This page is a permanent link to the reply below and its nested replies. See all post replies »

GerOttman · 61-69, M

SomeMichGuy · M

@GerOttman Good for her, guess she'll do it for free, have no social programs, defense, no keeping the Constitution & Declaration, LoC, federal judiciary incl. Supreme Ct., no laws, no regulations.

Guess she has some idea about people which is not conformant to Hobbes, etc., but is some very idealistic thing...or she thinks capitalism will solve all in a "fair" way.

lol

Guess she has some idea about people which is not conformant to Hobbes, etc., but is some very idealistic thing...or she thinks capitalism will solve all in a "fair" way.

lol

GerOttman · 61-69, M

SomeMichGuy · M

@GerOttman lmao Doesn't address what I said, would be horrible if true, guess progressive taxes are unfair...odd...

Perhaps you require some of your own Rx...

Perhaps you require some of your own Rx...

LeopoldBloom · M

@GerOttman “Who cares if there’s a toxic waste dump next door when you have legal weed”

SomeMichGuy · M

@GerOttman OK, here is the truth:

The Federal poverty guidelines are at

https://aspe.hhs.gov/poverty-guidelines

The 2020 rates for Social Security & Medicare are 6.20% and 1.45%, from p.2 of the 2020 Pub. 15 (Circular E), Employer's Tax Guide; these are taken from all employees, so they are taken out.

The 2020 tax rates & Standard Deduction are from

https://www.irs.com/articles/2020-federal-tax-rates-brackets-standard-deductions/

Standard deductions are

$12,400 for single filers (which I used for the first Federal poverty guidelines bracket), and

$24,800 for married filing jointly, which I used for the Federal poverty guidelines brackets with 2 or more persons per household)

[b]Because of the $24,800 standard deduction, EVEN AT THE POVERTY GUIDELINE OF $44,120, THE INCOME TAX RATE IS 10% OF THE DIFFERENCE, or only $1932, or 4.38%[/b]

[big][b]The TOTAL AMOUNT TAKEN, income taxes, Social Security, AND Medicare, is ONLY 12.03% of the $44,120[/b][/big]

This assumed no other income, and I didn't go through any allowance for child tax credits.

[u][b]The point is, that this is NOWHERE NEAR the 40% you claim. How old is that cartoon?[/b][/u]

Yeah, I have an Excel spreadsheet and did the whole thing.

The Federal poverty guidelines are at

https://aspe.hhs.gov/poverty-guidelines

The 2020 rates for Social Security & Medicare are 6.20% and 1.45%, from p.2 of the 2020 Pub. 15 (Circular E), Employer's Tax Guide; these are taken from all employees, so they are taken out.

The 2020 tax rates & Standard Deduction are from

https://www.irs.com/articles/2020-federal-tax-rates-brackets-standard-deductions/

Standard deductions are

$12,400 for single filers (which I used for the first Federal poverty guidelines bracket), and

$24,800 for married filing jointly, which I used for the Federal poverty guidelines brackets with 2 or more persons per household)

[b]Because of the $24,800 standard deduction, EVEN AT THE POVERTY GUIDELINE OF $44,120, THE INCOME TAX RATE IS 10% OF THE DIFFERENCE, or only $1932, or 4.38%[/b]

[big][b]The TOTAL AMOUNT TAKEN, income taxes, Social Security, AND Medicare, is ONLY 12.03% of the $44,120[/b][/big]

This assumed no other income, and I didn't go through any allowance for child tax credits.

[u][b]The point is, that this is NOWHERE NEAR the 40% you claim. How old is that cartoon?[/b][/u]

Yeah, I have an Excel spreadsheet and did the whole thing.

GerOttman · 61-69, M

@SomeMichGuy That's very good and I applaud your effort! Now I would like to ask you to add a few new columns to the calculations. State income tax, state sales tax, school/property tax, take a look at your phone/cable bill, water/sewer tax, city wage tax, fuel tax, restaurant/beverage tax, state and local license fees.. These are just a few off the top of my head. Can you think of any I missed? Please add them below, I'd be very interested in any additional research you may wish to contribute!

Also, as of last year, I believe the wife and I were in the 22% federal income tax bracket. That was after deductions and does not include medicare or SSI withholding.

Also, as of last year, I believe the wife and I were in the 22% federal income tax bracket. That was after deductions and does not include medicare or SSI withholding.

SomeMichGuy · M

@GerOttman

Most state income taxes are not high (CA has a progressive system), but, more to YOUR point:

The POOR don't pay huge taxes on income, property, sales, because the POOR by *definition* do not have the income to support much property, consumption, or even the income itself.

Also, many states have holes in the sales tax for food which has not been prepared (most grocery food items, but not, e.g., drinks from foundtain, sandwiches from the deli, etc. And yeah, ppl pay excise taxes, but those don't go to make up the 28% you are looking for.

And you demonstrate your own lack of knowledge by this:

[quote]Also, as of last year, I believe the wife and I were in the 22% federal income tax bracket. That was after deductions and does not include medicare or SSI withholding.

