As Gas Prices Reach New Highs, Oil Companies Are Profiteering

The Biden White House is confronting a form of shareholder capitalism that has no place for modest profits or rallying around Ukraine.

By John Cassidy

May 11, 2022

An Exxon gas station in Washington D.C.

The latest earnings announcements from the oil sector seem to back up the argument that oil companies are sitting on their hands to keep prices and profits high.Photograph by Stefani Reynolds / AFP / Getty

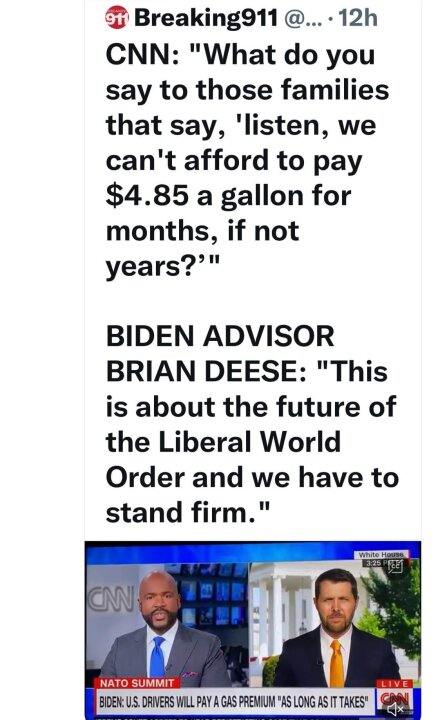

With the price of crude oil soaring to more than a hundred dollars a barrel this year, and A.A.A. reporting that the average national gas price reached a new high of $4.37 per gallon last week, Big Oil has been making historic profits. In the first three months of 2022, ExxonMobil pocketed $5.5 billion after taxes; Chevron gained $6.3 billion; and ConocoPhillips made $5.8 billion. Smaller energy producers, which are concentrated in the U.S. and often referred to as wildcatters, are also profiting enormously. Last week, Pioneer Natural Resources reported first-quarter earnings of two billion dollars, and Marathon Oil reported revenues of $1.3 billion.

Some Democrats on Capitol Hill have called for a windfall tax on oil companies. The Biden Administration hasn’t endorsed this idea, but it is pushing U.S. energy companies to help drive down prices by adding more rigs, pumping more crude, and increasing supply. “The C.E.O.s of major oil companies have said they’ll increase investment and production,” President Biden said in March. “They have the capacity to do it. . . . My message is: it’s time—in this time of war, it’s not a time of profit. It’s time for reinvesting in America.” Despite this appeal, though, over-all U.S. oil production is still running far below its pre-pandemic level. In February, 2020, U.S. oil fields generated around thirteen million barrels of crude a day; last month, they produced less than 11.9 million barrels a day.

Be the first to know when John Cassidy publishes a new piece.

The latest on politics and the economy.

E-mail address

Your e-mail address

Sign up

By signing up, you agree to our User Agreement and Privacy Policy & Cookie Statement.

This shortfall raises the question of whether energy companies are deliberately sitting on their hands to keep prices and profits high. “They’re not using the money for domestic energy production,” Chuck Schumer, the Senate Majority Leader, recently claimed. “They’re using it for stock buybacks. They’re using it to make their shares go up.” The latest earnings announcements from the oil sector seem to back up Schumer’s point. Exxon said that it intends to triple its purchases of its own stock from investors—a financial tactic corporations use to reduce the number of shares they have outstanding and boost their earnings per share. The company announced it will spend up to thirty billion dollars on buybacks between now and the end of 2024. Chevron said that it will devote ten billion dollars this year to buybacks, double its previous target.

What about increasing output? Exxon and Chevron both reported that, during the first quarter, their over-all production of oil and gas, which is pumped from drilling facilities in many parts of the world, fell slightly compared with the previous quarter. On the domestic front, both companies said that their U.S. operations produced slightly less crude in the first quarter of this year than they did in the previous three months, but more than they did in the first quarter of 2021. Some Republicans and oil-industry lobbyists blame the Biden Administration for the fact that U.S. oil production hasn’t fully rebounded, citing the Administration’s decisions to cancel the Keystone XL pipeline and freeze new drilling leases on federal lands. A senior Administration official whom I spoke with strongly contested this argument, saying no oil companies have told the White House that they weren’t increasing production because of a shortage of pipelines. In a recent earnings statement, Exxon noted that its output from the Permian Basin, which is situated in Texas and New Mexico, would rise by more than twenty-five per cent this year, and Chevron said that its production from the same area would rise by fifteen per cent.

