Oh snap . . . Now AI is being used to scam us with higher prices. It’s become an ENGINE OF INFLATION.

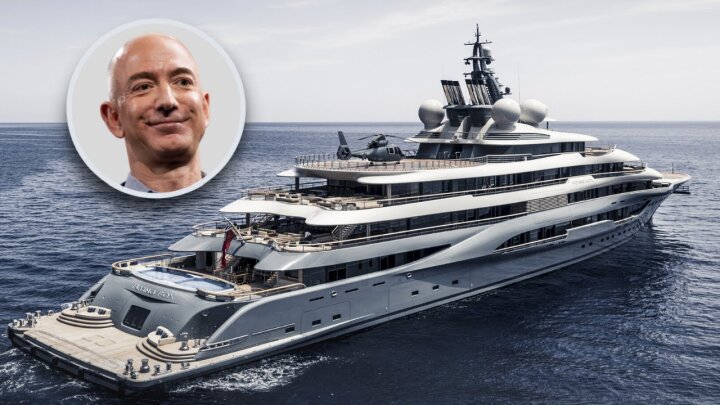

Photo above - Word of the day: "Surveillance Pricing." It could be how America's gazillionaires can afford mega-yachts.

Surveillance Pricing. I’d never even heard the term until I ran into the article last night (link below). The Federal Trade Commission thinks that a bunch of the biggest financial firms are in cahoots, and sharing data to decide which of us will pay more for stuff. The suspects: MasterCard, Chase Bank, Accenture, McKinsey, Bloomberg . . .

Here's how surveillance pricing works. Its' an updated version of dynamic pricing. Those Pepsi machines with Wi-Fi thermometers. When the local temperature exceeds some pre-set threshold (say 82 degrees) it would automatically raise the price of a 20 ounce bottle. From $1, say to $1.25, or $1.50. And then, at night and other low traffic periods, it would drop the price back down.

This is what your grocery store does too. All the discounts and sales happen Tues-Wed-Thur. You pay full price on weekends. Unless something is overstocked.

Back to MasterCard and Chase. Right off the bat, I’m suspicious about interest rates. How high can they jack up our credit card rates, without having us bail? I closed a department store card recently, and the customer service rep (based in the Philippines) immediately asked if this was due to the price increase. He even knew what my old and new interest rates were. Let me repeat: Hernando in the Philippines has access to my credit card rate history, and talking points to persuade me that I'm not being scammed.

It probably goes beyond credit cards. Someone with an 800 Fico score might pay as little as 4.9% for a 60 month car loan this summer. Or as much as 14.9%. How in hell does that happen, if the FICOs are the same? A dealership pulled this stunt on me in 2021 when I bought my car. The interest rate started at 3.9% (this was pre-Fed Funds rate increases), but eventually ended up at zero. Yep, no interest charges at all. Just because I said no to 3.9%. It took 3 hours to negotiate the deal with these clowns, but I calculate I saved $3,149 over the life of the loan. Meaning I made about $1,000 an hour by holding firm with the salesman for 3 hours.

The big enchilada for Surveillance Pricing is mortgages, though. Imagine what 1 or 2% is going to mean over 30 years, with a loan of $500,000? Some bank big shot is probably buying a vacation condo with the extra interest we pay.

Is surveillance pricing legal? I’m not a lawyer. But when the public got wind of Pepsi’s “long hot summer” dynamic pricing scheme, they were forced to walk it back. My guess is that the perps in this FTC case will sign a MOU (memorandum of understanding), and stop their BS too. Even if it isn’t specifically illegal. Just because they want to avoid adverse publicity.

Now if only the FTC would investigate Amazon pricing. I know for a fact that some of my neighbors pay more (or less) for the same stuff I buy. Same item, same fulfiller. This has to be surveillance pricing at work too. No wonder Jeff Bezos can afford the biggest luxury yacht in the history of planet earth.

I’m just sayin’ . . .

~What is 'surveillance' pricing, and is it forcing some consumers to pay more? FTC investigates (msn.com)~