Since you say "as of last year" and you didn't mention the AMT in your litany of taxes,

[b]You were in the 22% MARGINAL TAX BRACKET...ONLY your dollars over the BEGINNING of that bracket were taxed at 22%, and you STILL got the benefit of either the $24,400 Standard Deduction for 2019, or an even bigger itemized amount.[/quote]

In either case, you're NOT poor.

Your 2019 bracket was

[b]$78,951 - $168,400 $9,086 + 22% of the amount over $78,950[/b]

[big][b]So you made at least $103,351, if you were just $1 into it, and your ACTUAL TAX RATE would be UNDER 8.8%, NOT 22%. So stop whining about YOUR federal taxes and pretending *you* are POOR.[/b][/big]

FYI, the "22% bracket" for 2020 looks like this:

[b]$80,251 – $171,050 $9,235 + 22% of the amount over $80,250[/b]

Most state income taxes are not high (CA has a progressive system), but, more to YOUR point:

The POOR don't pay huge taxes on income, property, sales, because the POOR by *definition* do not have the income to support much property, consumption, or even the income itself.

Also, many states have holes in the sales tax for food which has not been prepared (most grocery food items, but not, e.g., drinks from foundtain, sandwiches from the deli, etc. And yeah, ppl pay excise taxes, but those don't go to make up the 28% you are looking for.

And you demonstrate your own lack of knowledge by this:

[quote]Also, as of last year, I believe the wife and I were in the 22% federal income tax bracket. That was after deductions and does not include medicare or SSI withholding.

Since you say "as of last year" and you didn't mention the AMT in your litany of taxes,

[b]You were in the 22% MARGINAL TAX BRACKET...ONLY your dollars over the BEGINNING of that bracket were taxed at 22%, and you STILL got the benefit of either the $24,400 Standard Deduction for 2019, or an even bigger itemized amount.[/quote]

In either case, you're NOT poor.

Your 2019 bracket was

[b]$78,951 - $168,400 $9,086 + 22% of the amount over $78,950[/b]

[big][b]So you made at least $103,351, if you were just $1 into it, and your ACTUAL TAX RATE would be UNDER 8.8%, NOT 22%. So stop whining about YOUR federal taxes and pretending *you* are POOR.[/b][/big]

FYI, the "22% bracket" for 2020 looks like this:

[b]$80,251 – $171,050 $9,235 + 22% of the amount over $80,250[/b]

GerOttman · 61-69, M

@SomeMichGuy I can see this is kind of like a roof.... It's over your head! But if you type in BOLD!! you must be right, Right??

SomeMichGuy · M

@GerOttman No, you just can't deal with facts.

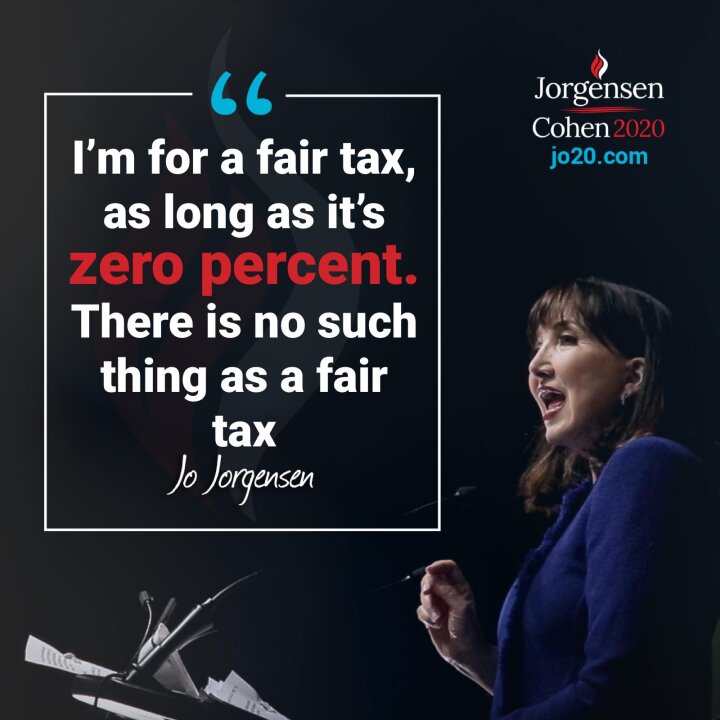

You started out with a graphic which, like many political slogans, seems to have some encapsulation of the truth.

It is just dead wrong. The POOR do NOT pay 40% in taxes.

And you don't even understand your *own* taxes. LOL

And you can't answer except to provide exactly the perfect info to show that you are whining about [b]rich peoples' problems[/b] in the guise of championing the poor.

Thanks for showing your own ignorance in front of everyone caring to follow...

You started out with a graphic which, like many political slogans, seems to have some encapsulation of the truth.

It is just dead wrong. The POOR do NOT pay 40% in taxes.

And you don't even understand your *own* taxes. LOL

And you can't answer except to provide exactly the perfect info to show that you are whining about [b]rich peoples' problems[/b] in the guise of championing the poor.

Thanks for showing your own ignorance in front of everyone caring to follow...

GerOttman · 61-69, M

@SomeMichGuy are you trying to convince me, or yourself??

