This page is a permanent link to the reply below and its nested replies. See all post replies »

ASolitaryMan · 61-69, M

Since its a world market. All our oil we produce goes to thar exact world market. OPEC sets the amount of oil release for refining. A barrel of oil is 44 gallons a drum. OPEC sets the wholesale price. Our oil is then brought back to refine. The oil corporations set the sale price. The only thing the government does is tax it, then each state taxes it more at the pump.

1-25 of 28

sunsporter1649 · 70-79, M

@ASolitaryMan Why bother with the ragheads when we have so much oil here at home?

Shaveit · 61-69, M

@sunsporter1649 only a Democrat can answer that question

ASolitaryMan · 61-69, M

@sunsporter1649 https://www.opec.org/opec_web/en/about_us/24.htm

ASolitaryMan · 61-69, M

The history of opec. Its how they control the market for maximum profits

sunsporter1649 · 70-79, M

@ASolitaryMan Why bother with the ragheads when we have so much oil here at home?

ElwoodBlues · M

@sunsporter1649 Production costs. Many of our oil sources here at home are very expensive to draw from. They only become profitable when OPEC raises prices high enough. It's basic market economics, dude; in other words, way beyond your ken🤣😂🤣😂

sunsporter1649 · 70-79, M

@ElwoodBlues Yeah, and the transportation costs, not to mention dodging ship-killing missles, costs are negliable, not to mention some raghead putting the squeeze on just to screw everyone else, right?

ElwoodBlues · M

@sunsporter1649 Whatsamatta, is google broken??

Costs of transporting Saudi oil to the US: around $13/barrel. Mexican & Venezuelan oil are far cheaper to transport, but OPEC still sets world prices.

Our oil sources here in the US are very expensive to draw from. They only become profitable when OPEC raises prices high enough. It's basic market economics, dude; in other words, way beyond your ken🤣😂🤣😂

Costs of transporting Saudi oil to the US: around $13/barrel. Mexican & Venezuelan oil are far cheaper to transport, but OPEC still sets world prices.

Our oil sources here in the US are very expensive to draw from. They only become profitable when OPEC raises prices high enough. It's basic market economics, dude; in other words, way beyond your ken🤣😂🤣😂

sunsporter1649 · 70-79, M

@ElwoodBlues Yup, when energy prices here in America dropped to record low levels under President Trump and we exported our excess to drive world prices lower your buddies the ragheads fell right in line. What kind of bullschiff you gonna spew next?

ElwoodBlues · M

@sunsporter1649 DEAD WRONG!! As usual!!

When energy prices dropped to record lows, US shale oil fracking operations shut down And the reduction in output happened under your sacred orange felonious turd. What kind of bulltrump you gonna spew next?

Read about it at https://qz.com/1830456/how-the-coronavirus-is-disrupting-the-us-fracking-industry

When energy prices dropped to record lows, US shale oil fracking operations shut down And the reduction in output happened under your sacred orange felonious turd. What kind of bulltrump you gonna spew next?

Read about it at https://qz.com/1830456/how-the-coronavirus-is-disrupting-the-us-fracking-industry

Vin53 · M

sunsporter1649 · 70-79, M

@ElwoodBlues Yup, who wants low energy prices, only helps put money in peoples pockets, spending goes up, which increases tax revenue for the gubberment. Screw the people, the ragheads run the country now, and what a fantastic job they are doing

sunsporter1649 · 70-79, M

@ElwoodBlues And of course oil only comes from shale, right?

ASolitaryMan · 61-69, M

@sunsporter1649 again a world market. Buy their oil and no use ours, basically.

ElwoodBlues · M

@ASolitaryMan Ol' sunstroke seems to believe there's tons of cheap crude to be found, but the d@mned woke oil giants will only drill for the expensive stuff, LOL!!!

sunsporter1649 · 70-79, M

@ElwoodBlues Enjoy your $4.00 a gallon gas, as opposed to the crazy high of $1.82 a gallon under President Trump

ElwoodBlues · M

This comment is hidden.

Show Comment

ASolitaryMan · 61-69, M

@Shaveit because supply and demand woukd cause oil production profits to go up. Harly Davidson has done it for years. Send bokes overs seas and bring them back to artificially keep prices higher, to make profits higher. Its the reason oil companies shut down refinaries to keep production in starving mode to keep profits higher

ElwoodBlues · M

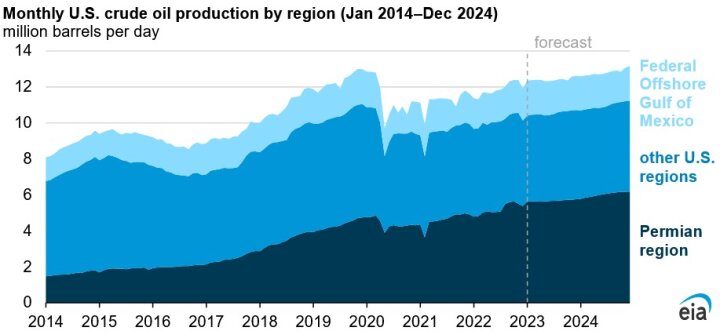

@Shaveit Nope. Look again. Oil production fell off in mid 2020, middle of the pandemic. And ijits like sunstroke, who think the president controls oil production, have trouble dealing with that reality.

