This page is a permanent link to the reply below and its nested replies. See all post replies »

BiasForAction · M

It’s pretty good for businesses and the tax breaks they get to keep since the 2017 law - there is much in the bill that isn’t about the very richest or the very poorest among us. My beef is that it runs up the national debt to unsustainable levels — there will be a reckoning and those who voted for it are hoping they are out of office before that day arrives.

ElwoodBlues · M

@BiasForAction Funny thing how the right wing spent four years moaning & crying about the deficit under Biden, only to turn around and grow the deficit YUGELY when they got power. SAD!!

BiasForAction · M

@ElwoodBlues both major political parties do that. Neither party cares about fiscal discipline. The reckoning will come and the country will suffer for years when it does

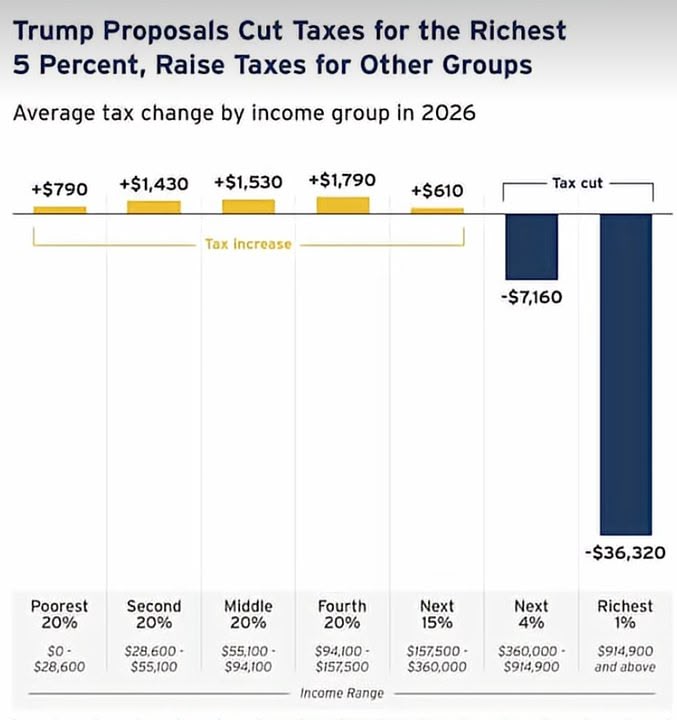

@BiasForAction It's absolutely horrible for employees that aren't making at least $350,000 per year.

This bill has extremely little that is positive for the average Americans.

It's to rob the poor and pay the rich

This bill has extremely little that is positive for the average Americans.

It's to rob the poor and pay the rich

BiasForAction · M

@sstronaut well I can repeat what I wrote sbd you can repeat what you wrote. Since I make less than 350K per year and I don’t think going to effect me much at all — please educate me as to its impact on me and why it is “horrible” for me

This message was deleted by its author.

@BiasForAction Because you're going to be paying more in taxes and raising the debt, and taking funding away for public resources such as hospitals and much more, just to lower taxes on those making over $350,000 per year, especially for themselves making more than $1 million per year.

What positive is in this Bill for you?

What positive is in this Bill for you?

BiasForAction · M

@sstronaut what specific tax that I pay now is going up under the bill?

@BiasForAction income tax

BiasForAction · M

@sstronaut I didn’t think it affected my income tax but I shall look into that by asking my tax counsel who knows the bill very well

BiasForAction · M

@BiasForAction ok I checked. The bill keeps several tax cuts from 2017 from expiring and it doesn’t increase my income tax personally.

BiasForAction · M

@sstronaut it raises certain other taxes for other groups but not income tax for me. I think you are wrong by shrinking it raises the income tax —there are other taxes it raises for sure

@BiasForAction Depends if you want to play word games... it increases the taxes based on the year you paid before.

They're factoring in the non-existing drop, that's only happening because they made the rich tax cuts permanent in 2017, and the poor people taxes have to be renewed.

But if you actually look at what you have been paying vs what you will be paying, more than the previous year for those earning less than $360,000

They're factoring in the non-existing drop, that's only happening because they made the rich tax cuts permanent in 2017, and the poor people taxes have to be renewed.

But if you actually look at what you have been paying vs what you will be paying, more than the previous year for those earning less than $360,000

BiasForAction · M

@sstronaut oh cool I’ll look into this some more.

BiasForAction · M

@sstronaut I’ll do fine under the bill — it lowers my tax bill compared to what would happen if the bill doesn’t become law. I think you are exaggerating the impact on most people’s income tax. It is clear the bill benefits the very rich the most and hurts the poorest the most. For those in the vast middle it is not so impactful but rather good if you have children dependents. My objection to the bill is what it does to the national debt (soaring) without spurring investment very much.

@BiasForAction You can think whatever you want, it doesn't change the facts. But you keep repeating the same thing, so just go away and stop being annoying. Thanks, bye.