Total world debt now equal to annual world economic output. Can we get a low-rate bill-consolidation loan to fix this?

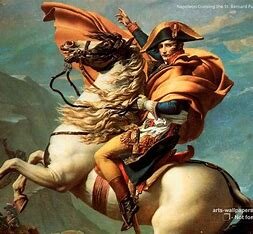

Photo above - Napoleon Bonaparte borrowed the equivalent of $25 trillion to wage war on the rest of Europe (1803-1815) Spoiler alert - he lost.

We're number 1! We're number 1! Total global debt is nearly $100 TRILLON. And the US government owes 1/3 of this ($34 trillion and rising). And it isn't even a war (for us). See link below.

Other than buying real estate, when should you borrow? Um . . . that would be never, according to financial experts. If you finance a Porsche, or roll over your balance on your credit card, or borrow for a vacation, you're an idiot (historically). You're borrowing to enjoy today's consumption. And betting you will be able to pay it back with tomorrows earnings.

The only way that can work is if you buy something that outpaces ordinary inflation. Like buying a home. Or office complex. Or shopping mall. Er . . . those last two haven't actually been working out so well recently. Between Amazon enticing us all to shop at home, and the government ordering a lot of us to work from home. Malls and skyscrapers are teetering on the edge of collapse. No wonder residential real estate looks like the last, best hope for anyone trying to outrun global economic collapse. Wait . . . I just a spam email urging me to convert my 401K to gold??!! Sorry . .. I'll pass.

Back to total global debt. This would possibly have a silver lining if governments had been buying land and constructing buildings with their borrowing. I can't speak for other nations, but that's technically illegal, in the USA. The federal government has to "expense" a building in the year it's completed. No 30 year mortgages on a new post office or penitentiary.

So that makes our $34 trillion even scarier. But readers in this forum will be quick to point out that since the US government borrows as much as it collects in taxes, a lot of that borrowed money is put into buildings, even if there's no mortgage involved. If the USA defaults (on it's treasury bills, for example) there will be no repo, no evictions. Interest rates of all kinds will simply skyrocket, and the government will have effectively prevented us from personally being able to afford real estate or a car or a mileage points credit card.

As a renter, my debt is about 30% of my personal income. I don't have a mortgage. Or a student loan. Just a car (Kia, not a Porsche) and couple of credit cards. But that's WITHOUT accounting for the US National debt. The $34 trillion. My share of that is $100,000 on top of what I personally owe.

I never voted to put myself $100,000 in debt. In fact, if I actually HAD $100,000 I'd put it down on a nice house, with manageable monthly mortgage payments. The reason I can't do that is because the USA has 1/3 of the worlds debt. And corporations are now buying up residential real estate, sending prices sky high. REITS (real estate investment trusts) may have guessed wrong on buying shopping malls and Manhattan skyscrapers, but they're NOT afraid of jumping into the home ownership market with both feet.

We'll see how this works out. Logic says we can't spend more than our income forever. Biden and congress say that we can. I'm not voting for Biden (OR Trump). You can do what you want, brothers and sisters. This can't go on forever.

I'm just sayin' . . .

Global debt hasn’t been this bad since the Napoleonic Wars, says World Economic Forum president (msn.com)