This page is a permanent link to the reply below and its nested replies. See all post replies »

Gibbon · 70-79, M

According to the current administration it's all our imagination. But they don't do their own grocery shopping or pay their own bills. And are clueless what living on a budget means.

1-25 of 34

JSul3 · 70-79

@Gibbon BS.

There is no law against price gouging.

Corporations continue to make record profits. The US is setting records on oil and energy production. Yes...the economy is not great for everyone. Harris has acknowledged that fact.

How about we raise the minimum wage for starters? The Trump controlled House refuses to govern.

Just what do you want to be done?

There is no law against price gouging.

Corporations continue to make record profits. The US is setting records on oil and energy production. Yes...the economy is not great for everyone. Harris has acknowledged that fact.

How about we raise the minimum wage for starters? The Trump controlled House refuses to govern.

Just what do you want to be done?

This comment is hidden.

Show Comment

JonLosAngeles66 · M

@Gibbon no theycstecsdying its price gouging and enforcing anti-trust laws.

BizSuitStacy · M

@JSul3 Net profit margin for groceries is about 1.5%. For oil and gas, it's about 2.8%. How is that gouging?

JSul3 · 70-79

@BizSuitStacy Do you work for Kroger or Walmart?

BizSuitStacy · M

@JSul3 their income statements are a matter of public record.

JSul3 · 70-79

@BizSuitStacy The WalMart family are in the top 1%. Please.

While grocery store margins may be 2%,

as a benchmark for comparison, the most profitable food companies have net profit margins between 20-30%.

While grocery store margins may be 2%,

as a benchmark for comparison, the most profitable food companies have net profit margins between 20-30%.

BizSuitStacy · M

@JSul3 This is where an understanding of accounting fails you. Those are operating margins...after tax profit margins of typical food companies is about 5%.

JSul3 · 70-79

@BizSuitStacy.

According to Business Insider, 10 companies control almost all large food and beverage brands in the world:

Business Insider

10 Companies Control the Food Industry - Business Insider

Sep 28, 2016 — Only 10 companies control almost every large food and beverage brands in the world:

Nestlé, PepsiCo, Coca-Cola, Unilever, Danone, General Mills, Kellogg's, Mars, Associated British Foods, and Mondelez.

These companies employ thousands of people and make billions of dollars in revenue each year. They operate under different brand names and have a significant impact on the environment, diets, and working conditions. For example, PepsiCo owns Pepsi, Quaker Oats, Doritos, and many other common brands. Unilever owns Ben & Jerry's, Lipton, and Slim-Fast. Mondelez owns popular sweets like Chips Ahoy!, Oreo, Cadbury, Toblerone, and Sour Patch Kids, as well as crackers and medicines like Trident, Triscuit, Nabisco, Halls, and belVita.

These companies made record profits during a pandemic and continue to record record profits now.

So what is your solution to high grocery prices?

A discussion on oil prices is off tbe table. Today oil is trading just over $80 per barrel. Am in DFW and today, Sunday Aug 18, I can buy regular unleaded gas for $2 79-2.99 per gallon.

According to Business Insider, 10 companies control almost all large food and beverage brands in the world:

Business Insider

10 Companies Control the Food Industry - Business Insider

Sep 28, 2016 — Only 10 companies control almost every large food and beverage brands in the world:

Nestlé, PepsiCo, Coca-Cola, Unilever, Danone, General Mills, Kellogg's, Mars, Associated British Foods, and Mondelez.

These companies employ thousands of people and make billions of dollars in revenue each year. They operate under different brand names and have a significant impact on the environment, diets, and working conditions. For example, PepsiCo owns Pepsi, Quaker Oats, Doritos, and many other common brands. Unilever owns Ben & Jerry's, Lipton, and Slim-Fast. Mondelez owns popular sweets like Chips Ahoy!, Oreo, Cadbury, Toblerone, and Sour Patch Kids, as well as crackers and medicines like Trident, Triscuit, Nabisco, Halls, and belVita.

These companies made record profits during a pandemic and continue to record record profits now.

So what is your solution to high grocery prices?

A discussion on oil prices is off tbe table. Today oil is trading just over $80 per barrel. Am in DFW and today, Sunday Aug 18, I can buy regular unleaded gas for $2 79-2.99 per gallon.

BizSuitStacy · M

@JSul3 and none of what you just wrote, refutes an after tax profit margin of 5% for various food companies.