Another reality that troubles ijits like sunstroke are the 2023 oil production numbers. The US produced more oil in 2023 than any nation ever produced in one year. It's funny how the right wing pretends Biden curtailed oil when in fact we set a world record, LOL!!!

Also see Oil & Gas Journal

https://www.ogj.com/general-interest/economics-markets/article/14310211/eia-us-currently-produces-more-crude-oil-than-any-country-in-history

Same facts confirmed by Fox Business

https://www.foxbusiness.com/economy/us-led-global-oil-production-sixth-straight-year-2023

Another reality that troubles ijits like sunstroke are the 2023 oil production numbers. The US produced more oil in 2023 than any nation ever produced in one year. It's funny how the right wing pretends Biden curtailed oil when in fact we set a world record, LOL!!!

the United States set a new record in 2023 by averaging 12.9 million barrels per day (b/d) of crude oil production, including condensate. This figure surpasses the previous US and global record of 12.3 million b/d, set in 2019. What’s even more impressive is that this record-breaking trend culminated in December 2023, when average monthly U.S. crude oil production soared to over 13.3 million b/d, marking a historic milestone.

https://mansfield.energy/2024/03/18/the-united-states-leads-the-world-in-crude-oil-production/Also see Oil & Gas Journal

https://www.ogj.com/general-interest/economics-markets/article/14310211/eia-us-currently-produces-more-crude-oil-than-any-country-in-history

Same facts confirmed by Fox Business

https://www.foxbusiness.com/economy/us-led-global-oil-production-sixth-straight-year-2023

sunsporter1649 · 70-79, M

@ElwoodBlues

01/20/2021 – Ending Trump's Energy Independence Initiatives: Biden wasted no time living up to his promise,

issuing a Day 1 Climate Change Executive Order (EO) requiring agencies to review and revoke Trump's pro-American

energy rules and actions throughout the executive branch.

• 01/20/2021 – Burdensome Emissions Regulations: Biden’s EO required agencies to take action to increase

burdensome emissions regulations as part of the Left’s green agenda and subsidize "good union jobs."

• 01/20/2021 – Monument Designations: Biden continued setting the tone on Day 1 by cordoning off large swaths of

federal land under the guise of National Monument designations, reducing the ability to produce American energy

domestically.

• 01/20/2021 – ANWR: Biden continued restricting domestic production by issuing a moratorium on all oil and natural

gas leasing activities in the Arctic National Wildlife Refuge.

• 01/20/2021 – Social Costs of Carbon: Biden restored and expanded the use of the social costs of carbon metric to

artificially increase the regulatory costs of energy production, as well as artificially increasing the so-called "benefits" of

decreasing production.

• 01/20/2021 – Keystone XL Pipeline: Biden’s EO went on to revoke the Keystone XL Pipeline, shutting off an efficient

source of energy transportation which would have brought more oil into the country.

• 01/20/2021 – WOTUS: Biden continued to revoke Trump administration executive orders, including those related to

WOTUS and the Antiquities Act. The Trump-era actions decreased regulations on Federal land and expanded the ability

to produce energy domestically.

Jan 25,

2021 $2.392

• 01/27/2021 – Climate Financing: A week later, Biden was back at it again. This Biden EO attacked the energy industry

by promoting “ending international financing of carbon-intensive fossil fuel-based energy while simultaneously

advancing sustainable development and a green recovery." In other words, the US government would leverage its power

to attack oil and gas producers while subsidizing favored industries.

• 01/27/2021 – Green the Fleet: This Biden action called on federal agencies to facilitate carbon neutrality by 2025,

with a particular focus on pushing electric vehicles for Federal, State, and local governments.

• 01/27/2021 – Wind Production: The Biden administration continued to push for inefficient fuel sources by setting a

goal to double wind production on Federal lands by 2025.

• 01/27/2021 – Gas Lease Moratorium: The EO announced a moratorium on new oil and gas leases on public lands or

in offshore waters and reconsideration of Federal oil and gas permitting and leasing practices. In other words, Biden

provided he is following through on his promise to "end" fossil fuels.

• 01/27/2021 – Fossil Fuel “Subsidies”: Biden's EO directed agencies to eliminate Federal fossil fuel subsidies

wherever possible without comparable actions for other energy sources, disadvantaging oil and gas.

01/27/2021 – Environmental Justice: Biden's EO pushed for an increase in enforcement of "environmental justice"

violations and support for such efforts, which typically are advanced by radical environmental organizations.

