This page is a permanent link to the reply below and its nested replies. See all post replies »

DeWayfarer · 61-69, M

My biggest gripe about any wind turbines is the turbines just don't last that long.

We have miles of them out in the desert and at least half are not operational. Now imagine how difficult it would be to repair out at sea, when they can't keep up with the maintenance on land.🤷🏻♂

We have miles of them out in the desert and at least half are not operational. Now imagine how difficult it would be to repair out at sea, when they can't keep up with the maintenance on land.🤷🏻♂

wishforthenight · 36-40New

@DeWayfarer Turbines are normally inspected every 6 to 12 months, so someone isn't doing their job ;)

DeWayfarer · 61-69, M

@wishforthenight this is a AI breakdown of the sustainability of wind turbines through comparison of two such projects...

AI analysis...

AI analysis...

💰 Financial Independence of Wind Turbine Projects

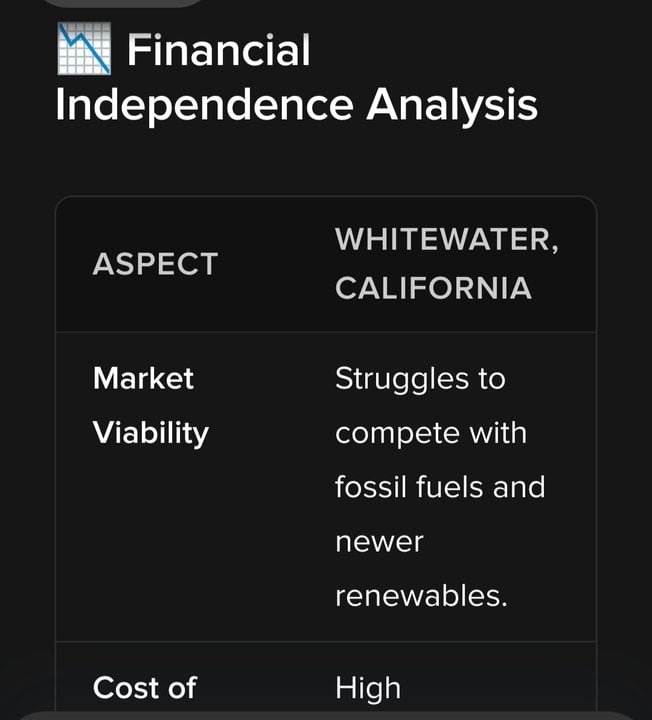

When evaluating the sustainability of wind turbine projects without considering government funding, the focus shifts to their ability to operate independently in the market. Here’s a breakdown of the financial independence of the wind turbine projects in Whitewater, California, and Scotland.

Key Financial Considerations

Market Viability: Both projects face challenges in market viability. Whitewater struggles significantly due to outdated technology and competition from cheaper fossil fuels. Scotland, while having potential, must navigate competition from both traditional and emerging energy sources.

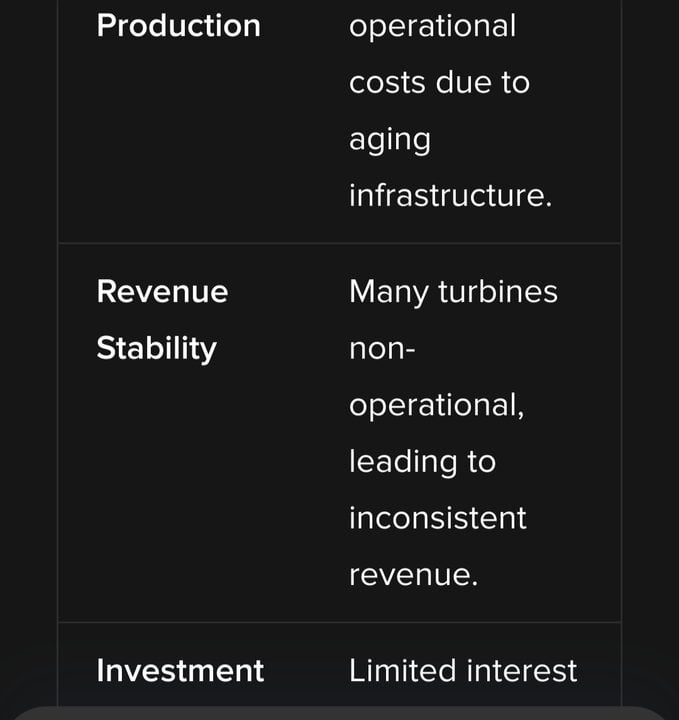

Cost of Production: The operational costs in Whitewater are high due to the need for maintenance on aging turbines, making it difficult to sustain operations without external support. In Scotland, offshore projects incur substantial costs related to installation and maintenance, which can impact profitability.

Revenue Stability: The non-operational status of many turbines in Whitewater leads to inconsistent revenue streams. In Scotland, while there is potential for revenue generation, it is heavily influenced by market conditions, making it less stable.