A major factor holding back U.S crude production, according to industry analysts, is the attitude of the smaller energy firms, which contribute to a sizable portion of total output. “We are not adding any growth capital due to higher prices: we are staying disciplined,” Lee Tillman, the chief executive of Marathon, told Wall Street analysts last week. Scott Sheffield, the C.E.O. of Pioneer, has been even more explicit. “Whether it’s a hundred-and-fifty-dollar oil, two-hundred-dollar oil, or a hundred-dollar oil, we’re not going to change our growth plans,” he said in February. In an earnings call with Wall Street analysts last week, Sheffield reiterated that Pioneer would cap its growth at five per cent this year and next year.

This refusal to add substantial new production capacity has infuriated many people in the Administration, including Biden. “They don’t want to increase supply because Putin’s price hike means higher profits,” he remarked in a recent speech. The President is certainly on to something, but the problem isn’t merely one of greedy C.E.O.s. In calling on oil producers to act patriotically, the White House is confronting an entire industry that is now operating according to the strict logic of shareholder capitalism—a logic that has no place for modest profits, angry S.U.V. owners, or rallying around Ukraine.

VIDEO FROM THE NEW YORKER

A Mother’s Plea to Keep Her Farm Running

During the fracking boom a decade ago, many shale-oil producers expanded production and raised a great deal of money from investors, particularly private-equity companies. After the price of crude collapsed, in 2014, profits disappeared, many shale producers went bankrupt, and investors suffered big losses that are still remembered on Wall Street—and in the oil patch. “Many oil-industry C.E.O.s think that if they grow production quickly they are going to get penalized, not rewarded,” Jason Bordoff, the founding director of the Center on Global Energy Policy at Columbia University, told me. “Energy companies lost a great deal of money for a decade by expanding in shale oil. Investors have been telling C.E.O.s that they don’t want to repeat that performance.”

In a recent survey of executives at more than a hundred oil and gas firms, carried out by the Federal Reserve Bank of Dallas, nearly sixty per cent of respondents said that the “investor pressure to maintain capital discipline” was the primary factor holding back the growth of production. Given this pressure from Wall Street, many energy executives, particularly those at smaller firms, are perfectly willing to defy the White House. With their far-flung global operations, the Big Oil executives know that, at any moment, they may need to call upon the U.S. government to protect their assets or resolve disputes with host countries. The domestic producers don’t have this concern, and the White House has less leverage over them as a result.

In addition to publicly pressuring oil producers, the Biden Administration has committed to releasing a million barrels of crude each day from the Strategic Petroleum Reserve for six months. It has also sought to improve relations with Saudi Arabia and Venezuela, two opec members with huge energy reserves. To reduce long-term dependence on fossil fuels, the Administration has launched new initiatives to encourage the use of clean-energy technology. However, its major clean-energy proposals, which were part of Biden’s Build Back Better plan, are still stalled in Congress. “Clearly, the world needs more oil output today but less in the long run,” Bordoff, who served as an adviser on energy and climate change in the Obama White House, said. “You have to figure out how to get more supply today without doing anything that undermines your ability to transition to clean energy over the longer term. That’s a difficult needle to thread.”

On Tuesday, in a speech about inflation, Biden mentioned some of the efforts his Administration is taking to bring down gas prices and attacked his Republican critics, saying, “They have no plan to bring down energy prices today, no plan to get us to a cleaner, energy-independent future tomorrow.” That’s certainly true, but the White House is well aware that the G.O.P. will try ruthlessly to exploit high gas prices in the midterm elections this fall.

So far this week, oil prices have actually dipped sharply, owing concerns about the global economy: on Tuesday, the price of West Texas Intermediate crude dropped below a hundred dollars. If this drop is sustained, gas prices should also fall in coming weeks, but, in the longer term, a lot ultimately depends on the level of supply. The senior Administration official expressed confidence that over-all domestic oil production will pick up during the second half of this year, but he also expressed frustration with companies that appear to be profiteering. “It’s beyond us,” the official said, “how somebody could watch the news from Ukraine, what’s happening at the pump, and the potential damage to the economy from high oil prices and say, ‘To hell with all of you: we’re going to do what’s good for our profits.’ ”

The response from energy C.E.O.s would surely be that they are paid to boost their companies’ profits and increase their share prices, not placate voters. That’s how corporate capitalism works these days, but, as the historian Karl Polanyi pointed out many decades ago, a market economy can be sustained only if it is embedded in a broader social and political settlement. Profiteering, especially in wartime, corrodes any such compact. Under the windfall-tax proposal from Senator Sheldon Whitehouse, of Rhode Island, and Representative Ro Khanna, of California, oil companies would pay a tax determined by the difference between the current oil price and the pre-pandemic one. To give the oil C.E.O.s another push, Biden should throw his support behind this proposal.

https://www.newyorker.com/news/our-columnists/as-gas-prices-reach-new-highs-oil-companies-are-profiteering