Feb 01,

2021 $2.409

• 02/02/2021 – EPA Hires Radical: The EPA hired Marianne Engelman-Lado, a prominent environmental justice

proponent, to advance its radical Green New Deal social justice agenda at the EPA, a signal to industry that it plans to

continue its attack on American energy.

• 02/04/2021 – DOJ Takes Aim at Energy Independence: At the behest of the January 27th Climate Crisis EO, the DOJ

withdrew several Trump-era enforcement documents which provided clarity and streamlined regulations to increase

energy independence.

Feb 08,

2021 $2.461

Feb 15,

2021 $2.501

• 02/19/2021 – Paris Climate Agreement: Biden rejoins the Paris Climate Agreement, an agenda which puts American

energy at risk, props up energy production in Russia and China, while increasing the dependence of Europe on Russian

oil.

Feb 22,

2021 $2.633

• 02/23/2021 – H.R. 803: Biden Administration issued a Statement of Administration Policy in support of H.R. 803 which

curtailed energy production on over 1.5 million acres of federal lands.

Mar 01,

2021 $2.711

Mar 08,

2021 $2.771

• 03/11/2021 – American Rescue Plan Act Slush Fund: The President signed ARPA, which included numerous

provisions advancing Biden’s green priorities, such as a $50 million environmental slush fund directed towards

"environmental justice" groups , including efforts advanced by Biden's EO.

• 03/11/2021 – ARPA Anti-Fossil Fuel Grants: ARPA also included $50 million in grant funding for Clean Air Act

pollution-related activities aimed at advancing the green agenda at the expense of the fossil fuel industry.

Mar 15,

2021 $2.853

• 03/15/2021 – Climate Disclosure Rule: The SEC sought input regarding the possibility of a rule that would require

hundreds of businesses to measure and disclose greenhouse gas emissions in a standardized way for the first time,

massively increasing so-called environmental costs of compliance and, in tandem with so-called social costs of carbon,

artificially disincentivizing oil and gas production.

04/15/2021 – FERC Carbon Pricing: The Federal Energy Regulatory Commission’s policy statement outlines - and

effectively endorses - how the agency would consider market rules proposed by regional grid operators that seek to

incorporate a state-determined carbon price in organized wholesale electricity markets. This amounts to a de facto

endorsement of a carbon tax that would be paid by everyday Americans.

Apr 19,

2021 $2.855 • 04/22/2021 – U.S. International Climate Finance Plan: This plan, a result of the President’s January 27, 2021 climate

change EO, would funnel international financing toward green industries and away from oil and gas.

Apr 26,

2021 $2.872

• 04/27/2021 – S.J. Res. 14: The Biden Administration issued a Statement of Administration Policy in support of S.J. Res.

14 which rescinded a Trump-era Rule that would have cut regulations on American energy production.

• 04/28/2021 – EPA Reconsideration of California Waiver: This EPA Notice of Reconsideration, an offspring of an

earlier Biden EO, would propose to revoke a Trump-era action which revoked California’s ability to set nation-wide

standards for emissions standards.

May

03,

2021

$2.89

• 05/07/2021 – Migratory Bird Incidental Take: This proposed Fish and Wildlife Service Rule revokes a Trump

administration rule and expands the definition of "incidental take" under the Migratory Bird Treaty Act (MBTA). The rule

would impact energy production on federal lands, increasing regulatory burdens.

May

10,

2021

$2.961

• 05/12/2021 – CAFE Preemption: This Proposed Rule would reinstate California’s waiver which allowed the state to set

its own emissions standards. This, effectively, allowed climate activists in California to set the de-facto national standard

for emissions standards, making cars less affordable and indirectly increasing energy costs for all Americans.

May

17,

2021

$3.028

• 05/20/2021 – Climate Related Financial Risk: This EO would artificially increase regulatory burdens on the oil and

gas industry by increasing the "risk" the federal government undertakes in doing business with them, among other things.

May

24,

2021

$3.02

• 05/28/2021 – Biden Green Book: Biden's FY 2022 revenue proposals include nearly $150 billion in tax increases

directly levied against the oil and gas energy producers

07/23/2021 –DOJ Climate Action Plan: DOJ's Climate Action Plan (CAP) includes an effort to "green" the fleet by

transitioning to electric vehicles and the advancement of environmental justice efforts.

Jul 26,

2021 $3.136

• 07/28/2021 – DOE Building Codes: This Department of Energy (DOE) determination increases regulatory burdens on

commercial building codes, requiring green energy codes to disincentivize natural gas and other carbon sources. DOE

readily admits they ignored efforts private industry is making on their own and utilized the questionable "social costs of

carbon" to overstate the public benefit.