You pull you hair out over talking points such as "record profits" and "making billions." But the devil is in the details and you lefties never put it in perspective. If a company makes $1 more in after tax net income than their previous record...it's record profits!

You pull you hair out over talking points such as "record profits" and "making billions." But the devil is in the details and you lefties never put it in perspective. If a company makes $1 more in after tax net income than their previous record...it's record profits!

JSul3 · 70-79

@Gibbon Did you forget the immigration bill that Trump torpedoed?

Congress passes bills. What have the GOP suggested? Zero!

Harris is not POTUS. ....and again, Congress passes bills. When a president tries to overcome the gridlock in Congress with Executive Orders, they can be challenged by the courts.

Inflation is down. Powell is likely going to cut rates soon....maybe twice before year end.

Congress passes bills. What have the GOP suggested? Zero!

Harris is not POTUS. ....and again, Congress passes bills. When a president tries to overcome the gridlock in Congress with Executive Orders, they can be challenged by the courts.

Inflation is down. Powell is likely going to cut rates soon....maybe twice before year end.

JSul3 · 70-79

@BizSuitStacy

Corporations in the United States made profits totaling 3.4 trillion U.S. dollars in the fourth quarter of 2023. This is a slight increase from the third quarter of 2023. The corporate profits are defined as the net income of corporations in the National Income and Product Accounts (NIPA).Jul 5, 2024

Corporations in the United States made profits totaling 3.4 trillion U.S. dollars in the fourth quarter of 2023. This is a slight increase from the third quarter of 2023. The corporate profits are defined as the net income of corporations in the National Income and Product Accounts (NIPA).Jul 5, 2024

BizSuitStacy · M

@JSul3 keep deflecting. What's the after tax profit margin?

This comment is hidden.

Show Comment

JSul3 · 70-79

@BizSuitStacy LOL! Considering the tax cuts and loopholes they enjoy.....what part of "net profits" do you not understand?

BizSuitStacy · M

@JSul3

And yet prices remain historically high.

It's like saying crime is down. No...crime is up... prosecutions are down.

Inflation is down.

And yet prices remain historically high.

It's like saying crime is down. No...crime is up... prosecutions are down.

JSul3 · 70-79

@BizSuitStacy That means price gouging by corporations.

BizSuitStacy · M

@JSul3

Clearly, you don't understand any of this because you're repeating talking points.

I asked you what's the after tax profit margin? Simple question that you continue to avoid. You have no clue.

Tell us all about these tax cuts and loopholes?

Considering the tax cuts and loopholes they enjoy.....what part of "net profits" do you not understand?

Clearly, you don't understand any of this because you're repeating talking points.

I asked you what's the after tax profit margin? Simple question that you continue to avoid. You have no clue.

Tell us all about these tax cuts and loopholes?

BizSuitStacy · M

@JSul3

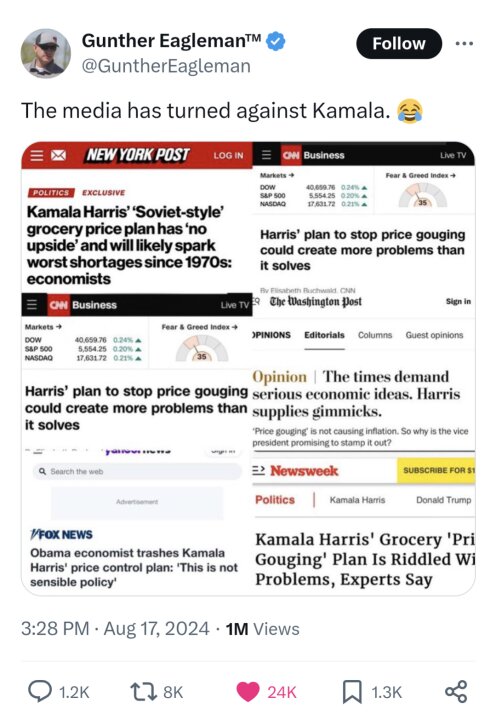

That means price gouging by corporations.

Running with talking points and exposing your complete lack of accounting fundamentals. Even your leftwing media recognizes the problem. I guess they don't want to starve either.

JSul3 · 70-79

@BizSuitStacy Look at the tax rates.

