Up to 3MM retirees will have Social Security checks docked to cover past due student loans. How did America get in so deep . . . ?

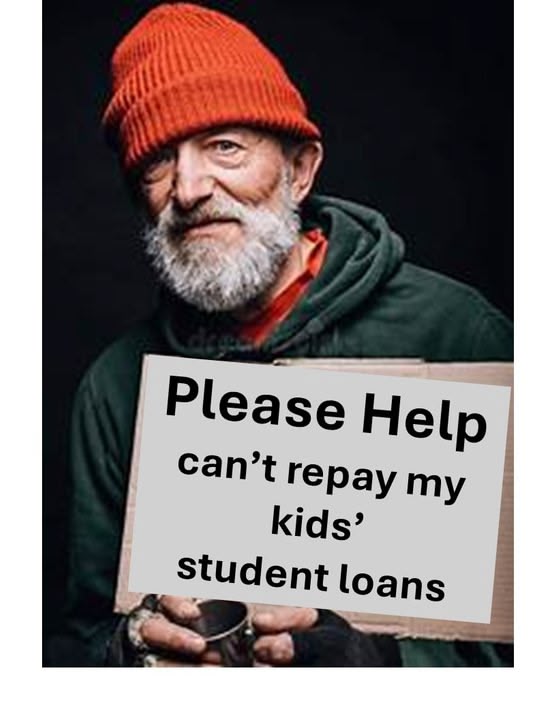

Are you a retiree, and behind on your student loans? No . . . I’m not talking about someone who went back to college at 45, retired at 65, and is now binging on Netflix. If a boomer simply co-signed a student loan, and their kid defaulted, those retirees could now be screwed for life. (See link below).

It may have seemed a like a good idea at the time. Co-sign that $100,000 student loan for your son Trevor’s philosophy degree, or Charlotte’s Art History degree. (Or possibly European History, French literature, English literature, gender studies, anthropology, archaeology, theology . . . ) Your kids made a few payments then stopped, even though you kept reminding them. You may also still carry those rascals on your AT&T cellphone plan, your car insurance, etc.

Starting on June 1, your social security check is going to get a haircut. Yikes . . . that’s like in 3 days!

How much money is involved? A LOT! Let’s see, 15% reduction on an average $1,999.97 monthly benefit payment, times 12 months, times 3 million retirees . . . that’s $11 billion being deducted, and won’t be there to pay the rent, electricity, car, groceries, prescriptions . . .

Trevor and Charlotte, you should be ashamed. Go out and get better jobs! Stop making your parents homeless. (I’m being satirical . . . hold the outrage and rants).

Trevor and Charlotte are NOT the biggest part of the problem. Colleges like UNC, UCLA-Berkley, and Stanford are. Those are the three top colleges for Art History degrees. Do you think Stanford was irresponsible to allow an 18 year old to go $100,000 or more into debt for a worthless degree? Do you think the Art History professors should have spoken up, instead of nesting with their tenured salaries? Do you think the Federal Government should have said “Whoa . .. we are so NOT insuring a ginormous student loan for Art History. Those degrees have an 8% unemployment rate and a 62% rate of under-employment, because most graduates end up as store clerks or telemarketers.”

But in fact, it’s still happening. Those billions in delinquent student loans continue to grow each month, because the conveyer belt student loan insurance machine hasn’t been turned off. I’d be more amenable to forgiving some student loans if we weren’t continuing to throw gasoline on the fire. Let private lenders do a credit check and decide who gets student loans, from which schools, for what degrees, without government guarantees.

I don’t have an extra $3,600 a year to make up the lost social security benefits for Trevor’s and Charlotte’s parents. Those folks need to work that out for themselves. But I am going to suggest that the US government completely exit the student loan guarantee business. Congress shouldn’t be guaranteeing student loans, beach house mortgages in the event of a hurricane, home equity lines of credit, or any other kind of mortgage. DC doesn’t even have enough money on hand to meet its obligations to insure our bank deposits, 401K balances, and pensions (yes . . . those are all federally insured too). Things could get really dicey at some point, and I don’t want to get a letter from Uncle Sam telling me they can’t make good on my bank account because of Charlotte’s art history degree or someone’s hurricane-flattened beach house.

I’m just sayin’ . . .

Social Security Benefits Could Be Targeted for Nearly Half a Million People - Newsweek