Aug

02,

2021

$3.159

• 08/05/2021 – Biden “Clean Cars and Trucks” Executive Order: This executive order established a new target to make

half of all new vehicles sold in 2030 zero-emissions vehicles, including battery electric, plug-in hybrid electric, or fuel cell

electric vehicles. The Executive Order also kicked off development of more stringent long-term fuel efficiency and

emissions standards to, among other things, "advance environmental justice, and tackle the climate crisis.”

• 08/05/2021 – EPA Clean Trucks Plan: The same day, the EPA announced plans for further transportation emissions

regulations targeted at heavy-duty trucks, aiming to shift markets in favor of zero-emission vehicles.

Aug 09,

2021 $3.172

Aug 16,

2021 $3.174

Aug

23,

2021

$3.145

• 08/26/2021 – EPA Proposed Rule on Passenger Car Emissions: The Environmental Protection Agency (EPA) issued

a proposed rule to heighten federal greenhouse gas (GHG)emissions standards for passenger cars and light trucks by

setting stringent requirements for reductions through Model Year (MY) 2026. According to the NPRM, "the proposal

would incentivize" technology, i.e., Green industries, to "encourage more hybrid and electric vehicle technology."

Aug

30,

2021

$3.139

• 09/03/2021 – CAFE Standards: This proposed rule would update the Corporate Average Fuel Economy Standards for

Model Years 2024–2026 Passenger Cars and Light Trucks. The rule is a direct result of a Biden EO and would increase

fuel economy regulations on passenger cars and light vehicles. The modeling used here misleadingly attributes "fuel

savings" by multiplying fuel price with 'avoided fuel costs', meaning the rule intends to disincentivize gas by making it

more costly to afford cars and trucks.

Sep

06,

2021

$3.176 • 09/09/2021 – Sustainable Flight National Partnership: NASA and the FAA launched a partnership to reduce "fuel use

and harmful emissions" by strong-arming industry to adopt elements of their green agenda.

09/09/2021 – Department of Education (ED) Climate Action Plan: ED's CAP includes efforts to incorporate the green

agenda into as many guidance and policies as possible, effectively leveraging the department as an anti-fossil fuel

propaganda tool.

• 09/09/2021 – DOL Climate Action Plan: The Department of Labor's CAP includes an increased focus on procurement

regulations on contractors relating to the use of fossil fuels and efforts to increase use of "green" energy sources.

Sep 13,

2021 $3.165

Sep 20,

2021 $3.184

Sep 27,

2021 $3.175

Oct 04,

2021 $3.19

• 10/04/2021 – MBTA Incidental Take: The FWS published its final rule revoking Trump-era action which eased

burdensome regulations on energy action.

• 10/07/2021 – CEQ NEPA Revisions: The Council on Environmental Quality revoked Trump administration NEPA

reforms that reduced regulatory burdens by reinstating tangential environmental impacts of proposed projects.

• 10/07/2021 – Monument Designations: Biden announced plans to designate the Northeast Canyons and Seamounts

Marine National Monument, a move counter to Trump's reversal of a similar Obama-era proclamation. Trump aimed to

allow energy exploration in the area to increase energy independence.

• 10/07/2021 – USDA Climate Action Plan: The U.S. Department of Agriculture's (USDA) CAP includes efforts to switch

fuel away from oil and natural gas and subsidize more costly, less efficient fuel sources.

• 10/07/2021 – DOE Climate Action Plan: The Department of Energy's (DOE) CAP includes leveraging the federal agency

to transition away from fossil fuel resources where possible, and plans to subsidize and advance "green" and renewable

industries at the expense of cheaper and more efficient energy resources.

• 10/07/2021 – EPA Climate Action Plan: As part of its CAP, EPA intends to incorporate Biden's Green New Deal agenda

throughout its rulemaking process.

Oct 11,

2021 $3.267

• 10/14/2021 – DOL ESG Rule: The rule would require fiduciaries to consider the economic effects of climate change and

other so-called environmental, social and governance (ESG) factors when evaluating funds for retirement plans. As

worded, the rule would strongly encourage fiduciaries to draw capital from domestic energy development in oil and

natural gas to less reliable renewables.

Oct 18,

2021 $3.322

• 10/21/2021 – FSOC Financial Stability Report: This report paints climate change, and there for oil and gas producers,

as a "risk to financial stability." The report recommended the "climate disclosures" later set forth by the Biden

administration.

10/29/2021 – BLM Social Costs of Carbon: BLM announced use of social costs of carbon in permitting decisions,

increasing regulations on oil and gas permitting, among other industries.

Nov

01,

2021

$3.39

• 11/02/2021 – Global Methane Pledge: Biden administration lead a "Global Methane Pledge" to reduce global methane

emissions by 30% by 2030. Russia and China both didn't sign the pledge, increasing the world's reliance on the countries

for oil and gas while disadvantaging the U.S. natural gas industry.

