force one and announce the latest government bailout, right?

I’m just sayin’ . . .

Personal note – I’m back at my apartment in Plant City Florida (thanks your concern). No flooding. Roof still on. Long gas lines. Missing pets. We feel fortunate. But perhaps we should make certain we understand the cost of living in “paradise” before rushing here to enjoy zero state income taxes and all the random rattlesnakes, okay?

Homeowners face rising insurance rates as climate change makes wildfires, storms more common (qz.com)