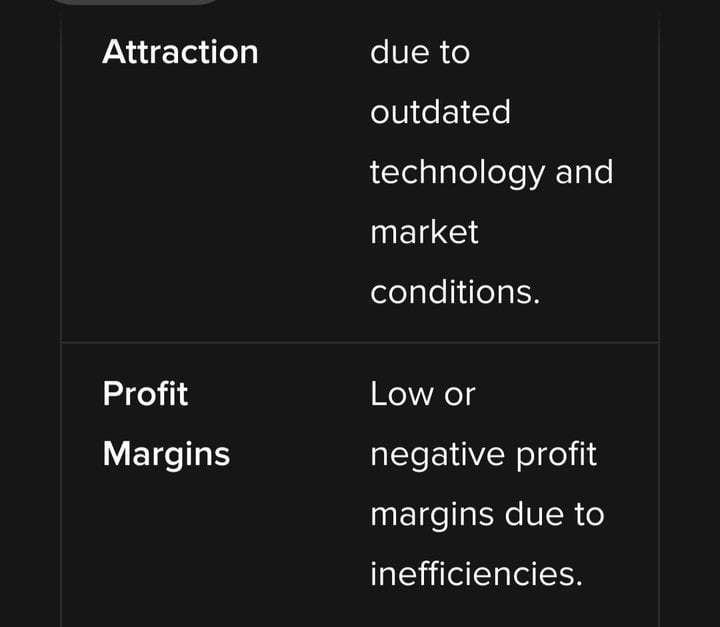

Investment Attraction: Whitewater has limited investment interest due to its aging infrastructure and market conditions. Conversely, Scotland may attract investment, but the high costs and risks associated with offshore projects can deter some investors.

Profit Margins: Profit margins in Whitewater are likely low or negative due to operational inefficiencies. In Scotland, profit margins can be tight, influenced by fluctuating energy prices and high operational costs.

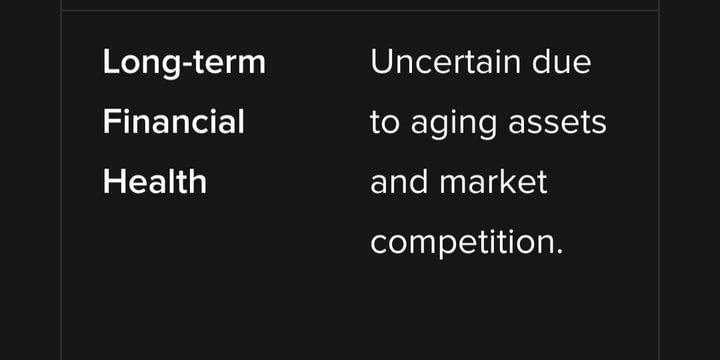

Long-term Financial Health: The long-term financial health of the Whitewater project is uncertain, primarily due to its aging assets and inability to compete effectively. Scotland's offshore projects have potential for improvement with advancements in technology, but their financial future remains uncertain.

This analysis highlights the financial independence of wind turbine projects when government funding is excluded from consideration.

The challenges of market viability, high operational costs, and revenue stability underscore the difficulties these projects face in achieving sustainable profitability without external support.

The complexities of the energy market and competition further complicate the financial landscape for both Whitewater and Scotland.

When evaluating the sustainability of wind turbine projects without considering government funding, the focus shifts to their ability to operate independently in the market. Here’s a breakdown of the financial independence of the wind turbine projects in Whitewater, California, and Scotland.

Key Financial Considerations

Market Viability: Both projects face challenges in market viability. Whitewater struggles significantly due to outdated technology and competition from cheaper fossil fuels. Scotland, while having potential, must navigate competition from both traditional and emerging energy sources.

Cost of Production: The operational costs in Whitewater are high due to the need for maintenance on aging turbines, making it difficult to sustain operations without external support. In Scotland, offshore projects incur substantial costs related to installation and maintenance, which can impact profitability.

Revenue Stability: The non-operational status of many turbines in Whitewater leads to inconsistent revenue streams. In Scotland, while there is potential for revenue generation, it is heavily influenced by market conditions, making it less stable.

Investment Attraction: Whitewater has limited investment interest due to its aging infrastructure and market conditions. Conversely, Scotland may attract investment, but the high costs and risks associated with offshore projects can deter some investors.

Profit Margins: Profit margins in Whitewater are likely low or negative due to operational inefficiencies. In Scotland, profit margins can be tight, influenced by fluctuating energy prices and high operational costs.

Long-term Financial Health: The long-term financial health of the Whitewater project is uncertain, primarily due to its aging assets and inability to compete effectively. Scotland's offshore projects have potential for improvement with advancements in technology, but their financial future remains uncertain.

This analysis highlights the financial independence of wind turbine projects when government funding is excluded from consideration.

The challenges of market viability, high operational costs, and revenue stability underscore the difficulties these projects face in achieving sustainable profitability without external support.

The complexities of the energy market and competition further complicate the financial landscape for both Whitewater and Scotland.

wishforthenight · 36-40New

@DeWayfarer so what's the solution? 100% fossil fuels?

DeWayfarer · 61-69, M

@wishforthenight your neighbor France is working on a real solution. So is the USA yet problems from the Trump administration are likely.

Fusion plants.

Fusion plants.

DeWayfarer · 61-69, M

@wishforthenight Here is what is in the works right now in the USA. This is not hype. Google has already bought 200 megawatts of power. Yet won't go online until 2030.

https://blog.cfs.energy/whats-new-at-cfs-sparc-assembly-and-commissioning-work-begins/

https://www.grpva.com/news/google-to-buy-power-from-chesterfield-fusion-plant/

https://blog.cfs.energy/whats-new-at-cfs-sparc-assembly-and-commissioning-work-begins/

https://www.grpva.com/news/google-to-buy-power-from-chesterfield-fusion-plant/

Pretzel · 70-79, M

@DeWayfarer "fusion"???????

are you MAD sir????

do you realize what is produced as a bi-product??????

HELIUM!!!!

We'll be talking like Donald Duck in a few years!!!

(just kidding)

are you MAD sir????

do you realize what is produced as a bi-product??????

HELIUM!!!!

We'll be talking like Donald Duck in a few years!!!

(just kidding)