• 11/04/2021 – COP 26 Pledge: The President committed to "ending fossil fuel financing abroad." The administration's

actions target the global fossil fuel industry, a move that must be viewed in tandem with their push to increase subsidies

for "green" energy. Doing so disadvantages the oil and gas industry and increases global gas prices. Further, key countries,

like China, did not sign the pledge, so the pledge harms signatories while empowering adversaries.

Nov

08,

2021

$3.41

• 11/09/2021 – FAA Climate Action Plan: The Federal Aviation Administration published its CAP which pushes a "wholeof-government” approach to enacting green policies in the aviation space. Put in plain tongue, the plan aims to force

industries to utilize favored "green" technologies through increased red tape.

• 11/12/2021 – New Source Review: These broad, overreaching regulations target new, modified, and reconstructed oil

and natural gas sources, and would require states to reduce methane emissions from hundreds of thousands of existing

sources nationwide for the first time. The Proposed Rule follows the President's Day 1 Climate EO and the passage of the

S.J. Res. 14, a CRA rescinding Trump-era energy independence policies. The proposed rule spends several paragraphs

dismissing the effects of the rule on the oil and gas industry and misleadingly applies its effects on the industry to only

the "140,000" (an underestimate of the over 220,000) employees directly involved in extraction. This means it ignores

the nearly 10 million other people working in the oil and gas industry and the impacts to the oil and gas economy more

broadly.

Nov

15,

2021

$3.399

• 11/15/2021 – Chaco Canyon: DOI announced plans to withdraw Chaco Canyon from oil and gas drilling for 20 years.

• 11/15/2021 – Omarova Nomination: The Biden administration nominated Saule Omarova to serve as Comptroller of

the Currency. Omarova's past comments speak for themselves: “A lot of the smaller players in [the fossil fuel] industry

are going to, probably, go bankrupt in short order—at least, we want them to go bankrupt if we want to tackle climate

change,” she said.

• 11/17/2021 – HUD Climate Action Plan: HUD's CAP leverages the Community Development Block Grant to advance

'environmental justice' efforts.

• 11/19/2021 – Biden-endorsed Methane Tax: Build Back Better (BBB) included a new tax on natural gas, in the form

of a tax on methane, of up to $1500 per ton

• 11/19/2021 – BBB Mineral and Energy Withdrawals: BBB includes language resulting in mineral and energy

withdrawals on federal lands and the repeal of TCJA policies allowing energy production in the Arctic. Prohibits offshore

leasing on the Outer Continental Shelf (OCS) in the Atlantic, Pacific and Eastern Gulf of Mexico Planning Areas.

01/20/2021 – Ending Trump's Energy Independence Initiatives: Biden wasted no time living up to his promise,

issuing a Day 1 Climate Change Executive Order (EO) requiring agencies to review and revoke Trump's pro-American

energy rules and actions throughout the executive branch.

• 01/20/2021 – Burdensome Emissions Regulations: Biden’s EO required agencies to take action to increase

burdensome emissions regulations as part of the Left’s green agenda and subsidize "good union jobs."

• 01/20/2021 – Monument Designations: Biden continued setting the tone on Day 1 by cordoning off large swaths of

federal land under the guise of National Monument designations, reducing the ability to produce American energy

domestically.

• 01/20/2021 – ANWR: Biden continued restricting domestic production by issuing a moratorium on all oil and natural

gas leasing activities in the Arctic National Wildlife Refuge.

• 01/20/2021 – Social Costs of Carbon: Biden restored and expanded the use of the social costs of carbon metric to

artificially increase the regulatory costs of energy production, as well as artificially increasing the so-called "benefits" of

decreasing production.

• 01/20/2021 – Keystone XL Pipeline: Biden’s EO went on to revoke the Keystone XL Pipeline, shutting off an efficient

source of energy transportation which would have brought more oil into the country.

• 01/20/2021 – WOTUS: Biden continued to revoke Trump administration executive orders, including those related to

WOTUS and the Antiquities Act. The Trump-era actions decreased regulations on Federal land and expanded the ability

to produce energy domestically.

Jan 25,

2021 $2.392

• 01/27/2021 – Climate Financing: A week later, Biden was back at it again. This Biden EO attacked the energy industry

by promoting “ending international financing of carbon-intensive fossil fuel-based energy while simultaneously

advancing sustainable development and a green recovery." In other words, the US government would leverage its power

to attack oil and gas producers while subsidizing favored industries.

• 01/27/2021 – Green the Fleet: This Biden action called on federal agencies to facilitate carbon neutrality by 2025,

with a particular focus on pushing electric vehicles for Federal, State, and local governments.

• 01/27/2021 – Wind Production: The Biden administration continued to push for inefficient fuel sources by setting a

goal to double wind production on Federal lands by 2025.

