Can the ponzi last through the next election cycle?

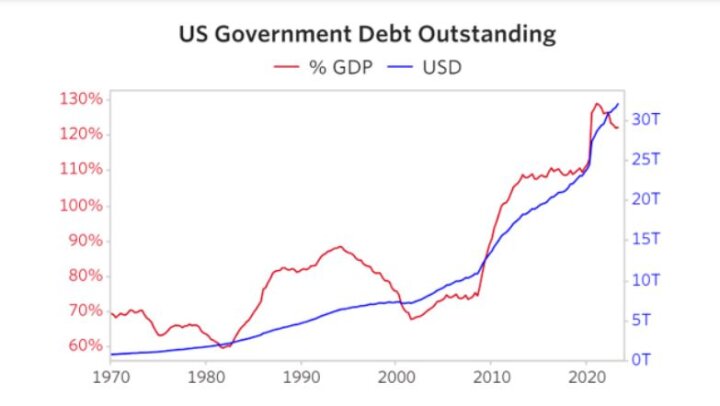

Fitch downgraded the United States’ long-term credit rating as expected. This is basically the reason:

Thank you Barak, Donald, Joe, Janet, Jerome, Ben, US Congress et al.

My question is, can the ponzi last through the upcoming election cycle? Instability rears its ugly head from time to time like an alcoholic realizing he is slipping into the abyss. SVB bank, commercial real estate, Fitch credit ratings....

How easy or difficult will it be for the party in power to pin it on the other party?

Oh well, I guess we'll just let the good times roll... for now.

Thank you Barak, Donald, Joe, Janet, Jerome, Ben, US Congress et al.

My question is, can the ponzi last through the upcoming election cycle? Instability rears its ugly head from time to time like an alcoholic realizing he is slipping into the abyss. SVB bank, commercial real estate, Fitch credit ratings....

How easy or difficult will it be for the party in power to pin it on the other party?

Oh well, I guess we'll just let the good times roll... for now.