The after-tax profit margin is calculated by dividing net income by net sales. In 2022, US corporations made almost $3 trillion in after-tax profits. In the fourth quarter of 2023, corporate profits after taxes were $2.8 trillion, which was a $105 billion increase from the previous quarter. This accounted for about 10% of the total quarterly GDP, which was slightly lower than the first three quarters of the year.

Corporations in the United States pay federal corporate income taxes levied at a 21 percent rate.Sep 27, 2022.

The biggest loophole in the corporate tax code is the one allowing corporations to pay a lower or even zero percent tax rate on profits stashed in tax havens.Apr 10, 2024

Ok....tell me a link to your tax profit margin.

The after-tax profit margin is calculated by dividing net income by net sales. In 2022, US corporations made almost $3 trillion in after-tax profits. In the fourth quarter of 2023, corporate profits after taxes were $2.8 trillion, which was a $105 billion increase from the previous quarter. This accounted for about 10% of the total quarterly GDP, which was slightly lower than the first three quarters of the year.

Corporations in the United States pay federal corporate income taxes levied at a 21 percent rate.Sep 27, 2022.

The biggest loophole in the corporate tax code is the one allowing corporations to pay a lower or even zero percent tax rate on profits stashed in tax havens.Apr 10, 2024

Ok....tell me a link to your tax profit margin.

JSul3 · 70-79

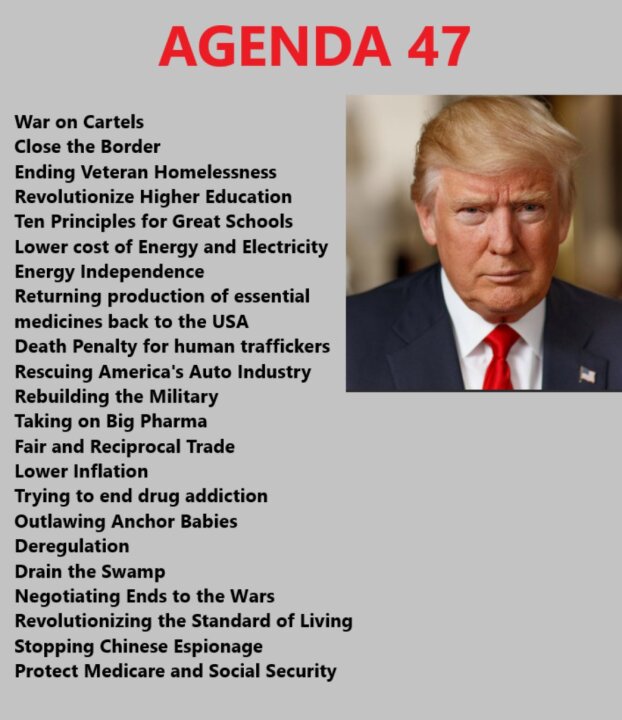

@BizSuitStacy Harris has proposals. It will require Congress to pass bills for her to sign into law.

What has Trump got besides fear and anger and personal attacks?

What has Trump got besides fear and anger and personal attacks?

BizSuitStacy · M

@JSul3 all US corporations - all of them -combined had $3 trillion in after-tax profits 🥱

Big deal. They are in the business of making money.

🤣🤣🤣 Ok...that's not even a thing.

BTW...ever hear of a loss carry forward? No, of course you haven't. I'm gonna be nice and tell you that you have absolutely no idea what you're talking about. My finance teacher used to refer to "Uncle Clem." Everyone has an Uncle Clem...clueless from a business and economics perspective, but Uncle Clem's vote counts as much as anyone's. I think you for the Uncle Clem role quite well in the discussion.

Big deal. They are in the business of making money.

The biggest loophole in the corporate tax code is the one allowing corporations to pay a lower or even zero percent tax rate on profits stashed in tax havens.Apr 10, 2024

🤣🤣🤣 Ok...that's not even a thing.

BTW...ever hear of a loss carry forward? No, of course you haven't. I'm gonna be nice and tell you that you have absolutely no idea what you're talking about. My finance teacher used to refer to "Uncle Clem." Everyone has an Uncle Clem...clueless from a business and economics perspective, but Uncle Clem's vote counts as much as anyone's. I think you for the Uncle Clem role quite well in the discussion.

BizSuitStacy · M

@JSul3

What's Harris got besides equal outcomes and communist price controls. They aren't even hiding it.

What's Harris got besides equal outcomes and communist price controls. They aren't even hiding it.

1-25 of 34