• 01/27/2021 – Gas Lease Moratorium: The EO announced a moratorium on new oil and gas leases on public lands or

in offshore waters and reconsideration of Federal oil and gas permitting and leasing practices. In other words, Biden

provided he is following through on his promise to "end" fossil fuels.

• 01/27/2021 – Fossil Fuel “Subsidies”: Biden's EO directed agencies to eliminate Federal fossil fuel subsidies

wherever possible without comparable actions for other energy sources, disadvantaging oil and gas.

01/27/2021 – Environmental Justice: Biden's EO pushed for an increase in enforcement of "environmental justice"

violations and support for such efforts, which typically are advanced by radical environmental organizations.

Feb 01,

2021 $2.409

• 02/02/2021 – EPA Hires Radical: The EPA hired Marianne Engelman-Lado, a prominent environmental justice

proponent, to advance its radical Green New Deal social justice agenda at the EPA, a signal to industry that it plans to

continue its attack on American energy.

• 02/04/2021 – DOJ Takes Aim at Energy Independence: At the behest of the January 27th Climate Crisis EO, the DOJ

withdrew several Trump-era enforcement documents which provided clarity and streamlined regulations to increase

energy independence.

Feb 08,

2021 $2.461

Feb 15,

2021 $2.501

• 02/19/2021 – Paris Climate Agreement: Biden rejoins the Paris Climate Agreement, an agenda which puts American

energy at risk, props up energy production in Russia and China, while increasing the dependence of Europe on Russian

oil.

Feb 22,

2021 $2.633

• 02/23/2021 – H.R. 803: Biden Administration issued a Statement of Administration Policy in support of H.R. 803 which

curtailed energy production on over 1.5 million acres of federal lands.

Mar 01,

2021 $2.711

Mar 08,

2021 $2.771

• 03/11/2021 – American Rescue Plan Act Slush Fund: The President signed ARPA, which included numerous

provisions advancing Biden’s green priorities, such as a $50 million environmental slush fund directed towards

"environmental justice" groups , including efforts advanced by Biden's EO.

• 03/11/2021 – ARPA Anti-Fossil Fuel Grants: ARPA also included $50 million in grant funding for Clean Air Act

pollution-related activities aimed at advancing the green agenda at the expense of the fossil fuel industry.

Mar 15,

2021 $2.853

• 03/15/2021 – Climate Disclosure Rule: The SEC sought input regarding the possibility of a rule that would require

hundreds of businesses to measure and disclose greenhouse gas emissions in a standardized way for the first time,

massively increasing so-called environmental costs of compliance and, in tandem with so-called social costs of carbon,

artificially disincentivizing oil and gas production.

04/15/2021 – FERC Carbon Pricing: The Federal Energy Regulatory Commission’s policy statement outlines - and

effectively endorses - how the agency would consider market rules proposed by regional grid operators that seek to

incorporate a state-determined carbon price in organized wholesale electricity markets. This amounts to a de facto

endorsement of a carbon tax that would be paid by everyday Americans.

Apr 19,

2021 $2.855 • 04/22/2021 – U.S. International Climate Finance Plan: This plan, a result of the President’s January 27, 2021 climate

change EO, would funnel international financing toward green industries and away from oil and gas.

Apr 26,

2021 $2.872

• 04/27/2021 – S.J. Res. 14: The Biden Administration issued a Statement of Administration Policy in support of S.J. Res.

14 which rescinded a Trump-era Rule that would have cut regulations on American energy production.

• 04/28/2021 – EPA Reconsideration of California Waiver: This EPA Notice of Reconsideration, an offspring of an

earlier Biden EO, would propose to revoke a Trump-era action which revoked California’s ability to set nation-wide

standards for emissions standards.

May

03,

2021

$2.89

• 05/07/2021 – Migratory Bird Incidental Take: This proposed Fish and Wildlife Service Rule revokes a Trump

administration rule and expands the definition of "incidental take" under the Migratory Bird Treaty Act (MBTA). The rule

would impact energy production on federal lands, increasing regulatory burdens.

May

10,

2021

$2.961

• 05/12/2021 – CAFE Preemption: This Proposed Rule would reinstate California’s waiver which allowed the state to set

its own emissions standards. This, effectively, allowed climate activists in California to set the de-facto national standard

for emissions standards, making cars less affordable and indirectly increasing energy costs for all Americans.

May

17,

2021

$3.028

• 05/20/2021 – Climate Related Financial Risk: This EO would artificially increase regulatory burdens on the oil and

gas industry by increasing the "risk" the federal government undertakes in doing business with them, among other things.

May

24,

2021

$3.02

• 05/28/2021 – Biden Green Book: Biden's FY 2022 revenue proposals include nearly $150 billion in tax increases

directly levied against the oil and gas energy producers

07/23/2021 –DOJ Climate Action Plan: DOJ's Climate Action Plan (CAP) includes an effort to "green" the fleet by

transitioning to electric vehicles and the advancement of environmental justice efforts.