SomeMichGuy · M

@GerOttman You don't even understand marginal tax rate v. actual tax rate.

So this is only to show others; you have a self-sealing view which shifts and ignores facts, even as you provide more kindling for the fire of your foolish opinion.

You aren't teachable. Other are. This is for them.

So this is only to show others; you have a self-sealing view which shifts and ignores facts, even as you provide more kindling for the fire of your foolish opinion.

You aren't teachable. Other are. This is for them.

GerOttman · 61-69, M

@SomeMichGuy Ohhhh... Well aren't you the humanitarian! Everyone, may I present "The Smartest Man in the ROOOMMMMMMM....!!" Congratulations. So, you're more a tree counter kinda guy and less a see the forest type? Just the vibe I'm getting here!

SomeMichGuy · M

@GerOttman Never said nor claimed to be the smartest guy in the room, but your shift-and-deflect way of NOT answering is lame for a guy who started with bluster, and are ending the same way.

You made a claim. You provide no hard facts, except that you are *not* poor & don't even comprehend the actual facts for your own situation.

I provided numbers from the government to back up my point.

"go educate yourself"

You made a claim. You provide no hard facts, except that you are *not* poor & don't even comprehend the actual facts for your own situation.

I provided numbers from the government to back up my point.

"go educate yourself"

GerOttman · 61-69, M

@SomeMichGuy You sure are getting a lot out of this! I'm just sitting here enjoying the show. And don't do the false modesty,please. I have a feeling you're always the smartest guy in the room, and quite proud of it..

SomeMichGuy · M

@GerOttman No, I just don't care for people who equate bluster with reasoning, unsupported assertions with facts, and who can't take their own advice.

"go educate yourself"

You probably think the poor are people without boats.

"go educate yourself"

You probably think the poor are people without boats.

GerOttman · 61-69, M

@SomeMichGuy Boy you're just a regular Dewey Parker you are! Well done sir..

SomeMichGuy · M

@GerOttman "Boy", you should go get some basic education. You should at least understand your own tax situation.

GerOttman · 61-69, M

@SomeMichGuy Taxation is theft is all anyone needs to understand. Still having fun playing along I see. You always this easily amused?

SomeMichGuy · M

@GerOttman

[quote]Taxation is theft is all anyone needs to understand.[/quote]

Oh, so now a new argument?

If you believe this, then you ought to go live elsewhere, because the power to tax is arguably the biggest power the US Congress has (and why the Tax Code gets so complicated, since most every policy gets expressed in it).

I do not mind paying a portion of my income to help the very needy, take care of injured soldiers, etc. I have been blessed and support the causes in which I take a special interest with charitable giving, too. While I don't think paying higher taxes is a virtue, I think taxes ARE stealing when they are misused.

For me, as for a conservative friend of mine in Alberta, it isn't the taxes, it is what are you getting in return...?

If a

• safer food & drug supply,

• safer air & other transportation,

• insurance of your bank accounts through the FDIC et al.,

• defense of your neighborhood, state & country,

• retirement & health care,

• better roads, etc.,

• attempts to smooth out the economy's roughest patches

• postal service, etc.,

• funding for research in vaccines, other drugs, new technologies, etc.,

• help with stabilizing food production & prices,

• loans to rural communities & other development,

• judicial recourse for government violation of your rights in the Bill of Rights, etc.,

• regulate trade with other countries,

• have valid money,

• issue passports,

• interact with foreign governments,

• have safe havens for US citizens overseas,

...

...then please make your case to your Congressman & start the process of repealing Amendment XVI & part of Art. I, Sec. 8.

What's your next dodge-and-conflate?

[quote]Taxation is theft is all anyone needs to understand.[/quote]

Oh, so now a new argument?

If you believe this, then you ought to go live elsewhere, because the power to tax is arguably the biggest power the US Congress has (and why the Tax Code gets so complicated, since most every policy gets expressed in it).

I do not mind paying a portion of my income to help the very needy, take care of injured soldiers, etc. I have been blessed and support the causes in which I take a special interest with charitable giving, too. While I don't think paying higher taxes is a virtue, I think taxes ARE stealing when they are misused.

For me, as for a conservative friend of mine in Alberta, it isn't the taxes, it is what are you getting in return...?

If a

• safer food & drug supply,

• safer air & other transportation,

• insurance of your bank accounts through the FDIC et al.,

• defense of your neighborhood, state & country,

• retirement & health care,

• better roads, etc.,

• attempts to smooth out the economy's roughest patches

• postal service, etc.,

• funding for research in vaccines, other drugs, new technologies, etc.,

• help with stabilizing food production & prices,

• loans to rural communities & other development,

• judicial recourse for government violation of your rights in the Bill of Rights, etc.,

• regulate trade with other countries,

• have valid money,

• issue passports,

• interact with foreign governments,

• have safe havens for US citizens overseas,

...

...then please make your case to your Congressman & start the process of repealing Amendment XVI & part of Art. I, Sec. 8.

What's your next dodge-and-conflate?

GerOttman · 61-69, M

@SomeMichGuy I'm sorry, I didn't even try to read that. It's not a switch, it's the basic concept. Again, right over your head!