Money experts warn America is at risk because consumer debt rose $185 billion. Why they are insane . . .

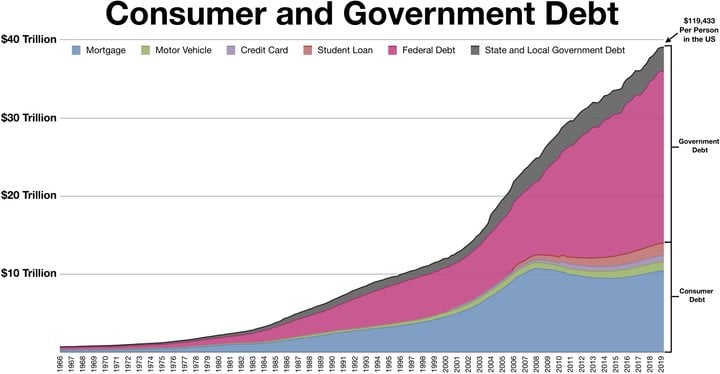

Chart above - the national debt is more than the size of all household borrowing combined.

When I read the “Go Banking” headline (link below), I was alarmed. Consumer/household debt rose $185 Billion last quarter? OMG !!!! $185 billion seems like a lot. But in fact, it's only a 1% increase. The entire universe of household debt (mortgages, student loans, car loans, credit cards) is $18 Trillion – ninety nine times higher. So should a 1% rise in household borrowing send the media into a frenzy?

In fact, the National Debt ($37 Trillion) is DOUBLE our consumer debt – the stuff we knowingly and personally borrowed. And the National Debt is rising far more rapidly. The congressional budget office projects that interest on the national debt will soon be the single largest expense item in the US national budget.

Imagine if the interest you paid on your credit cards and mortgage took up most of your paycheck. THAT would be a crisis. Having your personal debt edge up 1% (as documented by “Go Banking”) is NOT a crisis.

The national debt, ($37 trillion/$370,000 per family), is the number one problem in America. Not Jimmy Kimmel getting a paid vacation. Not whatever Epstein documents are in the FBI vaults. Not Trump getting hoodwinked by Putin again. All these other stories are diversions, intended to keep us from thinking too much about the National Debt, and how we can't continue like this forever. It will all come crashing down, and we will look like Argentina, Venezuela, or Zimbabwe.

I’m just sayin’ . . .

Household Debt Just Hit a New Record — Are You at Risk?

Average American Household Debt in 2025: Facts and Figures | The Motley Fool