Jul 26,

2021 $3.136

• 07/28/2021 – DOE Building Codes: This Department of Energy (DOE) determination increases regulatory burdens on

commercial building codes, requiring green energy codes to disincentivize natural gas and other carbon sources. DOE

readily admits they ignored efforts private industry is making on their own and utilized the questionable "social costs of

carbon" to overstate the public benefit.

Aug

02,

2021

$3.159

• 08/05/2021 – Biden “Clean Cars and Trucks” Executive Order: This executive order established a new target to make

half of all new vehicles sold in 2030 zero-emissions vehicles, including battery electric, plug-in hybrid electric, or fuel cell

electric vehicles. The Executive Order also kicked off development of more stringent long-term fuel efficiency and

emissions standards to, among other things, "advance environmental justice, and tackle the climate crisis.”

• 08/05/2021 – EPA Clean Trucks Plan: The same day, the EPA announced plans for further transportation emissions

regulations targeted at heavy-duty trucks, aiming to shift markets in favor of zero-emission vehicles.

Aug 09,

2021 $3.172

Aug 16,

2021 $3.174

Aug

23,

2021

$3.145

• 08/26/2021 – EPA Proposed Rule on Passenger Car Emissions: The Environmental Protection Agency (EPA) issued

a proposed rule to heighten federal greenhouse gas (GHG)emissions standards for passenger cars and light trucks by

setting stringent requirements for reductions through Model Year (MY) 2026. According to the NPRM, "the proposal

would incentivize" technology, i.e., Green industries, to "encourage more hybrid and electric vehicle technology."

Aug

30,

2021

$3.139

• 09/03/2021 – CAFE Standards: This proposed rule would update the Corporate Average Fuel Economy Standards for

Model Years 2024–2026 Passenger Cars and Light Trucks. The rule is a direct result of a Biden EO and would increase

fuel economy regulations on passenger cars and light vehicles. The modeling used here misleadingly attributes "fuel

savings" by multiplying fuel price with 'avoided fuel costs', meaning the rule intends to disincentivize gas by making it

more costly to afford cars and trucks.

Sep

06,

2021

$3.176 • 09/09/2021 – Sustainable Flight National Partnership: NASA and the FAA launched a partnership to reduce "fuel use

and harmful emissions" by strong-arming industry to adopt elements of their green agenda.

09/09/2021 – Department of Education (ED) Climate Action Plan: ED's CAP includes efforts to incorporate the green

agenda into as many guidance and policies as possible, effectively leveraging the department as an anti-fossil fuel

propaganda tool.

• 09/09/2021 – DOL Climate Action Plan: The Department of Labor's CAP includes an increased focus on procurement

regulations on contractors relating to the use of fossil fuels and efforts to increase use of "green" energy sources.

Sep 13,

2021 $3.165

Sep 20,

2021 $3.184

Sep 27,

2021 $3.175

Oct 04,

2021 $3.19

• 10/04/2021 – MBTA Incidental Take: The FWS published its final rule revoking Trump-era action which eased

burdensome regulations on energy action.

• 10/07/2021 – CEQ NEPA Revisions: The Council on Environmental Quality revoked Trump administration NEPA

reforms that reduced regulatory burdens by reinstating tangential environmental impacts of proposed projects.

• 10/07/2021 – Monument Designations: Biden announced plans to designate the Northeast Canyons and Seamounts

Marine National Monument, a move counter to Trump's reversal of a similar Obama-era proclamation. Trump aimed to

allow energy exploration in the area to increase energy independence.

• 10/07/2021 – USDA Climate Action Plan: The U.S. Department of Agriculture's (USDA) CAP includes efforts to switch

fuel away from oil and natural gas and subsidize more costly, less efficient fuel sources.

• 10/07/2021 – DOE Climate Action Plan: The Department of Energy's (DOE) CAP includes leveraging the federal agency

to transition away from fossil fuel resources where possible, and plans to subsidize and advance "green" and renewable

industries at the expense of cheaper and more efficient energy resources.

• 10/07/2021 – EPA Climate Action Plan: As part of its CAP, EPA intends to incorporate Biden's Green New Deal agenda

throughout its rulemaking process.

Oct 11,

2021 $3.267

• 10/14/2021 – DOL ESG Rule: The rule would require fiduciaries to consider the economic effects of climate change and

other so-called environmental, social and governance (ESG) factors when evaluating funds for retirement plans. As

worded, the rule would strongly encourage fiduciaries to draw capital from domestic energy development in oil and

natural gas to less reliable renewables.

Oct 18,

2021 $3.322

• 10/21/2021 – FSOC Financial Stability Report: This report paints climate change, and there for oil and gas producers,

as a "risk to financial stability." The report recommended the "climate disclosures" later set forth by the Biden

administration.

