“Greatest bubble in human history close to bursting” claims attention seeking mutual fund manager.

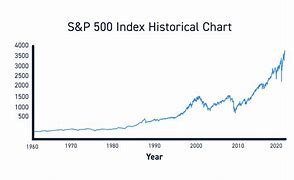

[i]Chart above - 60 years of stock market performance. Will it all end in tears?[/i]

Well, maybe the stock market will go down. It always does, at some point. I’ve been a skeptic since 2016, when Trump was elected. So I’ve been wrong for 8 years now, and the market is up. But when a “black swan” investor starts screaming that this is the worst bubble in all of history, everyone’s BS detectors should start going off. (see link below)

First of all, I can name a bunch of “bubbles” which were the worst in history. Dutch Tulips. The 1929 US stock market. Confederate war bonds. Zimbabwe currency futures. Want more? I can do this all day.

Mark Spitznagel, a self described “black swan investor” is trying to drum up business for his bearish mutual fund Universa Investments. It’s an LLP, so it doesn’t have disclose its own financial inner workings. Spitznagel claims his fund had a 3,621% gain as of March 2020. The Wall Street Journal tracked Universa’s strategies and came up with a more down to earth 12% compounded return. Oh well . . .

Wait, it gets better. Universa’s “strategy” involves simultaneously buying puts and calls – not actual stocks – multiple times a minute. And Spitznagle was accused of triggering the 2010 stock market “flash crash” by trying to take advantage of split second pricing differences between those puts and calls. The SEC has since reigned in this sort of hypersonic gamesmanship, as probably contrary to the interests of 401K holders, IRA account holders, ordinary investors, federally insured banks, and the stability of the entire nation. Oh well . .

Mr. Spitznagel will get his market crash eventually. But I’m the wrong person to predict when, since I’ve been a skeptic about how inflation, record federal debt, homelessness results in lasting prosperity. Clearly, I don’t know $hit about the market, since I’m holding more cash (CDs paying 5.x%) than mutual funds. I don’t want the market to crash. I just can’t see what’s propping it up. It’s not todays deficit spending, and it won’t be an upcoming increase in tariffs on imported goods. If anyone can make a case for 2025 and beyond resulting more huge market gains, please explain your rationale.

I’m just sayin’ . . .

~'Greatest Bubble in Human History' Close to Bursting, Spitznagel Says - Markets Insider (businessinsider.com)~

~Universa Investments - Wikipedia~