10/29/2021 – BLM Social Costs of Carbon: BLM announced use of social costs of carbon in permitting decisions,

increasing regulations on oil and gas permitting, among other industries.

Nov

01,

2021

$3.39

• 11/02/2021 – Global Methane Pledge: Biden administration lead a "Global Methane Pledge" to reduce global methane

emissions by 30% by 2030. Russia and China both didn't sign the pledge, increasing the world's reliance on the countries

for oil and gas while disadvantaging the U.S. natural gas industry.

• 11/04/2021 – COP 26 Pledge: The President committed to "ending fossil fuel financing abroad." The administration's

actions target the global fossil fuel industry, a move that must be viewed in tandem with their push to increase subsidies

for "green" energy. Doing so disadvantages the oil and gas industry and increases global gas prices. Further, key countries,

like China, did not sign the pledge, so the pledge harms signatories while empowering adversaries.

Nov

08,

2021

$3.41

• 11/09/2021 – FAA Climate Action Plan: The Federal Aviation Administration published its CAP which pushes a "wholeof-government” approach to enacting green policies in the aviation space. Put in plain tongue, the plan aims to force

industries to utilize favored "green" technologies through increased red tape.

• 11/12/2021 – New Source Review: These broad, overreaching regulations target new, modified, and reconstructed oil

and natural gas sources, and would require states to reduce methane emissions from hundreds of thousands of existing

sources nationwide for the first time. The Proposed Rule follows the President's Day 1 Climate EO and the passage of the

S.J. Res. 14, a CRA rescinding Trump-era energy independence policies. The proposed rule spends several paragraphs

dismissing the effects of the rule on the oil and gas industry and misleadingly applies its effects on the industry to only

the "140,000" (an underestimate of the over 220,000) employees directly involved in extraction. This means it ignores

the nearly 10 million other people working in the oil and gas industry and the impacts to the oil and gas economy more

broadly.

Nov

15,

2021

$3.399

• 11/15/2021 – Chaco Canyon: DOI announced plans to withdraw Chaco Canyon from oil and gas drilling for 20 years.

• 11/15/2021 – Omarova Nomination: The Biden administration nominated Saule Omarova to serve as Comptroller of

the Currency. Omarova's past comments speak for themselves: “A lot of the smaller players in [the fossil fuel] industry

are going to, probably, go bankrupt in short order—at least, we want them to go bankrupt if we want to tackle climate

change,” she said.

• 11/17/2021 – HUD Climate Action Plan: HUD's CAP leverages the Community Development Block Grant to advance

'environmental justice' efforts.

• 11/19/2021 – Biden-endorsed Methane Tax: Build Back Better (BBB) included a new tax on natural gas, in the form

of a tax on methane, of up to $1500 per ton

• 11/19/2021 – BBB Mineral and Energy Withdrawals: BBB includes language resulting in mineral and energy

withdrawals on federal lands and the repeal of TCJA policies allowing energy production in the Arctic. Prohibits offshore

leasing on the Outer Continental Shelf (OCS) in the Atlantic, Pacific and Eastern Gulf of Mexico Planning Areas.

ElwoodBlues · M

@sunsporter1649 Thanks for all the bulltrump LOL!!!

ElwoodBlues · M

ElwoodBlues · M

@sunsporter1649 Reich-wingers don't want you to know about our AMAZING 2023 oil production numbers!!

The US produced more oil in 2023 than any nation ever produced in a one year span. It's funny how the right wing pretends Biden curtailed oil when in fact we set a world record, LOL!!!

Also see Oil & Gas Journal

https://www.ogj.com/general-interest/economics-markets/article/14310211/eia-us-currently-produces-more-crude-oil-than-any-country-in-history

Same facts confirmed by Fox Business

https://www.foxbusiness.com/economy/us-led-global-oil-production-sixth-straight-year-2023

The US produced more oil in 2023 than any nation ever produced in a one year span. It's funny how the right wing pretends Biden curtailed oil when in fact we set a world record, LOL!!!

the United States set a new record in 2023 by averaging 12.9 million barrels per day (b/d) of crude oil production, including condensate. This figure surpasses the previous US and global record of 12.3 million b/d, set in 2019. What’s even more impressive is that this record-breaking trend culminated in December 2023, when average monthly U.S. crude oil production soared to over 13.3 million b/d, marking a historic milestone.

https://mansfield.energy/2024/03/18/the-united-states-leads-the-world-in-crude-oil-production/Also see Oil & Gas Journal

https://www.ogj.com/general-interest/economics-markets/article/14310211/eia-us-currently-produces-more-crude-oil-than-any-country-in-history

Same facts confirmed by Fox Business

https://www.foxbusiness.com/economy/us-led-global-oil-production-sixth-straight-year-2023

sunsporter1649 · 70-79, M

@ElwoodBlues Great, now that we import no oil from the middle-east our fuel costs will drop back to where they were under President Trump!

1-25 of 28